Universal Display: What Is OLED, And Is It Worth Buying?

OLED #OLED

3drenderings/iStock via Getty Images

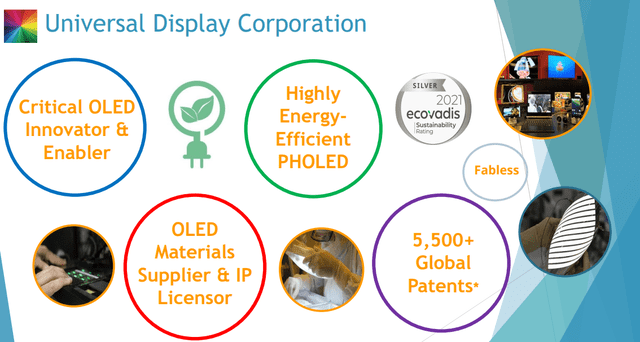

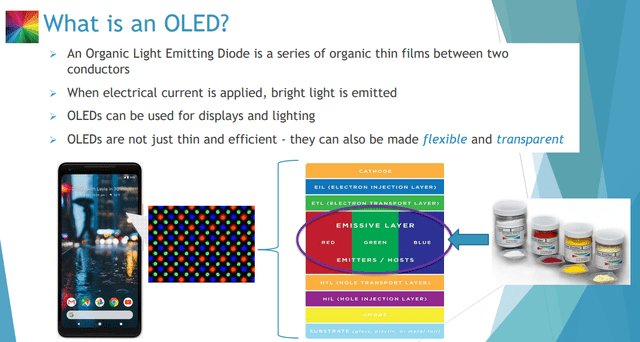

Universal Display Corporation (NASDAQ:OLED) is an interesting business in the OLED space – as the company’s symbol suggests. OLEDs are organic light-emitting diodes, which are used for displays and other lighting products. OLEDs are part of a growing market as the pricing for the technology which was once astronomical, has steadily gone down to more affordable levels.

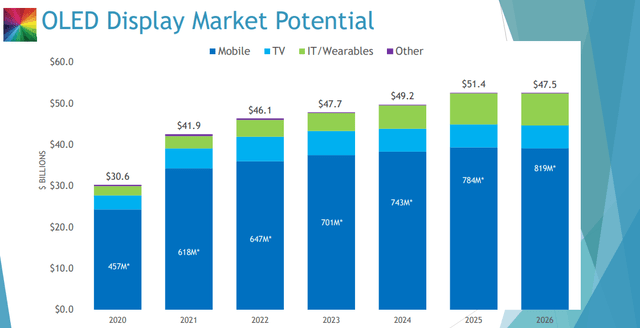

The technology is capturing market share in segments like phones, TVs, wearables, tablets, notebooks and PCs, AR, VR, and portable media devices. Automotive sectors have also been a new adopter of OLED technologies.

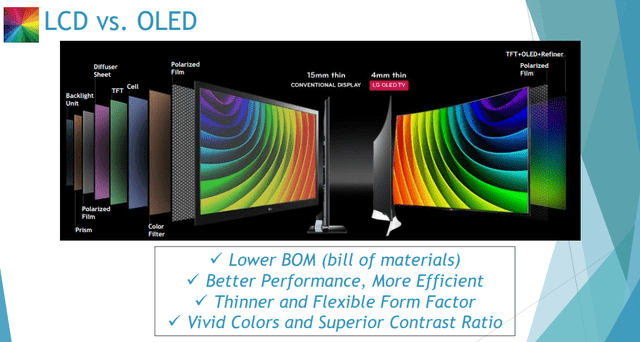

The company believes that OLED technology offers advantages of efficiency, contrast ratio advantages, viewing angles, video responses, form factors, and the recent advantage of an actual manufacturing cost.

Universal Display Corporation – What the company is & does

The company believes that OLEDs will display most display technologies that are currently in use. OLED has over 20 years of experience in the business of working with manufacturers and believes this will help the business capture significant future market share.

OLED IR

The company Universal Display Corporation is in the business of developing new OLED materials, and then selling existing and new materials to manufacturers for display applications. OLED produces the material – then sells it to product manufacturers.

OLED IR

Aside from this the company also develops as well as licenses its portfolio of proprietary OLED materials, device design patents/form factors and its manufacturing technologies. The company has a large portfolio of fully proprietary OLED technologies and materials which have been attained through internal company research and developments.

