Ofcom UK Sets Plan to Auction 26GHz and 40GHz for Faster 5G Mobile

Ofcom #Ofcom

The UK media and telecoms regulator, Ofcom, has today revealed more details about their proposed plan to auction off a large chunk of millimetre wave (mmW) radio spectrum frequency across the 26GHz and 40GHz bands, which will be used by mobile operators to deliver even faster 5G (mobile broadband) services in urban areas.

At present most mobile operators, including EE (BT), O2 (VMO2), Vodafone and Three UK, already have access to several 5G friendly mobile bands between 700MHz to 3.8GHz. Such spectrum reflects the same sort of bands that mobile operators have been harnessing since the advent of the first 3G and 4G data networks some years ago.

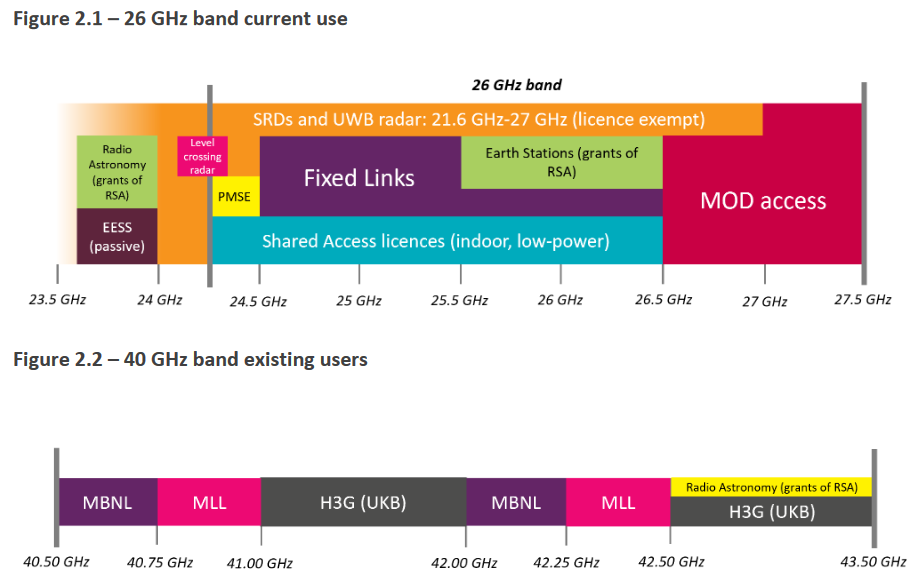

NOTE: The regulator will make over 6.25GHz of mmW spectrum available across the 26GHz (24.25GHz – 27.5GHz) and 40GHz (40.5GHz – 43.5GHz) bands for mobile technology.

The move to auction off the two higher frequencies of 26GHz and 40GHz is designed to complement that by providing mobile operators with lots of additional spectrum frequency, which means more data capacity to potentially support extremely fast speeds (e.g. multi-Gigabit performance is easier). The catch is that such signals are very easily disrupted (weak) and can only travel a short distance in a mobile environment.

Put another way, mmW bands like this are more useful when serving densely populated areas (e.g. city shopping malls, airports, events etc.) and for supporting fixed wireless access (FWA) style broadband links to specific homes and businesses. But they won’t do much, if anything, to expand overall geographic network coverage.

Ofcom have been busy consulting upon how they intend to auction off the new bands since earlier this year (here) and the regulator has today revealed the first details of their chosen strategy. In 68 major towns and cities across the UK, they will award 15-year, fixed term citywide licences (“high density areas”) to use mmWave spectrum by auction.

The regulator will also assign more localised licences (“low density areas”) within these cities – and elsewhere in the UK where they expect deployments to be sparser – on a first come, first served basis, using their Shared Access licensing framework. But in order to avoid any complications, they won’t be holding the auction until AFTER the competition watchdog (CMA) has decided the outcome of Vodafone and Three UK’s proposed merger (here) – this is sensible as that may involve some changes in competitive spectrum ownership.

What Ofcom have decided – in brief

We are enabling opportunities to access mmWave spectrum across the country for a variety of new uses, including 5G. In this document, we set out our decisions to:

• Auction Spectrum Access licences to use both 26 GHz and 40 GHz spectrum in the major towns and cities, where we expect the highest volume of mmWave deployment (“high density areas”). We refer to these licences as the “award licences” in the remainder of this document.

• Hold this auction after the CMA’s decision on the proposed merger between H3G and Vodafone.

• Set a 15 year term for these award licences and consult on our approach to ensuring an efficient allocation of the spectrum at the end of this term.

• Include the majority of our standard Spectrum Access licence terms and conditions in the award licences, and our standard Shared Access licence terms and conditions in the Shared Access licences.

• Include technical conditions specific to mmWave spectrum, in particular we will set a maximum transmit power of 36 dBm in the award licences and the medium power Shared Access licences.

• Use the method that we proposed in March 2023 for identifying which fixed links using mmWave spectrum and located outside high density areas are likely to receive harmful interference from new users operating in high density areas.

As part of this the regulator will first need to clear the incumbent fixed wireless links that currently exist in the associated bands, which will not be able to coexist with mobile technology in this spectrum. For services in the 26GHz band, at least those deemed to be at risk of causing interference, this means following a statutory revocation process (this will begin soon for high density areas).

Last time we also highlighted how Three UK, which is one of the four major mobile operators, already holds a block of the 40GHz band (as does MBNL and MLL Limited), which could potentially create some competition concerns.

The regulator recently completed the statutory process for revoking existing licences in the 40GHz band and revoked them with effect from 1st June 2028. Ofcom’s announcement reveals that, in high density areas, they will now offer to grant individual fixed link licences for this band before the end of the revocation period (i.e. before June 2028).

Ofcom plans to publish a statement and further consultation on the design of the auction process “later this year“, while the CMA’s final decision on the proposed merger between Three UK and Vodafone isn’t expected until September 2024.

In other words, the regulator does NOT “expect the award process to begin before Q3 FY 2024/25“. Nevertheless, they do plan to make Shared Access licences available in the 26GHz band early next year (i.e. the competition impacts of these are lower).