Tax breaks for affordable housing deals move forward a month after Mayor Turner said he’d hit pause

Turner #Turner

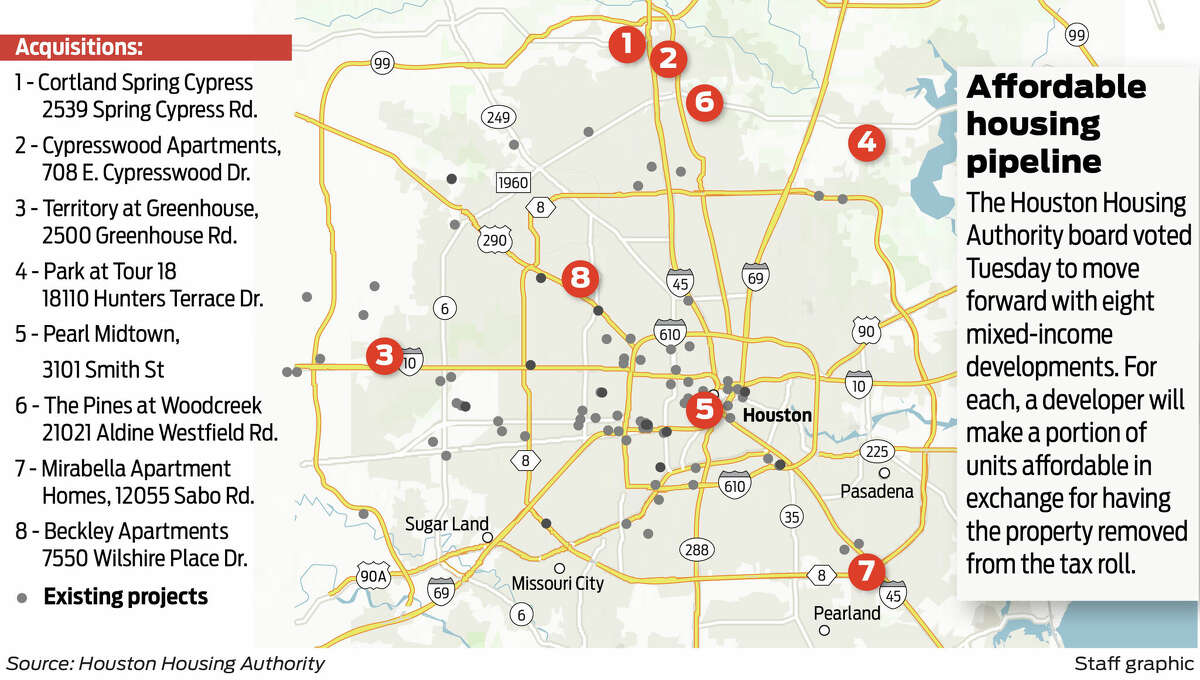

One of the eight properties that was vote on, the Cortland Spring Cypress apartments, was fully greenlit — the Houston Housing Authority will take the $37 million property off the tax rolls in exchange for making half of its 287 units more affordable. Specific terms for the other seven remain under consideration.

PFCs: After backlash in high-income Tanglewood, Houston pauses affordable housing deals across city

An affordable one-bedroom at the Cortland complex can rent for as much as $1,262, according to the housing authority. Market rates for the one-bedrooms at the complex, according to its website, start at $1,270. It is unclear whether renters of the 127 “affordable” apartments created by the deal will receive any meaningful subsidy in exchange for the housing authority exempting the apartment complex, appraised at over $37 million, from paying property taxes. Cortland has not yet commented on how its affordable rents compare to market rates.

The housing authority is still negotiating the terms of the deals for the other seven properties. In other words, they’re gauging how many units the property owners are willing to make affordable, and at what discounts, in exchange for not having to pay property taxes.

The tax breaks, which use what are known as public facility corporations, have drawn public attention since the Tanglewood Homes Association, belonging to a wealthy neighborhood with a history of protesting affordable housing, began pushing back on a deal in their neighborhood. Soon after, the group brought the issue to the mayor. More than half a dozen bills related to public facility corporations have been introduced in the Texas Legislature.

The Houston Housing Authority voted on Feb. 28 to move forward with eight public facility corporation deals. One was greenlit for acquisition; the others are still negotiating terms.

Ken Ellis

Housing authority officials tout what they’ve been able to achieve through the tax breaks — as of mid-February, their 76 public facility corporation agreements had created 12,600 apartments with discounted rents, 5,000 of which were reserved for households earning 60 percent of the Houston area’s median income or less. The deals they have negotiated go well beyond the minimum required by law.

What’s more, many of the new PFCs are in what is known as the “Houston arrow” — a triangle extending from the western portion of the city to a point just east of downtown, an area that corresponds with a slew of positive quality-of-life variables: lower poverty rates, higher educational attainment, lower rates of childhood asthma, higher home values and other beneficial outcomes

But on the other side are people who wonder whether the deals meet the needs of Houston’s most rent-burdened residents and of taxpayers.

More from R.A. Schuetz: Houston Housing Authority votes to purchase 45 Third Ward properties to “reimagine” Cuney Homes

“PFCs are not a great tool for what we think of as affordable housing,” said John Henneberger, a co-director at the tenant advocacy group Texas Housers.

He pointed to National Low Income Housing Coalition data, which shows that Houston has enough housing that is considered affordable to people earning between 50 and 100 percent of the region’s median income. Where the shortage lies is with households earning below 50 percent of the Houston region’s median income — or less than roughly $35,000 for a two-person household.

The Houston Housing Authority has gone above some housing authorities in targeting some units to people earning less than 50 percent of the area’s median income. For example, a 2020 report showed that in the course of negotiating five tax break deals, Fort Worth had created only eight such units. By that time Houston had created 39 units affordable to those incomes; as of this February, the city has created 829.

Nonetheless, only a small share of affordable units created through these tax breaks are targeted at renters with those incomes. The majority of affordable units created by the Houston Housing Authority using public facility corporations are for people earning as much as 80 percent of the Houston area’s median income — or about $57,000 for a two-person household.

What’s more, while most affordable housing programs, such as housing choice vouchers, define an affordable rent as taking no more than 30 percent of a household’s income, the Houston Housing Authority sets it by apartment size.

For example, the housing authority said that, for PFC deals being considered in February, a one-bedroom apartment could rent for $1,262 for a family earning up to 80 percent of the Houston area’s median income, or $1,081 for a family earning up to 60 percent of the Houston area’s median income. That means that some families may end up putting more than 30 percent of their incomes toward rent — and that rents the city is calling “affordable” are not always large discounts from market rates.

SEARCH YOUR ZIP CODE: Houston home value tracker: The most (and least) expensive ZIP codes

What’s more, those rent discounts are purchased at a hefty price to the city. The average property saves roughly $1 million every year in property taxes, David A. Northern Sr., the housing authority’s chief executive, told members of the Houston City Council’s Housing Committee.

That money may not be felt directly by Houston or local school districts’ budgets. Voters have capped the revenue the city can collect — and the city hits that cap every year, usually forcing it to reduce its property tax rate. And the state’s “Robin Hood” system for funding school districts, which tries to even out how much every school gets per student, means that revenue reductions may not always be felt by Houston’s school districts.

But those tens of millions of dollars come from somewhere. For Houston’s taxes, owners without the tax break make up the difference. And if a revenue loss may not be felt by a local district, such as HISD, directly, the loss would be felt by the less wealthy school district that would have otherwise received the funds.

rebecca.schuetz@houstonchronicle.com