OLED, to date, has over 5,500 patents issued and pending across the world. It owns a powerful portfolio. It’s also completely fabless, meaning it carries only very limited overall asset risk.

The company uses Energy-efficient Phosphorescent materials called UniversalPHOLED emitters, which do not use any conflict materials. OLED has zero debt, and a net cash position of almost $850M, including cash/equivalents and long-term investments. It has one of the strongest balance sheets in the sector and can be considered fundamentally sound.

The company’s business model can therefore be said to consist of Revenues, through its license, royalty fees, and material sales. It’s also a technology enabler, through direct patent licensing of PHOLED Emitters &% Hosts, and it’s a researcher, with Device & Architecture IP’s.

Overall, it’s a very attractive business model – and the market has significant overall potential that’s worth considering.

Why?

Because the market has been growing and is expected to almost double on a 6-year basis by 2026E.

OLED IR

The advantages of OLEDs over other technologies are strong. The technology offers a 75% cumulative reduction in power consumption, better image, thinner, wider viewing angle, better blacks and contracts, real-time video speeds, Low UV output, and a minimal bezel. The technology can also be made flexible.

It requires less manufacturing than comparative technologies, doesn’t require a backlight, color filters, or liquid crystals, and enables non-glass-based substrates.

In short, virtually everything is better with OLED.

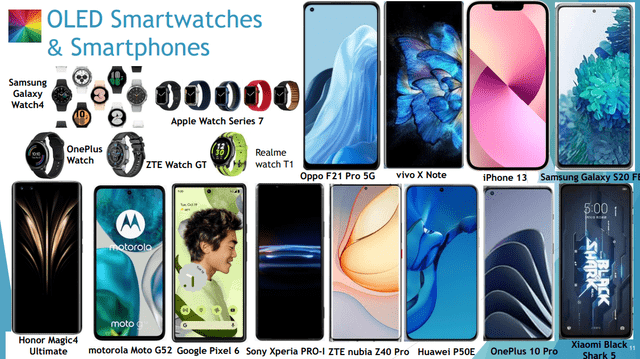

That is what you’re investing in when you look at OLED as the company. You’ve already seen OLED technology, because its everywhere.

OLED IR

The tech is also in televisions, the new Mercedes EQS, new computers, Nintendo Switch consoles, Samsung computers, and other technologies. The flexibility has already been proven commercially with rollable displays, folding phones, and folding computers.

A good comparison is between a standard LCD screen and an OLED.

OLED IR

So, the tech is good – what about the company?

OLED is an interesting investment, to say the least. Its 20-year returns are absolutely superb at 11.7% annualized for the 20-year period. But at the same time, this company has spent the lion’s share of the past 4-6 years at crazy type valuations of P/E’s up to 60-80X – in short, exactly the sort of company I’d want you to avoid if you’re a conservative investor. In the past year alone, the company has lost almost 60% of its market cap as the stock has completely crashed from what I viewed as completely uninvestable overvaluation.

The company has no credit rating – but also has no debt, so it can be argued that it does not need one. It has a market cap of close to $5B, compared to much higher a year ago.

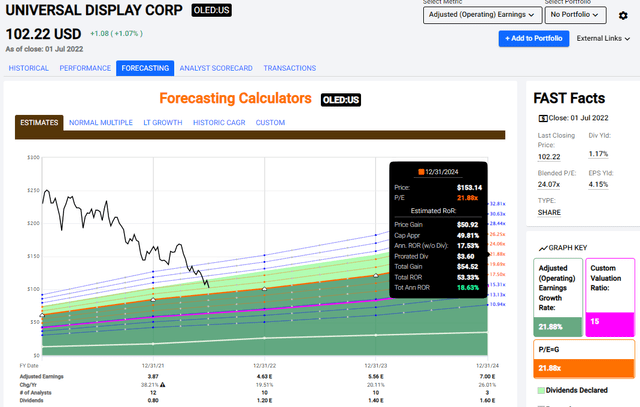

The company’s expectations are for the earnings, thanks to market demand and growth, to grow in turn by 22% annually for the next 3 years.

Those are some hefty expectations, and if they realize, I have no issue paying a premium for such earnings growth. More about that in the company valuation segment.

