The Sky’s The Limit: Why Investors Look To KONE And The Elevator Industry

Sky News #SkyNews

HJBC

Introduction

A year ago, Terry Smith s ditched his stake in Finnish elevator and escalator company KONE (OTCPK:KNYJF, OTCPK:KNYJY) and replaced it with Otis (OTIS). The main reason, as far as I could understand it, was double-sided. In fact, Terry Smith held Kone in his portfolio for more than a decade (he first bought into the company in April 2011) when Otis was not yet publicly traded as a stand-alone company. On the other side, though, Kone is far more exposed than Otis to China, a market where liquidity constraints in the housing market are hurting residential escalators and elevators as well.

Now, a whole year has gone by and it is time to look at Kone once again to see how the company is performing and if it can be an interesting investment.

Q3 Results

Right from the start of the earnings report, Henrik Ehrnrooth, President and CEO of Kone, released a statement saying he was particularly pleased “with the continued excellent performance in the Service and Modernization businesses and with the strong momentum in China orders”. But he also spoke about “soft overall New Business Solutions market”.

Let’s look at the overall performance:

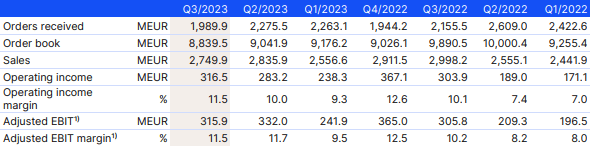

Kone Q3 2023 Interim Report

As we can see from the table below, Q3 orders were down both YoY and QoQ, with the order book shrinking a bit and being below $9 billion for the first time in two years.

But, as China accounts for approximately one third of Kone’s sales, we have to give a closer look at this market because a continued decline in the Chinese construction sector poses a real threat to the company’s financial performance. Not only, but the majority of components used in Kone’s supply chain are sourced externally and most of Kone’s suppliers are Chinese. This means China plays a major role even for Kone’s performance in other markets.

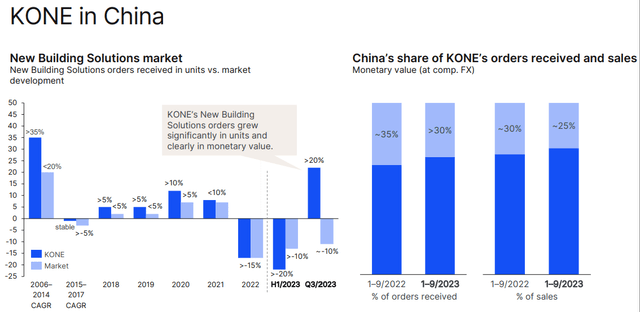

Let’s look then at what Kone reported about China. First of all, Kone tries to report the positive data of Kone’s new building solutions outperforming the market in terms of units and monetary value. However, the 20+% increase reported comes after a major decline of over 20% seen in H1 2023.

Kone Q3 Results Presentation

Kone couldn’t deny that “the New Building Solutions market is expected to decline by approximately 10–15% during 2023” and that “policy actions are central to market recovery”. However, we can’t also deny that Q3 brought strong momentum in order for Kone in China, which is an overall good thing for the company.

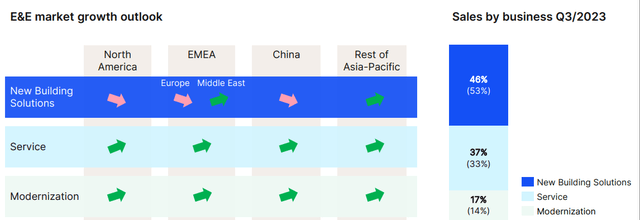

Zooming out from China, we see how, generally speaking, while New Building Solutions are struggling, Service and Modernization are performing well. After all, this is the secret of the elevator and escalator business, which doesn’t rely only on new sales, but actually generates its real profits from the other two business segments. It can be seen on the right hand side of the slide below, where New Building Solutions makes up 46% of total sales, while the remaining 54% comes from Service and Modernization.

Kone Q3 Results Presentation

Now, as we have seen for Kone’s largest peer Otis, modernization is going to be the segment where the highest growth rate is expected. It makes sense for two reasons: when customers don’t want to take on new loans to finance the purchase of new solutions, it is a much better deal to modernize old equipment. Now, the key of modernization is that, usually, customer retention rate in services is way higher once the modernization has been carried out. The second reason is that, especially in China, the first big residential boom was between 2005 and 2015. This means that the equipment sold at the beginning of that cycle is aging and is now more than 15 years old. Usually, elevators and escalators need modernization after 15-20 years.

Kone was able to reiterate its 2023 guidance, expecting to grow sales in the range of 3-6% while keeping low double-digits EBIT margins (11-12%)

This can be achieved thanks to the business mix moving in the direction where service and modernization continue to increase, as said during the last earnings call.

So, is Kone a buy right now? The stock trades at €40 in the former Helsinki Stock Exchange (Now Nasdaq Helsinki).

Valuation

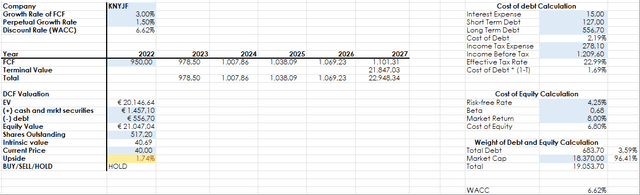

Running a discounted cash flow model for the next five years, with Kone’s WACC of 6.7% I find the stock is fairly priced at €40. My assumptions, as we can see below, are a 3% FCF growth rate for the next 5 years and a perpetual growth rate of 1.5%. Not extremely bullish, but I think these are reasonable for a business whose stability is great, but whose growth is that of a mature one.

Author, with TTM financial data from SA

After all, the stock currently trades at a 22.7 PE ratio and a fwd EV/EBITDA ratio of 13.2. These are not cheap multiples, but they are more or less in line with Otis’. However, Otis is more profitable than Kone, sporting a 15.6% EBIT margin and a return on total capital of 52% vs. Kone’s 24%. The Finnish company keeps on being a very interesting player in an industry every investor should be aware of. However, it is no steal at the moment and it is exposed to greater risk than Otis due to its business in China. This is why my pick remains Otis, while I reiterate my hold rating for Kone.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.