Yellow Cake: A Nuclear Buying Opportunity

Yellow #Yellow

Evgeny Gromov/iStock via Getty Images

Overview

Yellow Cake plc. (OTCQX:YLLXF) is a London-quoted company listed on AIM. It was established in 2018 with the primary objective of offering investors an opportunity to invest directly in Uranium (U3O8). The Sprott Physical Uranium Trust (OTCPK:SRUUF) is the only other vehicle that offers a similar investment opportunity.

The company doesn’t have any operating assets and avoids hedging arrangements. Instead, it engages in uranium-related transactional activities, such as uranium location swaps. Moreover, it actively seeks other operational and financial transactions on an opportunistic basis to secure uranium exposure, including streaming and royalties and other financing opportunities.

Yellow Cake benefits from a significant strategic advantage owing to its long-term contract with NAC Kazatomprom JSC (Kazatomprom), the largest and one of the lowest-cost uranium producers globally. The contract enables the company to procure uranium at a price agreed upon before announcing any intended purchase or associated financing, allowing Yellow Cake to acquire substantial volumes of uranium at undisturbed prices.

Currently, Yellow Cake has acquired approximately 20.1 million pounds of U3O8, which are held in storage accounts at Cameco in Canada (CCJ) and Orano in France.

The Investment Case for U3O8

In 2007, the uranium sector entered a decade-long bear market due to structural oversupply. This bear market lasted until 2017 and resulted in systemic underinvestment due to a significant overhang of U3O8 reserves, particularly produced by Kazakhstan. From 2017 to 2019, the market bottomed out as the overhang gradually disappeared, and prices began to rise again.

U3O3 price (tradingeconomics.com)

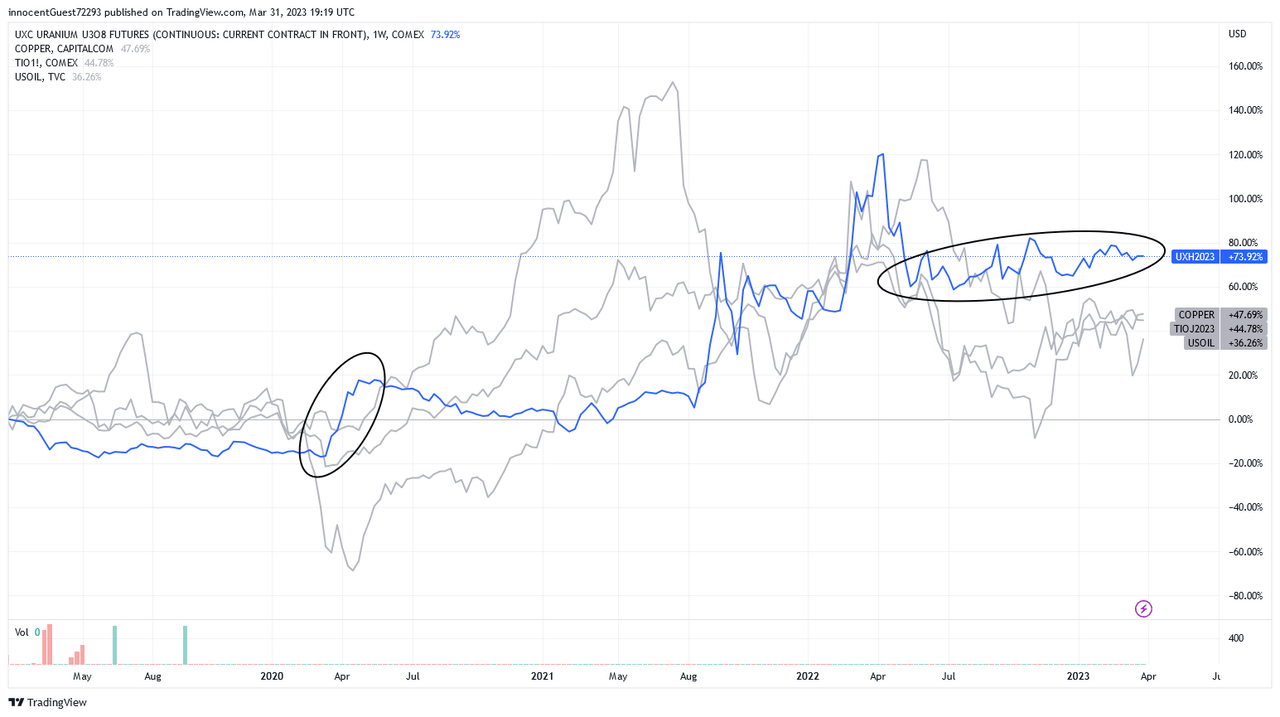

During the ongoing bull market, uranium prices increased threefold, rising from $20 per pound in 2017 to $65 in April 2022, fueled by easy monetary conditions. However, affected by the subsequent tightening of monetary conditions, the price of U3O8 suffered a harsh setback to $46. Since then, it has increased steadily, despite market turmoil in other commodity markets.