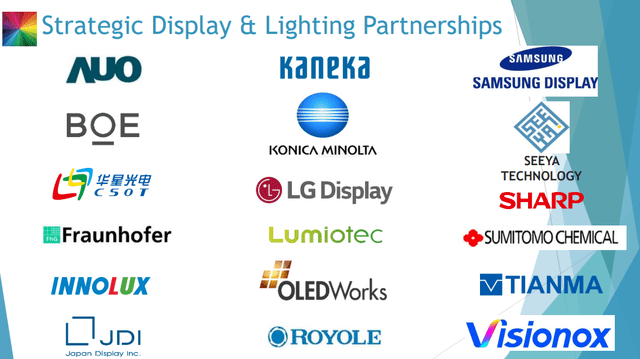

OLED has very strong partnerships across the world. Most relevant players are using the company’s products in one way or another, as we can see on this list.

OLED IR

Furthermore, the company’s historical performance indicates that the future here is rosy, with revenue close to doubling in less than 6 years. Income was relatively flat between 2017-2020, but really took off in 2021, when OLED started to take off in turn.

OLED is a high-margin business with a fabless, lean operating model. It’s the largest phosphorescent OLED technology and materials portfolio in the world with thousands of patents, and one of the most robust customer relationship bases out there, working directly, boots-on-the-ground with more than 25 major businesses around the globe.

Furthermore, the company does most of its research at its US-based testing facility in Ewing, NJ. The company owns more than 50,000 feet of space here and works with research, optimization, and prototyping.

The combined upside of the OLED technology, the future market size, and this company’s market share, prospective and actual, is what makes this company a potentially interesting buy here. OLED has already proven that it’s able to deliver significant earnings growth. For the past 14 years, it’s been growing its EPS by an average of 42.5% (though there is some up and down here).

The company id does not have the most solid sort of dividend historically, but has been growing steadily since 2017 now, to where we can say that the company dividend is actually “respectable”.

Let’s look at OLED’s valuation to see what exactly the company can offer.

Universal Display Corporation – That Valuation

You know me – give me 50-80X P/E and I’ll give you the boot. I won’t be caught dead investing at those multiples, no matter what business you’re peddling. That’s why I was opposed to investing in OLED a year ago when a reader asked me specifically about the company.

Things, as they say, are changing.

OLED now trades at an average weighted P/E of 24X. That’s within the parameters that I will buy certain businesses. With the growth rates we’re expecting from OLED, this is not at all outside of the realm of possibility. In fact, based on its growth rate as a P/E ratio, the company is trading very closely to “fair value”, if you believe that the business should average its growth ratio.

Because if this is the case, and if you believe in this upside, we can see an upside of 18.6% annually to a 2024E 21.88X P/E. Even if the company were to continue declining, you won’t be losing money based on the company’s current forecasts and a 15X forward P/E based on this forecast, even if that upside is only 6% for the next few years.

It’s a growth stock, that even in the case of a conservative 15X P/E doesn’t present a massive downside – and that’s pretty rare.

OLED upside (F.A.S.T graphs)

There are a few downsides to this forecast though. The forecast accuracy for OLED is pretty terrible. The company has a strong history, not of outperforming, but of underperforming. OLED has a strong tendency, around 62% on a 1-year basis and 77% on a 2-year basis with a 10% and 20% MoE respectively, of missing forecasts. So those positive 10-20% growth rates are subject to those miss ratios.

S&P Global gives the company a target range of $105 up to $253. What this means is that no matter how low you want to value this company, or agree with these analysts, even the lower-range price targets are currently above where the company is trading. The S&P Global average for OLED is at around $177/share, with 9 of 11 analysts following the company at either a “BUY” or an “Outperform”.

Based on the current average price target, we see an upside of 73% here. There is a lot to like about this company – and the current valuation is one of those things.

The bullish thesis for the company is based on a reversion based on strong market trends, including contract negotiations with large consumers, technology expertise, and continued valuation pressure that is really unrelated to the company’s actual performance. Yes, the company was overvalued for a long time – but it’s recently been caught in the sell-off.

At this point, even I am starting to call this decline “overdone”, at 50%+ in a year.

I am, therefore, at this point, establishing my base thesis for OLED.

Thesis

My thesis for the company is the following:

Remember, I’m all about :

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.