Huge corporations are saving $10 billion on Texas taxes, and you’re paying for it

Tedesco #Tedesco

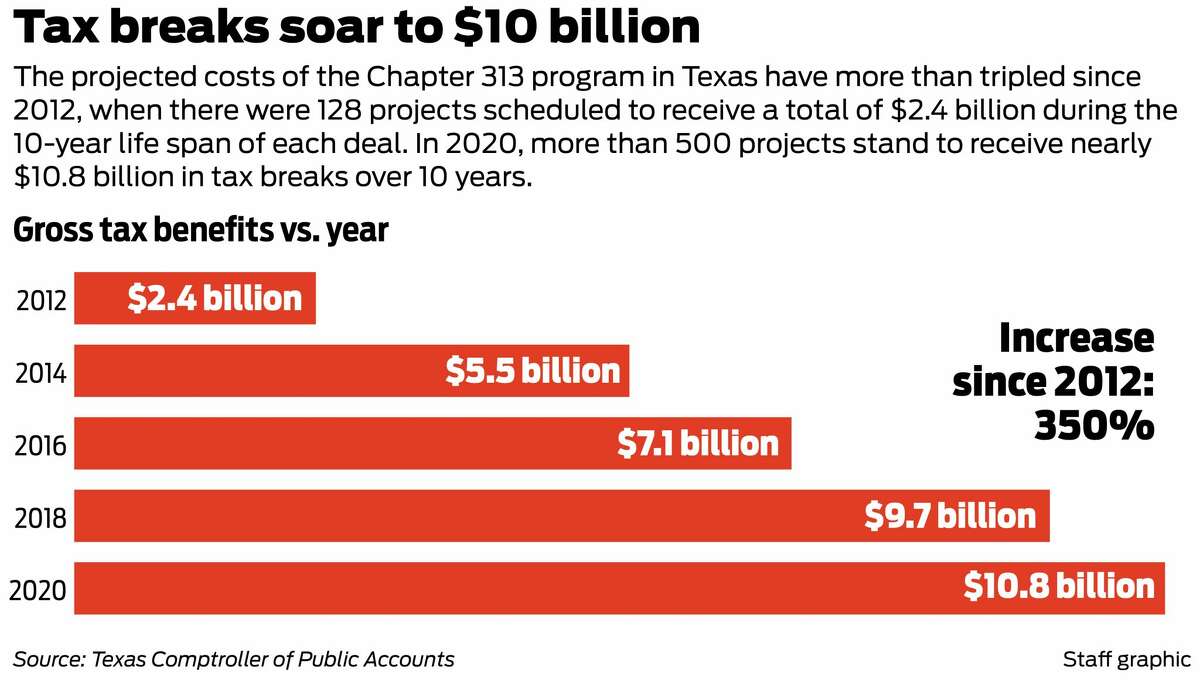

As millions of Texans struggle with the economic devastation of COVID-19, the biggest corporate tax giveaway in Texas has helped businesses cut more than $10 billion from their property taxes — and there are no limits on the program’s exponential growth.

The gusher of tax incentives is flowing to firms ranging from petrochemical plants on the Gulf Coast to sprawling wind farms in the Panhandle. Companies are saving billions by promising to bring their business to Texas — even if evidence suggests some never would have gone anywhere else.

Meanwhile, nothing has changed during the pandemic for Texas homeowners who must pay their property tax bills on time or face stiff penalties.

For renters, it took Texas until mid-February, nearly a year after the pandemic hit, to launch a rental and utility assistance program. It was plagued for months by long waits.

“We’re living paycheck to paycheck,” said Dulce Cramer, who was laid off at her new job in Houston last year when the pandemic began. Cramer said she was denied state unemployment benefits while her husband’s employer cut his hours, and they could barely afford the rent at their Westchase apartment.

“It was hell,” she said.

It’s a far different story for the energy and manufacturing companies that qualify for assistance under an obscure section of the Texas Tax Code called Chapter 313.

Twenty years ago, state lawmakers created the program in response to unfounded fears that Texas was losing bidding wars with other states to attract new business.

Since then, the program has ballooned into the largest corporate tax incentive in Texas — and lawmakers are working to renew it this year.

Here’s how it works: An eligible company that promises to spend, say, $200 million on a manufacturing plant can apply for a Chapter 313 incentive and lower the appraised value of its property on a school district’s tax rolls, erasing millions of dollars in property taxes over the course of a decade.

With more than 500 active projects in Texas, the program has become more popular than ever. State officials predict it will cost nearly $10.8 billion in tax breaks over the life span of each project, according to a report on the program that covers all active deals through early 2020.

Since then, some projects have dropped out of the program, but records recently released by the comptroller’s office show another 90 projects have since been approved that will save companies an additional $900 million.

To make up for the taxes these companies are not forced to pay, the Legislature must allocate more general revenue — the taxes all Texans pay — to public education, leaving fewer dollars not only to increase school spending but to build roads, provide health care and fund other vital services.

In essence, Chapter 313 asks all Texas taxpayers — renters, homeowners and small business owners — to help some of the world’s largest companies get a discount on their taxes.

“What we’re doing is building a two-tiered tax system where large industrial companies get a discounted tax rate and small businesses and homeowners pay full freight,” said Dick Lavine, a senior fiscal analyst with the left-leaning research group Every Texan and a longtime critic of the program.

Supporters say Chapter 313 has lured major employers to Texas — companies such as Samsung, Toyota and Tesla. They contend the tax breaks create high-paying jobs and encourage manufacturing and energy companies to make marquee investments here.