The chart is quite astonishing. U3O8 seems to be negatively correlated during times of distress – even during the Covid panic in March 2020!

U3O8 (blue) vs. Coal, Copper, Oil, Iron Ore (Grey) (tradingview.com)

Oil, copper, coal, and iron ore prices are closely linked to economic activity. As economic growth slows, demand for these commodities decreases, and their prices fall. However, during the recent commodity downturn, the price of U3O8 showed remarkable strength compared to other commodities. This is likely due to two factors: a) the uranium market benefits from geopolitical disruptions, and b) the demand for uranium is relatively unaffected by medium-term economic cycles.

Supply Constraints Primary Production

For the last five years, primary production has consistently fallen below market demand for uranium. The supply deficit likely reached its peak in 2020 due to global Covid lockdowns. For a long time, the supply deficit from primary sources was compensated for by secondary supply sources, such as government and utility inventory drawdowns and especially enricher underfeeding. However, secondary supplies have already been drawn down today, and new primary supply is needed.

Higher prices for U3O8 have already met an increase in primary production. For investors, this is a very important aspect. A bull run could be prematurely stopped by undisciplined expansion of primary production. Risks for this have reduced because the previous bear market consolidated the number of producing companies. Today, only the top five producers supply ~60% of global U3O8.

Cameco has already restarted the McArthur River mine and plans to produce 18 million pounds of U3O8 per year from 2024 onwards. That is 40% below the annual licensed capacity, totaling ~31 million pounds of U3O8 in 2024 for the company. Kazatomprom is showing supply restraint too, with plans to increase annual output to ~8 million pounds of U3O8 in 2024, totaling ~50 million pounds.

Assuming other companies increase their supply in 2024 by 10%, which would add ~74 million pounds, this adds up to ~155 million pounds of new primary supply in 2024. The demand for U3O8 remains steady at ~165 million pounds. Therefore, even with McArthur opening and all other producers increasing supply in 2024, the supply gap remains. However, investors have to keep in mind that U3O8 is not a rare commodity. The supply and demand mismatch will resolve itself with higher prices. The production output of primary supply has to be monitored closely.

Secondary Production

The aforementioned secondary supply was responsible for closing the supply gap, especially during the last five years or so. Today, secondary supplies have dwindled for the most part.

a) The Carry Trade

During the last phase of the Uranium bear market, the U3O8 spot market was flushed with liquidity, and interest rates were at record lows. Because of low prices, producers were reluctant to contract with utilities. The logical conclusion for utilities was to secure their future Uranium supplies with carry traders. The Carry traders would purchase Uranium from the spot market and make a contract with the utility to deliver the Uranium later on for a mark-up. Low interest rates, the expectancy of lower prices, and reluctance of utilities made this carry trade lucrative for several years. However, with interest rates substantially higher, a U3O8 price at ~$50, and producers entering the contract market, this carry trade subsided completely. An additional secondary supply, peaking at ~20-30 million pounds of U3O8 per year ceased to exist.

b) The Nuclear Fuel Cycle: Underfeeding to Overfeeding

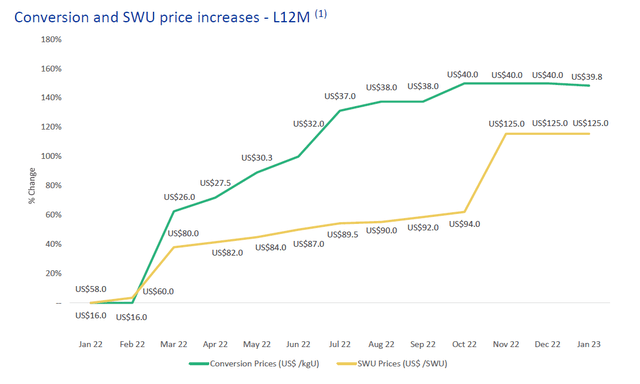

Another source of secondary supply, which amounted to roughly 20-25 million pounds per year, was created by underfeeding from enrichers, which in turn was caused by low nuclear demand.

Enrichers turn UF6, which comes from the conversion of U3O8, into SWU (Separative Work Units). SWUs are basically hours sold to utilities. Enrichers can decide to use less UF6 but enrich it longer to create the same amount of SWUs they contracted for (=underfeeding). Underfeeding saves more UF6 (secondary supply), which in turn lowers the demand for U3O8.

However, the whole process can be reversed if nuclear demand increases. If enrichers signed contracts but still can’t keep up with rising demand, they can use more UF6 to shorten the process to create the same amount of SWUs they contracted for (=overfeeding). Overfeeding has the opposite effect: it increases the demand for U3O8. For investors, this process can be viewed as inherent leverage to the price of U3O8.

