Sterling Infrastructure Can Continue To Outperform

Sterling #Sterling

niphon

Investment Thesis

Sterling Infrastructure, Inc (NASDAQ:STRL) has meaningfully outperformed the broader markets since our last buy recommendation, gaining 26.71% versus over 6% decline in S&P 500 (SPY). The company delivered good results in the third quarter of 2022 despite a volatile macroeconomic environment. The demand in the majority of its end markets is still strong, especially in commercial markets for building e-commerce warehouses and data centres. The funding from Infrastructure Investment and Job Act (IIJA) has started benefitting the company’s order growth and this should continue to accelerate throughout 2023. Through its business strategy, the company has also increased its bidding activity and maintained its focus on a higher-margin project mix. The company is being negatively impacted by inflation and supply chain issues with concrete and diesel since the second quarter of 2021. However, as we move forward, I expect inflation to moderate, and supply chain constraints to ease. In addition to improving macro conditions, healthy backlog, Federal funding, and strong demand in the majority of end markets, combined with higher margins in the backlog and its business strategy should help the company deliver revenue and margin growth in 2023. The stock is still trading at a discount versus its historical P/E levels. Hence, I believe Sterling Infrastructure, Inc can continue its outperformance and is a good buy.

STRL Q3 2022 Earnings

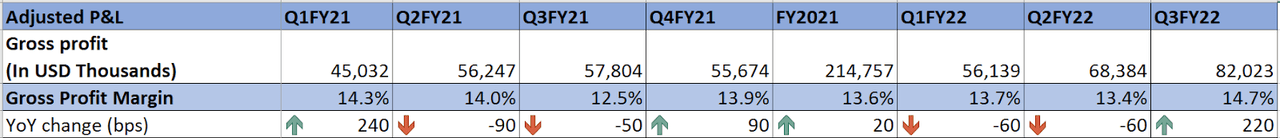

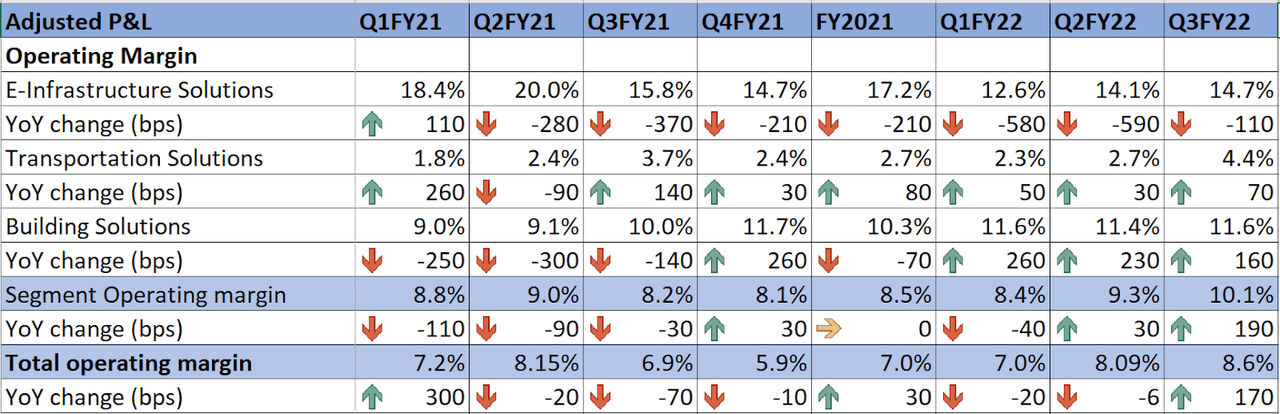

Sterling Infrastructure, Inc reported better-than-expected results in the third quarter of 2022. Revenue for the quarter was $556 million, up 20% Y/Y and ~$47 mn higher than the consensus estimate of $509 million. Adjusted EPS was $0.97, up 35% from the year-ago quarter and above the consensus estimate of $0.87. The gross profit margin of 14.7%, increased by 220 basis points (bps) Y/Y and the operating margin was up by 200 bps Y/Y to 9%. The company’s adjusted EBITDA was $60.5 million up 51% Y/Y. The increase in revenue was due to a healthy backlog and growth in the E-Infrastructure segment as the end-market demand remained strong. The increase in gross margin was a result of higher volume generation in the segments, whereas operating margins were up due to increased revenue and gross profit. However, these benefits were partially offset by continuing supply challenges and inflationary pressures. The increase in adjusted EPS was a result of higher revenue and better margins.

