Pfizer: Bear Market Conviction Pick

Pfizer #Pfizer

ChainGangPictures

A more in-depth version of this report, including metric definitions and targets, was first shared with members of my Quality + Value Strategies subscription service in the Seeking Alpha Marketplace on October 4, 2022.

Even in this bear market, I find it challenging to uncover enduring enterprises not still trading at a premium, despite steep price drops. Nevertheless, Pfizer, Inc. (NYSE:PFE), the pharmaceutical giant, presents a rare, quality value investing new idea.

In this initial primary ticker research report, I put Pfizer and its common shares through my market-beating, data-driven investment research checklist of the value proposition, shareholder yields, fundamentals, valuation, and downside risk.

The resulting investment thesis:

Rare for the current market, Pfizer rates as bullish in all five areas of my quality plus value proprietary investment checklist, making PFE a bear market conviction pick on the long side.

My current overall rating: Buy, based on a bullish view of the company and a bullish view of the stock.

Unless noted, all data presented is sourced from Seeking Alpha Premium as of the market close on October 10, 2022; and intended for illustration only.

Drug Pipeline Still Improving Post-COVID

PFE is a dividend-paying large-cap stock in the healthcare sector’s pharmaceuticals industry.

Pfizer discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products worldwide. Pfizer Inc. was founded in 1849 and is headquartered in New York, New York, USA.

My value proposition elevator pitch for PFE:

Despite substantial near-term growth and cash windfalls from its COVID-19 vaccine and treatments, Pfizer’s drug pipeline is still improving with several successful recent drug launches.

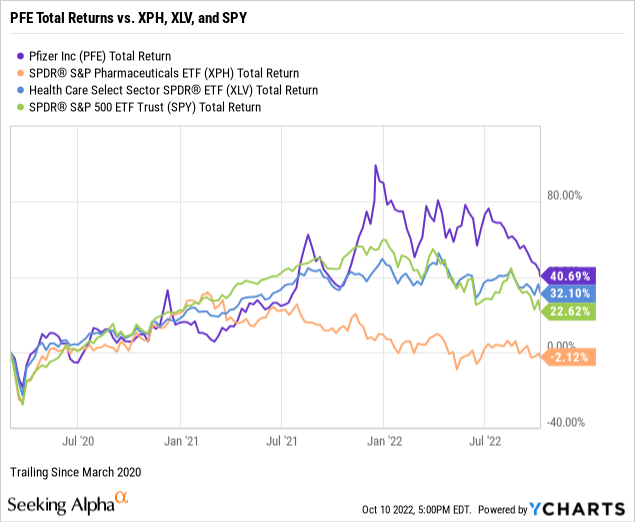

The chart below illustrates the stock’s performance against the SPDR S&P Pharmaceuticals ETF (NYSE:XPH), the Health Care Select Sector SPDR Fund ETF (NYSE:XLV), and the SPDR S&P 500 Trust ETF (NYSE:SPY) from the coronavirus pandemic through the current endemic bear market.

Ultimately, investing in individual common stocks should aim to beat the benchmark indices over time. For example, PFE has outperformed the total returns of its industry, sector, and market over the past three-plus years, reflecting its positioning as a core defensive holding.

My value proposition rating for Pfizer: Bullish.

Data by YCharts Shareholder Yields Doubling the 10-Year

Data by YCharts Shareholder Yields Doubling the 10-Year

As part of my due diligence, I average the total shareholder yields on earnings, free cash flow, and dividends to measure how a targeted stock compares to the prevailing yield on the 10-Year Treasury benchmark note. In other words, what is the equity bond rate of the common shares.

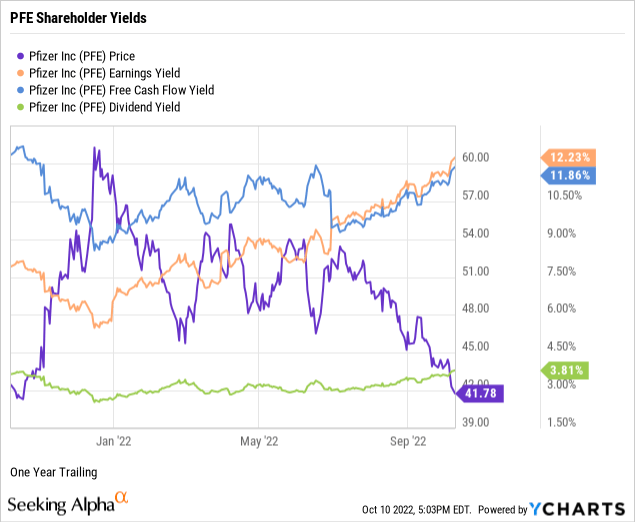

PFE was trading with an attractive earnings yield of 12.23%, as demonstrated in the below chart. Moreover, at 11.86%, the stock’s free cash flow yield was also well above my threshold.