Recent price action in conversion and enrichment suggests that nuclear demand is picking up further, and the additional supply is turning into additional demand.

Conversion and SWU price increases (YellowCake)

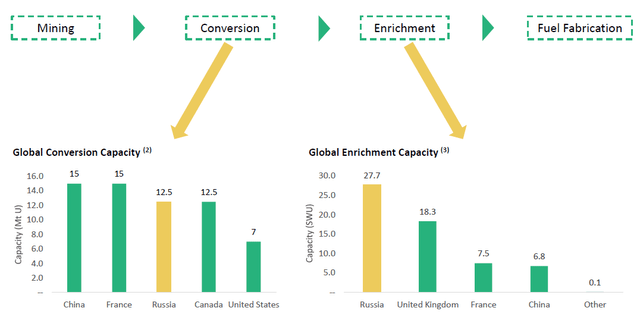

To further complicate things, geopolitical tension favors conversion and enrichment demand. Russia and China have 27.5% of global conversion capacity and 34.5% of global enrichment capacity. The Russian state firm Rosatom is by far the biggest global player in Uranium services.

Nuclear Fuel Cycle (YellowCake)

As western utilities begin to renew their long-term contracts, where safety is the biggest priority, they heavily prioritize western enrichment facilities. The bifurcated market leads to significant inefficiencies, which in turn pushed, and still pushes demand for Uranium services. Western utilities have already stopped underfeeding and could start overfeeding if global tensions persist. This could be the catalyst for the next leg up in U3O8 pricing.

Demand Mismatch a) Inelastic medium-term demand

Similar to other commodities and the energy sector in general, Uranium is in short supply because of cyclical underinvestment. However, the demand for Uranium is much more resilient compared to other commodities because Utilities have to continue their operations. They buy every 18 months, have large inventories, and even if they operate at a loss for a short period of time, shutting down a nuclear reactor is much more costly.

Furthermore, the costs for Uranium compared to the total costs associated with operating a nuclear reactor are in the low single digit percentages of the revenues of Utilities. Therefore, the demand is price inelastic up to a certain extent. All in all, the demand for U3O8 is less dependent on the global economy, and therefore an investment could be considered, even while the global economy is likely entering a recession in 2023.

Of course, producers like Cameco, Kazatomprom, Uranium Energy (UEC), Denison Mines (DML:CA), or NexGen (NXE:CA) exactly know the aforementioned circumstances of the market, which is why they try to dampen the supply response. This has worked until now. However, several mining operations are restarting, and investors need to keep a close eye on the supply response from miners.

b) Growing long-term demand

Whether one agrees with it or not, policymakers and the vast majority of the Western population are aiming to reduce CO2 emissions over the long term. It is blatantly obvious that the green energy transition requires nuclear energy as a stable base load to stabilize the grid, especially while establishing further electrification of cars and other purposes. There’s one country left that is still fighting against reality: sadly, it’s my home country, Germany. But at least we are serving as a negative role model for the world.

Every other country is doing better. China is currently building 21 reactors, and 47 are planned. The Chinese are planning to triple their fleet of nuclear reactors in the next 10 years. India is constructing eight reactors, and 12 are planned. Russia is building three reactors, and 25 are planned.

The global nuclear reactor fleet currently stands at 438 (equating to ~165 million pounds of U3O8). Globally, 58 reactors are under construction, 104 are planned, and 341 are proposed. Now, proposed and planned reactors don’t have to be built. But unless a nuclear catastrophe repeats, and the green energy transition continues, nothing is going to change these plans for the foreseeable future.

On a side note, long-term demand could have further upside due to the ongoing development of small modular reactors (SMRs). These reactors are much smaller and face zero meltdown risk. However, the future demand for U3O8 from these reactors is uncertain, as it is proposed that such reactors could partially use nuclear waste for further energy production. The development stage for SMRs is too early to give them serious weight when discussing the Uranium investment case.

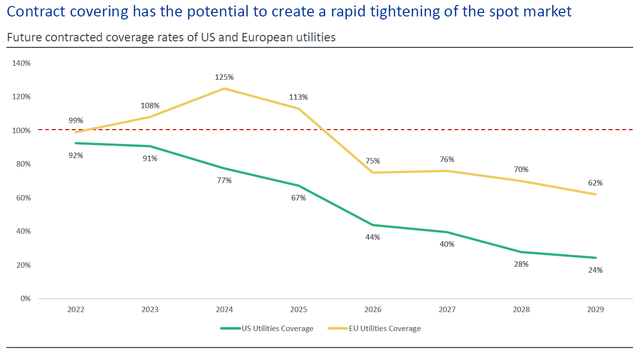

c) Utility contracting cycle

US utilities have not covered all of their uranium needs for the next few years. While the future curve of contracted revenues doesn’t look particularly tight, the uranium spot market does. If utilities are in a hurry to close long-term contracts while secondary markets are providing much less liquidity than before and inventories of UF6 have depleted, the U3O8 price could experience significant upward pressure.