Revenue Analysis And Outlook

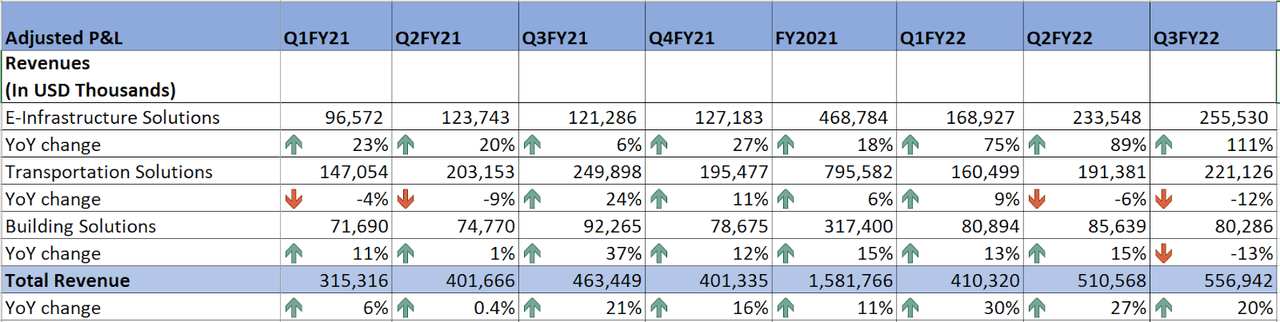

In the third quarter of 2022, Sterling Infrastructure Inc reported an increase in revenue by 20% Y/Y to $556 million. The increase was attributed to a strong backlog and increased end-market demand in the E-Infrastructure segment, which saw an increase in revenue by 111% Y/Y to $256 million. The increase in the revenue for the segment includes $84 million from the Petillo acquisition and $50 million in organic growth from the Plateau business. On a pro forma basis, the E-Infrastructure segment saw organic growth of 40% due to continuing strong demand for distribution centers, data centers, and warehouses. Moving to The Transportation segment, revenue declined by $28.8 million or 12% Y/Y to $221 million. The decrease was a result of lower heavy highway and aviation revenues due to the timing of backlog execution. The decrease was partially offset by increased water-related projects. Lastly, In the Building segment, revenue decreased by 13% Y/Y to $80.2 million. The decline was attributable to a decline in the housing market as home ownership became less affordable due to an increase in interest rates and a rise in real estate prices.

STRL’s Revenue (Company Data, GS Analytics)