Pfizer offers an excellent forward dividend yield of 3.81%. Moreover, its conservative 25.99% payout ratio indicates a safe, well-covered dividend with room for annual raises.

Next, I take the average of the three shareholder yields to measure how the stock compares to the prevailing yield of 3.89% on the 10-Year Treasury. For example, the average shareholder yield for PFE was 9.30%. Conventional market wisdom holds equities as riskier than U.S. bonds. However, securities such as PFE, which reward shareholders with yields more than double the government benchmark, argue for owning the stock instead of the bond.

Remember that earnings and free cash flow yields are inverse valuation multiples, suggesting that PFE currently trades at a discount. I’ll further explore valuation later in this article.

My shareholder yields rating for PFE: Bullish.

Data by YCharts Outstanding Performance in Midtown

Data by YCharts Outstanding Performance in Midtown

Next, I’ll explore the fundamentals of Pfizer, uncovering the performance strength of the company’s senior management.

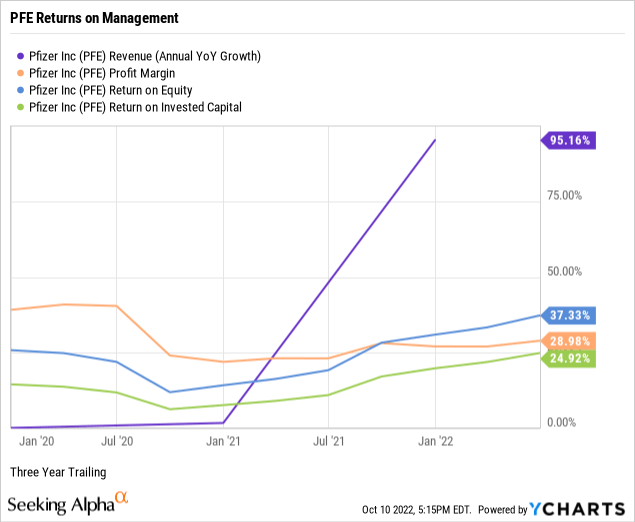

Per the below chart, Pfizer had three-year annualized revenue growth of 95.16%, far exceeding the 13.07% median growth for the healthcare sector. Notably, the company’s leading participation in developing and marketing COVID-19 vaccinations and antivirals ignited the growth spurt.

Pfizer had a trailing three-year double-digit pre-tax net profit margin of 28.98%, far outperforming the sector’s negative median net margin of -2.40%. I screen for profitable companies to avoid unnecessary speculation.

Management was producing a trailing three-year return on equity or ROE at a resounding 37.33% against a negative median ROE of -38.32% for the sector.

Arguably, the board of directors’ periodic stock repurchases is escalating the ROE, a good sign for shareholders. However, the board has not repurchased stock since March of this year. Nonetheless, it appears the company bought its shares at a discount.

At 24.92%, Pfizer had a return on invested capital or ROIC that obliterated the sector’s negative median ROIC of -21.02%, indicating that its senior executives are highly capable capital allocators.

ROIC needs to exceed the weighted average cost of capital or WACC by a comfortable margin, confirming management’s ability to outperform its capital costs. For example, Pfizer’s ROIC comfortably exceeds its trailing WACC of 7.83% (Source: GuruFocus).

The skyrocketing, albeit temporary, revenue growth, double-digit net profit margin, and high returns on equity and capital indicate outstanding management performance in midtown Manhattan.

My fundamentals rating for Pfizer: Bullish.

Data by YCharts Stock Price is Cheaper Than Its Drugs

Data by YCharts Stock Price is Cheaper Than Its Drugs

I rely on just four valuation multiples to estimate the intrinsic value of a targeted quality enterprise’s stock price.

