Wizz Air And Ryanair: Blocked Schengen Accession Romania Sparks Changes

Romania #Romania

Photofex/iStock Editorial via Getty Images

The past years and also the past year has been an eventful year for airlines around the world. A mix of shortages of new commercial aircraft, staff shortages and sky-high demand for air travel despite rising energy prices and inflation caused a significant boom to airline revenues. However, Romania recently found out that there are some limits.

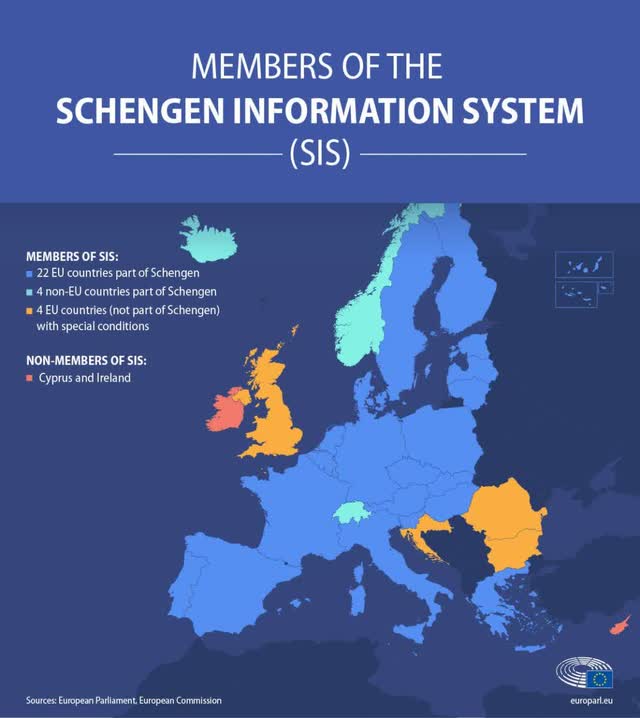

Blocked Accession To Schengen For Romania

European Comission

2022 should have been the year in which Romania would finally be allowed into the Schengen Area. The Schengen Area guarantees free transfer of goods, services, money and persons. The visa policy that goes with it allows tourists with a visa for one Schengen country to travel to other Schengen countries for 90 days. So, a membership of the Schengen Area can significantly boost the economy by means of an improved business climate and ease of travel for tourists, including air travellers.

Right now, if I travel to and from Romania where I live, I have to pass passport control twice. One time at the departure airport and one time at the destination airport. While it is no big deal, it does take time and for international travellers, for instance, people who come from other continents to Europe the absence of the visa policy for Romania provides a significant headwind to the tourism industry.

So, it is no surprise that Romania wants to join the Schengen area as it will provide significant value. It is estimated that accession to the Schengen zone will add 0.5 percentage points to the gross domestic product of Romania. So, this is significant. Romania has been trying to become part of the Schengen Area since 2007 without much success. Even though several institutions concluded that Romania meets the accession criteria, membership of the areas was blocked and since accession is only possible after an unanimous vote Romania has not been able to join for years.

This year, however, was expected to be different. With the situation in Ukraine, Romania’s importance for the safety in Europe was put on display as the country hosts quick response forces from NATO to reinforce the Eastern Flank and from my office, I can see Chinooks and Black Hawks of the US Army fly over frequently. With Romania showing its importance as a NATO member, it was widely assumed that the country would be rewarded with accession to the Schengen Area by January 1st, 2023.

The Netherlands was initially seen as the biggest threat to accession. However, after Prime Minister Rutte of The Netherlands visited the Dutch troops stationed in Romania, a information delegation was sent to Romania which verified that the country met the criteria to be allowed into the Schengen Area. Things went differently. While The Netherlands changed their stance on Romania’s accession so did Austria which unexpectedly voted against accession citing concerns about a migrant flow from Romania to Austria. This was unexpected even more so since Austrian companies are active in Romania. A few examples are OMV and Raiffeisen Bank and BCR. Furthermore, the argument of illegal flows of migrants and refugees is hard to understand since the mountain range in Romania makes it highly unlikely that refugees would prefer this route as their ticket to Western Europe.

Verschuiving voor Ryanair en Wizz Air

Author

Ryanair (NASDAQ:RYAAY) and Wizz Air (OTCPK:WZZZY) seemed to be preparing for Romania’s accession to the Schengen Area, which would provide a boost to tourism and economic activity supporting air travel demand to and from Romania. In June 2021, Ryanair started flights to Sibiu where I currently live and in the winter 2021-2022 schedule, two new routes were added from Charleroi which is where I usually land when returning to The Netherlands.

Due to the war in Ukraine, Ryanair and Wizz Air halted flights to and from Ukraine and Russia and Wizz Air abandoned its base in Moldova. This gave both low-cost carriers which are battling each other in Eastern Europe some capacity to deploy. Flights were moved to Iași, Suceava and Bacau and so it seemed that the low-cost carriers were using the excess capacity to increase presence in Romania.

Blue Air

This was further boosted by the demise of Romanian carrier Blue Air, which operated flights to several cities in Western Europe. When Blue Air halted its operations, Ryanair and Wizz Air saw chances to offer lower fares to stranded passengers in an attempt to expand its Romanian customer base and Wizz Air even saw a role for itself to become the de-facto national carrier of the country.

However, driven by the block on the accession, expected increase in air travel demand to and from Romania and higher fare opportunities remained side-lined, causing changes to the plans of the low cost carriers. Ryanair will remove itself from Oradea, Sibiu, Suceava and Timișoara. The decision to pull from those cities has to do with the competitive force from Wizz Air while in the smaller cities such as Sibiu the economic potential will remain limited for now while the airport is unwilling to grant concessions to keep Ryanair as a customer. In total, the cities from which Ryanair will remove itself will lose 22 routes with Suceava and Sibiu being hit hardest with 16 reductions. Ryanair did announce that it would add eight new routes from Iași and Cluj while Wizz Air announced in September, before the accession vote, that it would add five planes to bases in Romania and in Suceava it will open a base as Ryanair abandoned the city. The expansion there goes at the expense of four routes to and from other Romanian cities.

So, what we are seeing is that driven by a reduced demand profile for smaller cities in Romania due to the block on Romania’s accession to Schengen, low-cost carriers are optimizing their routes to operate only the routes with the highest profit potential recognizing that expect profits from improving connectivity with smaller cities in Romania will not materialize. This is further amplified by shortages of aircraft as Airbus nor Boeing can build and deliver planes fast enough, creating a situation in which fares are high and low-cost carriers have to pick or better said cherry pick where they deploy capacity.

Conclusion: Romania Remains In Focus But Connectivity Suffers

With the blocked accession of Romania to the Schengen Area, we have seen some shifts in how Ryanair and Wizz Air will deploy their capacity and it is no coincidence that some of these changes were announced after Austria vetoed on the accession vote. With demand being high and a shortage of aircraft, Ryanair and Wizz Air have opted to focus on key cities where they see value and with that we see that connectivity is not spread connecting secondary cities with the rest of Europe but is concentrated on some of the higher yield and secure markets. For Romania as a whole, this is a blow as accession and the improved air connectivity that goes with that would have significantly boosted local economies and we are now seeing that badly motivated political decisions are driving away that boost to local economies that was expected and maybe more importantly for the unity of Europe not having Romania becoming part is bad and it is a missed opportunity for the European continent overall as Romania is one of the countries with the highest economic growth numbers and prospects.

For Ryanair and Wizz Air, Romania remains a very important market due to the amount of Romanian citizens that work in other countries in Europe and require air travel, but we see that growth will be much more concentrated than diverse.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.