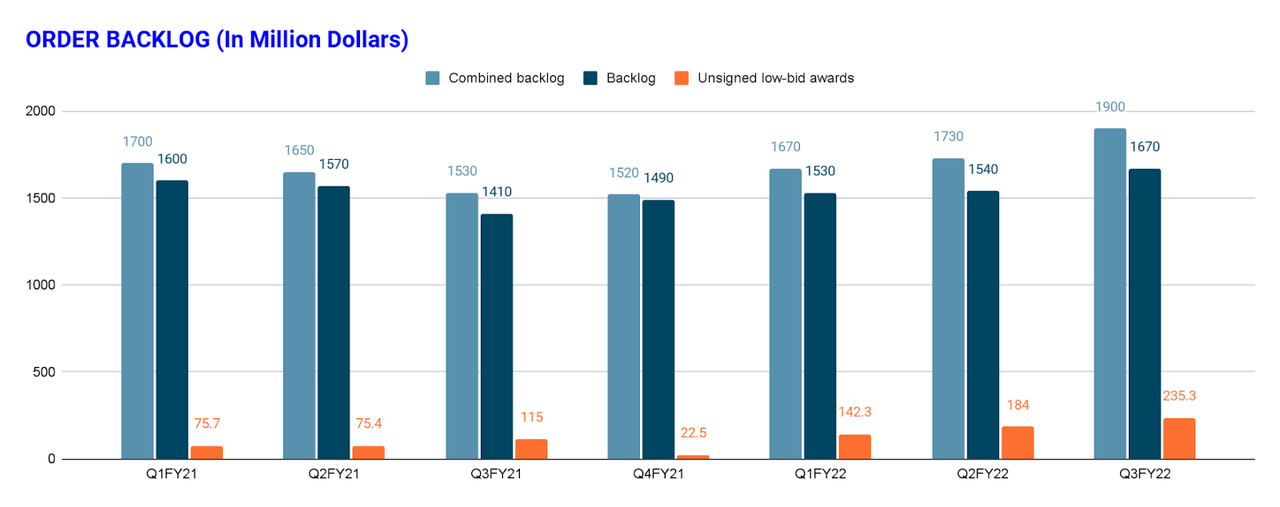

The increase in the backlog was driven by strong end-market demand in the E-Infrastructure and the Transportation segment. In addition, Sterling Infrastructure’s business strategy, announced in 2016, also contributed to the higher revenue and backlog. The business strategy includes three key elements, solidifying the base, growing high-margin projects, and expanding into adjacent markets. In solidifying the base, the company focuses on discipline bidding to significantly reduce the probability of project losses, with the key objective of risk reduction. Since the implementation of the business strategy in 2016, the company has been able to improve its heavy highway backlog gross margin from 4% before 2016 to 9.5% at the end of the last year. In the second element, growing higher-margin projects, the company focuses on lowering the proportion of low-bid heavy highway revenue by shifting its project mix from low-bid heavy highway projects to alternative delivery heavy highway projects and other higher margin work (e.g., airports, commercial, piling, and shoring). The higher-margin projects that the company targets are in the 12-15% gross margin range. The objective is to increase bottom-line growth. The last element, expanding into adjacent markets, focuses on the acquisition of companies and assets that will enable the company to broaden its types of projects by targeting companies that have a gross margin of 15% or more. A good example of one such acquisition is Petillo, acquired in December 2021 under the E-Infrastructure segment.

STRL’s Order Backlog (Company Data, GS Analytics)

The market in which Sterling infrastructure operates continued to remain healthy in the E-Infrastructure segment and the transportation segment. The E-Infrastructure segment which represents 46% of the company’s total revenue in the third quarter saw record bookings and increased backlog as the company started benefiting from the recent trend towards onshoring. The company recently won a new 500-acre plus Rivian electric vehicle plant in Georgia. This new manufacturing activity, combined with the continued high demand for data centres and e-commerce warehouses, makes me optimistic for the segment in 2023 and beyond. The transportation segment also continues to see strong demand and represented 40% of the revenue in the quarter. The funding under the Infrastructure Investment and Job Act (IIJA) which is being deployed by the Department of Transportation continues to flow through states. The company believes that IIJA will continue to grow in and through 2023. Furthermore, bid activity also increased in the third quarter. The combination of a multi-year backlog along with Federal funding and increased bid activity should position the segment for revenue growth in the years ahead. The building segment, however, saw a decline in the end-market demand especially in its largest home market in Dallas, due to an increase in real estate prices and rising interest rates which are affecting affordability. The softening of end-market demand will continue to negatively impact revenue for this segment in the near term. However, this is relatively a smaller portion of the overall business and healthy demand in the other two segments should more than offset the decline in this business. Further, the builders are becoming aggressive in incentive programs to help buyers in overcoming the affordability issue. These increases in incentives should help offset some of the demand slowdowns.

In a nutshell, I believe that the company holds good revenue growth potential in the years ahead. The continuing strong demand in the majority of its end markets, a healthy backlog along with increased bid activity and funding levels should help in revenue growth in 2023.

Margin Outlook

In the third quarter of 2022, Sterling Infrastructure’s gross margin saw an increase of 220 bps Y/Y and climbed to 14.7%. The increase was attributed to an increased mix of revenue from a higher-margin E-infrastructure segment and increased margins in the combined backlog. The general and administrative expenses increased by $6.8 million Y/Y in the current quarter to $26.5 million. The increase was attributed to the cost associated with the Petillo acquisition and inflationary pressure on expenses.

STRL’s Historical Gross Profit Margin (Company Data, GS Analytics)

Looking forward, while the supply chain issues along with higher concrete and diesel prices should be a headwind in the near term, they should be more than offset by increased leverage from higher volume generation, higher priced projects in the backlog and price increases taking effect. In the medium to long term, gross margins and operating margins should expand with supply chain constraints easing, moderating inflation, a shift in mix towards higher margin E-infrastructure business as well as continued bidding discipline which should result in higher margins in the backlog.

STRL’s Operating Profit Margin (Company Data, GS Analytics)

Valuation And Conclusion

Sterling Infrastructure Inc is currently trading at a 10.27x 2022 consensus estimate of $3.16 and a 9.60x 2023 consensus estimate of $3.37. The company is currently trading slightly lower than its 5-year average forward P/E of 11.86x. I believe the company holds good potential for growth in the coming years. The healthy backlog combined with strong demand in the E-Infrastructure and the Transportation segment should benefit revenue in 2023. Margins should also improve with inflationary costs and supply chain issues easing in 2023. Hence, I believe Sterling Infrastructure Inc is a good buy.