OPEC Drops The Bombshell

OPEC #OPEC

coffeekai/iStock via Getty Images

Article Thesis

Prices for oil and natural gas had been pulling back in recent months on recession fears, but the supply-demand imbalance remains in place. With SPR releases likely ending soon, and with OPEC now deciding to cut production by a hefty 2 million barrels per day, oil markets should become even tighter. That bodes well for energy companies – in this article, we’ll highlight a couple of those that seem attractive at current prices.

Tight Energy Markets Get Even Tighter As OPEC Flexes Its Muscles

Demand for oil dropped during the initial phase of the pandemic when lockdowns led to less air travel and less traffic. But global demand quickly recovered. At the same time, a trend that had already been in place for a couple of years accelerated: Capital expenditures for new energy projects declined to an even lower level. ESG mandates, tough regulation, a free cash flow focus by management teams, and the lowish oil prices prior to and especially during the pandemic have led to significant underinvestment in new production capacity. With supply from existing production facilities declining over time due to wells becoming less productive as they age, the world was positioned for a tight supply-demand situation. When the Russia-Ukraine war started, energy markets got even tighter, and prices soared.

More recently, prices for oil and natural gas pulled back as central bank tightening increased the likelihood of a recession. But we do believe that this may have been an overreaction by the market, as easing COVID measures in countries such as China and recovering air travel should offset at least some of the headwinds from a potential recession. It’s also important to note that oil demand doesn’t drop all that much during recessions: In 2009, the year when the Great Recession had the largest impact on the global economy, oil demand dropped by 1.2 million barrels per day. That was an especially harsh and deep recession on a global scale, and yet, it only left a minor dent in global oil demand. A more benign recession, especially if it were to emerge in some markets only (e.g. the US and Europe, but not the rest of the world) should naturally lead to an even smaller decline in oil demand. But even if another 2009-style recession were to emerge and demand would drop by a similar amount today, that would basically only balance out the supply from the Strategic Petroleum Reserve that will most likely end soon.

In this already tight market with global storage levels being rather low, OPEC has just announced that they would cut oil production by 2 million barrels per day. That means several things. First, it will mean even lower supply, although it’s important to note that the actual production cut will be smaller – OPEC has been underproducing vs. its own quotas, thus a 2 million barrel reduction in quotas will have a somewhat smaller impact in “real” terms. Still, production will decline. On top of that, this also sends an important message to the market and to politicians around the world. OPEC is not inclined to increase production in order to bring down gas prices in the West. Instead, OPEC is seemingly adamant about keeping oil prices at a level they deem attractive – they want profits, and they’re willing to cease some market share to keep oil prices at a level they deem appropriately high. That’s bad news for Western governments that had been hoping for support from Saudi Arabia and others when it comes to easing supply concerns, but seemingly that’s not OPEC’s priority. It’s also bad news for consumers around the world that will likely pay higher prices for gasoline, diesel, and so on. But it’s good news for producers that will benefit from OPEC’s price support for oil.

Many of those oil producers that had already been in a very solid position before the OPEC production cut will be even better positioned for strong profits and cash flow following this bombshell announcement. Let’s look at some of them.

Exxon Mobil

Exxon Mobil (XOM) is the largest Western energy company and has been an excellent performer year-to-date, delivering a total return of around 60% in this crisis year. With its low-cost assets in the Permian Basin, Guyana, etc., Exxon Mobil is well-positioned to thrive in a wide range of oil price environments. Even with oil at $60 per barrel, free cash flow generation would be very healthy and easily high enough to cover the company’s dividend which yields 3.7% today. With oil in the $90 range, profits and cash flow will of course be even higher.

That allows Exxon Mobil to do several things at the same time. The company keeps strengthening its balance sheet while also paying its dividend and buying back shares. Under its current authorization, Exxon Mobil can repurchase a hefty $30 billion, or close to one-tenth of the company.

Based on current estimates, Exxon Mobil is trading at just 7.5x forward earnings. With the OPEC production cut likely giving more support to oil prices over the next couple of months, the company’s earnings could beat current estimates, which would translate into an even lower valuation. No matter what, this diversified supermajor with strong assets looks inexpensive today and will offer hefty shareholder payouts over the foreseeable future.

Canadian Natural Resources

Canadian Natural Resources (CNQ) is one of my favorite energy names. The Canadian oil-sands-focused company has low production costs, large reserves, and low decline rates which means that not a lot of reinvestment is needed. This translates into a business model that allows for hefty free cash generation in all kinds of oil price environments. In fact, even during the crisis year 2020 Canadian Natural Resources remained free cash flow positive, with all capital spending for maintenance and growth already being accounted for. The company has a strong dividend growth track record, having raised its dividend by a hefty 22% a year over the last five years, while the payout has increased every year since payments started in 2001. That’s remarkable for a company active in this sometimes volatile industry, and it shows the focus management puts on creating value for shareholders.

At current prices, CNQ is trading for just 6.0x this year’s net profits and offers a dividend yield of 4.3%. As the balance sheet is getting stronger and stronger every quarter, even higher shareholder payouts in the next couple of quarters would not be surprising.