Contract covering of Western Utilities (YellowCake)

As of now, the spot market for U3O8 is trading at around $50 per pound. However, there are rumors that utilities are already fixing future supplies at long-term contract rates of above $60, with Cameco being particularly vocal about this in their earnings calls.

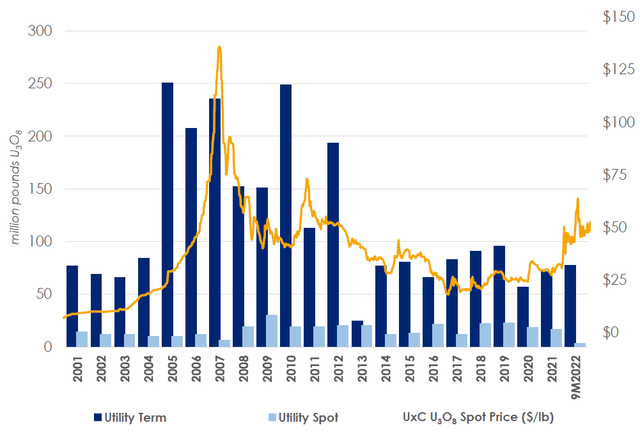

For nine years, from 2013 to 2022, long-term contracting has been below the annual demand for U3O8, which highlights the magnitude of the oversupply that occurred from 2005 to 2012.

U3O8 price and long-term contracting volumes (Kazatomprom)

During the first three months of 2023, long-term contracts with a volume of 52 million pounds of U3O8 have already been signed. If this rate were to continue throughout the year, it would represent a figure similar to the levels seen in 2005-2006 when the price of U3O8 began to rise significantly, but the major squeeze had not yet occurred. This suggests that uranium remains a multi-year investment idea.

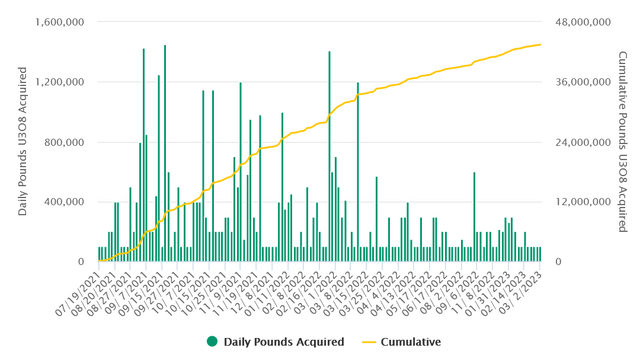

Not only is organic short-term, medium-term, and long-term demand outpacing supply, but another source of demand has entered the market. Closed-end trusts like the Sprott Physical Uranium Trust (OTCPK:SRUUF) or companies like YellowCake specifically aim to corner the U3O8 market by removing uranium from the supply chain. The numbers are significant: during the first quarter of 2023, YellowCake purchased 1.35 million pounds of U3O8 and now holds 20.1 million pounds since inception, while the Sprott Physical Uranium Trust added 2.3 million pounds of U3O8 during the same period.

However, the inflows into these trusts are heavily dependent on financial conditions and liquidity. It’s no surprise that the massive buying by Sprott during 2021 didn’t continue into 2022 when global central banks started to tighten monetary policy, and the US dollar rapidly increased in value. Additionally, the ongoing collateral crisis of private banks and commercial real estate is also affecting investment vehicles for uranium.

Holdings of Sprott Physical Uranium Trust (sprott.com)

However, sooner or later central banks will have to ease financial conditions because the economy is likely to decelerate during 2023 due to the collateral crisis continuing to severely affect credit provision. If an acute liquidity crisis emerges, U3O8 prices will also be affected, as every asset gets sold in such circumstances. However, given the relatively inelastic demand, the tight spot market, and the possibility that no such event ever happens during 2023, I believe that waiting for an absolute meltdown isn’t the correct investing response. Instead, I prefer to stay invested and extend my position opportunistically.

Why Yellow Cake?

The answer is simple: Yellow Cake has been trading at a discount to net asset value for a long time. The company tried to implement a repurchase program to close the gap and unlock shareholder value, but the discount remains, likely due to the aforementioned financial conditions. Currently, investors can purchase U3O8 with a spot price of $50.75 per pound for the price of approximately $44 per pound via Yellow Cake, a discount of around 13%. That’s approximately 5% cheaper than purchasing U3O8 via the Sprott Physical Uranium Trust, which trades at around an 8% discount to net asset value.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.