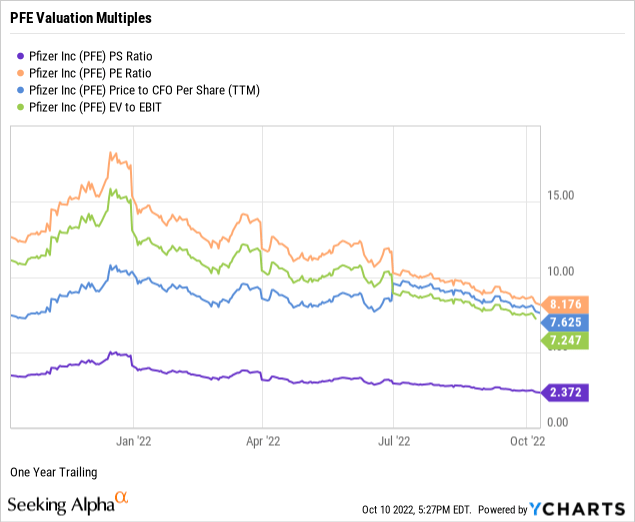

The trailing price-to-sales ratio or P/S was 2.37 for PFE, lower than the 4.28 times for the healthcare sector and about equal to the 2.26 times P/S for the S&P 500. (Source of S&P 500 P/S: Charles Schwab & Co.) Thus, the weighted industry plus market sentiment suggests a reasonably-priced stock relative to Pfizer’s topline.

Although a hit-or-miss multiple, PFE had a price-to-earnings or P/E of 8.18 times against a sector P/E of 23.76, indicating investor sentiment discounts the stock price relative to earnings per share. Further, PFE was trading at less than half of the S&P 500’s overall P/E multiple of 18.05. (Source of S&P 500 P/E: Barron’s).

PFE’s 7.63 times price-to-operating cash flow was trading at a discount to the sector’s median of 16.67, indicating the market prices the stock below fair value relative to current cash flows.

Against the broader sector median of 19.46 times, PFE was trading at 7.25 times enterprise value to operating earnings or EV/EBIT, signaling the stock was underbought or oversold by the market, a bullish signal.

Weighting the preferred valuation multiples suggests the market assigns a discount to Pfizer’s stock price relative to sales, earnings, cash flow, and enterprise value. Therefore, based on the fundamentals and valuation metrics uncovered in this article, risks and potential catalysts notwithstanding, I would call PFE an underpriced stock of a legacy A-rated healthcare enterprise.

My valuation rating for PFE: Bullish.

Data by YCharts Wide-Moat Surrounds Low Downside Risk

Data by YCharts Wide-Moat Surrounds Low Downside Risk

When assessing the downside risks of a company and its common shares, I focus on five metrics that, in my experience as an individual investor and market observer, often predict the potential risk/reward of the investment. Hence, I assign a downside risk-weighted rating of above average, average, below average, or low, biased toward below average and low risk profiles.

Alpha-rich investors target companies with clear competitive advantages from their products or services. An investor or analyst can streamline the value proposition of an enterprise with an economic moat assignment of wide, narrow, or none. For example, Morningstar assigns PFE a wide moat rating.

A favorite of the legendary value investor Benjamin Graham, long-term debt coverage demonstrates balance sheet liquidity or a company’s capacity to pay down debt in a crisis. Notably, as reported on its July 2022 quarterly financial statements, at 1.96 times, Pfizer’s long-term debt coverage could readily pay off 100% of its longer-term debt obligations in a crisis using its liquid assets, such as cash and equivalents, short-term investments, accounts receivables, and inventory.

In a further test of its paydown capacity, Pfizer’s long-term debt to equity was a safe 39.44%.

Current liabilities coverage or current ratio measures the short-term liquidity of the balance sheet. For example, Pfizer’s short-term debt coverage was 1.42 times. Thus, its balance sheet provides significant liquid assets to pay down 100% of its current liabilities, including accounts payable, accrued expenses, short-term borrowings, and income taxes.

As a long-term investor, I use a five-year beta trendline to screen for stocks with below-market volatility. PFE’s 60-month trailing beta was 0.67, and its shorter-term 24-month beta was about equal at 0.62. With price volatility trading well below the S&P 500 standard of 1.00, PFE presents as a low-volatility core portfolio holding.

The short interest percentage of the float for PFE was bear paws-off at 1.14%. So perhaps the near-sighted traders view the stock as a safe wide-moat healthcare staple with a loyal and sustainable customer and investor base.

Pfizer is a fundamentally superior company with a market-beating value proposition and an attractive risk profile against a broader bear market.

My downside risk rating for PFE: Low.

More the Needle than the Haystack

Catalysts confirming or contradicting my overall buy investment thesis on Pfizer, Inc. and its common shares include, but are not limited to:

(Additional source of catalysts: Morningstar.)

In this bear market, finding quality enterprises trading at value prices are more the needle than the haystack. Nevertheless, quantitatively and qualitatively, Pfizer and its common shares are a core holding conviction buy.