Other major oil sands players from Canada, such as Cenovus (CVE) or Suncor (SU) could be mentioned as well. They’re also offering compelling shareholder returns that will only grow over time as target net debt levels are reached in the next couple of quarters. Like CNQ, they’re trading at mid-single-digit earnings multiples only.

TotalEnergies

TotalEnergies (TTE) is a French supermajor that offers broad-based, diversified energy exposure with compelling LNG assets at a very low valuation. The company is, like its European peers Shell (SHEL) and BP (BP), moving into green energy assets over time, but continues to generate hefty profits from its legacy hydrocarbon assets. Due to the energy crisis in Europe, which has led to high prices for electricity, natural gas, gasoline, and so on, TotalEnergies can operate very profitably in the current environment. The company plans to offer reliable dividend growth in the 5% range over the next couple of years, even if oil prices were to pull back to the $60s. Since TTE is offering a starting dividend yield of 5.6%, that makes for a compelling dividend growth pick. Buybacks are offered as well, as the company plans to repurchase $7 billion worth of stock this year.

At current prices, TTE is trading for just 3.5x forward earnings, while its enterprise value to EBITDA multiple stands at an abysmally low 2.3. The ultra-low valuation gives TotalEnergies significant upside potential over the next couple of years, I believe. Its European supermajor peers BP and Shell are trading at highly inexpensive valuations as well, with market uncertainty around their green investments likely playing a key role. But even if those investments were to fail, the legacy business would earn back the entire market capitalization for these companies over a couple of years at current valuation levels.

American Shale Names

For investors that want to mitigate currency risk and potential windfall profit taxes for producers in offshore markets, American shale players could be a good choice as well. Some of the internationally active oil companies are active here, but there are also focused US shale players.

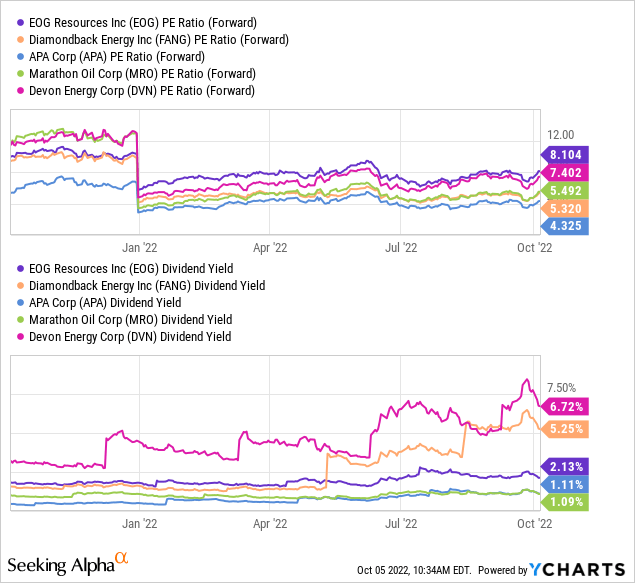

Data by YCharts

Data by YCharts

Names such as EOG (EOG), Diamondback (FANG), APA (APA), Marathon Oil (MRO), and Devon (DVN) are trading at 4x to 8x forward profits and offer hefty shareholder payouts. Some of them focus on (partially variable) dividends, such as Devon or Diamondback, while others are focused on share repurchases. Dividend yields in the above chart are on a trailing twelve month basis, on a forward basis they are even higher. Marathon Oil, as an example of a buyback-focused company, will buy back around 15% of its shares this year alone. If that is kept up for a while, investors that hold on to their shares will see their portion of the company’s future profits rise dramatically over time.

Infrastructure Names

Infrastructure players, such as pipeline companies Enbridge (ENB), Enterprise Products (EPD), or Energy Transfer (ET), are not seeing immediate direct benefits from higher oil prices that could be caused by the OPEC production cut. But they will benefit indirectly. Their counterparties will become more profitable, allowing for higher rate increases in the future. With Western governments increasingly realizing that OPEC is doing what’s best for OPEC, Western/American energy and energy infrastructure companies could also get more government support. With the US potentially becoming more reliant on US production as OPEC is cutting back, demand for pipelines could also continue to grow, as US production needs to be moved to end markets in the US. Last but not least, infrastructure names should continue to benefit from sector-based buying, e.g. via diversified energy ETFs. Many of these pipeline/infrastructure firms trade at inexpensive valuations of well below 10x cash flow and offer 5% to 10% dividend yields, making them attractive income picks.

Takeaway

OPEC is flexing its muscles. The organization dropped a bombshell when announcing a much larger-than-expected production cut. Oil markets should get even tighter now, and even in a recession, demand will likely not fall much – at least that’s what historic data from 2009, an especially harsh year, suggests.

That’s bad news for oil consumers and for (Western) governments that had hoped for OPEC to increase supplies to ease this energy crisis. But it’s good news for energy investors that can still load up on inexpensive companies with massive tailwinds.