“We brag about how we don’t have a personal income tax in Texas. We make up for that with very high property and high sales taxes,” said Dale Craymer, president of Texas Taxpayers and Research Association, which has long supported the program. “Those high property taxes not only burden homeowners, but it also creates a substantial barrier against new capital investment, so 313 helps reduce that barrier to new investment.”

But a Houston Chronicle review of thousands of pages of state documents, corporate filings, reports and audits going back nearly two decades shows the program often falls short of its goals. It also functions without the guardrails lawmakers insist they have enacted to ensure the tax burden does not needlessly shift from major companies to individual taxpayers.

See MoreCollapse

Among the Chronicle’s findings:

The comptroller’s office declined to make its staff available for an interview, citing the ongoing legislative debate about the program. It said in written responses to the newspaper’s questions that its staff does not track the rate at which applications are denied and has no opinion on the proper rate of rejections.

“Our office works diligently to administer this program in the manner prescribed by the Legislature,” said spokesman Chris Bryan. “Our office remains neutral and tries to answer questions from all parties. Similarly, we make a lot of information available to the public and media so that others have sufficient information from which to make their own informed opinions on the program.”

As Chapter 313 saved billions for businesses, Gov. Greg Abbott declined to act on calls from appraisal districts and Texas lawmakers at the beginning of the pandemic to freeze property-tax values at 2019 levels to offer relief to property owners or extend the deadline to pay their tax bills.

“That’s what galls me. They don’t give a damn,” said Steve Tallent, 71, a heavy equipment operator in Mont Belvieu who fell behind on his property taxes after falling ill in 2019 and ended up owing more than $4,800 in taxes and penalties on his house.

Steve Tallent, photographed outside the icehouse he opened last year in Liberty County, fell behind on his property taxes but received little assistance during the pandemic.

Mark Mulligan, Houston Chronicle / Staff photographer

Tallent hoped to pay his bills with income from a bar he owns — but he was temporarily forced to close it because of the pandemic and couldn’t pay that tax bill on time, either.

The governor’s office did not respond to repeated requests for comment.

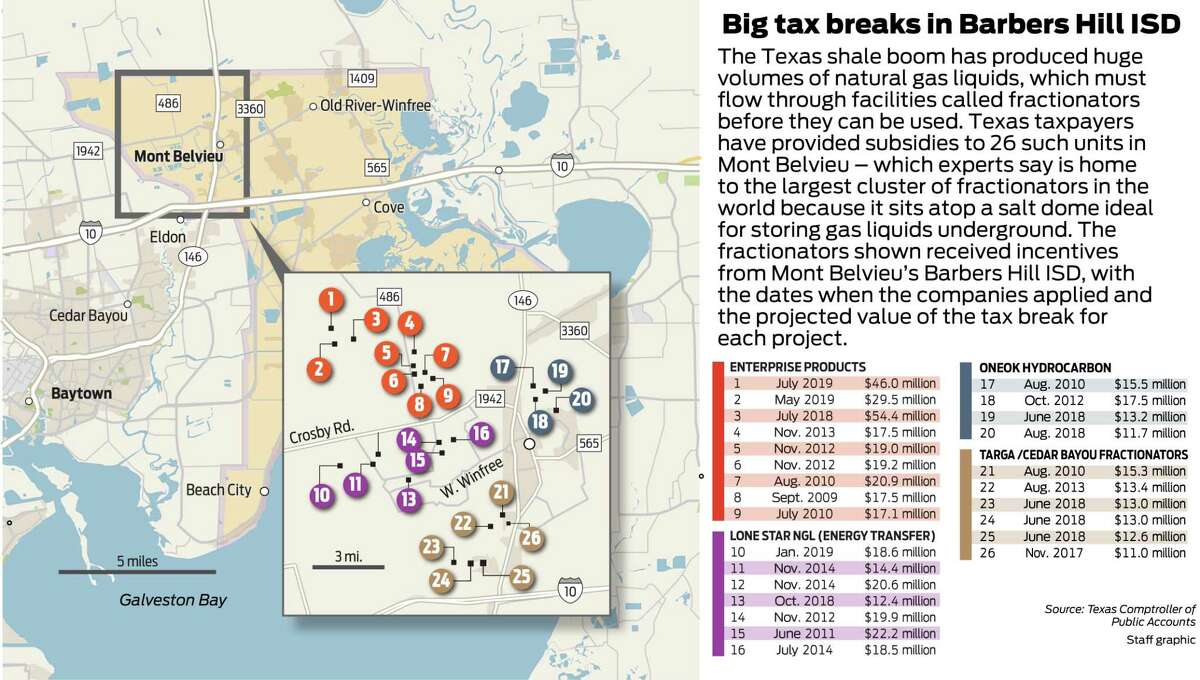

Tallent lives in the Chapter 313 capital of Texas. Trustees of the Barbers Hill Independent School District, which serves Mont Belvieu, have approved more Chapter 313 deals than any other school district in Texas.

The total cost of incentives over the 10-year duration of each deal: nearly $900 million.

“Yes, we do have the most (projects). And they’ve been tremendous,” said Superintendent Greg Poole, an avid supporter of the program who moonlights as a consultant to help other school districts negotiate deals under the law.

Poole and other proponents say Chapter 313 has lured businesses to Texas that would have invested in other states. The law requires the comptroller’s office to scrutinize every deal, they say, ensuring that tax breaks go only to companies that truly need them.

Some even argue the program costs taxpayers nothing because without the incentives, the companies would have invested elsewhere.

The law has never required such a stringent review.

The comptroller’s office is charged only with deciding whether the tax break is “a determining factor” in a firm’s decision to proceed with the project — a low hurdle for companies to clear.

The program’s other gatekeepers — elected members of local school boards — usually have few reasons to turn down an application. That’s because state education funding formulas ensure that school districts don’t feel the pain from the property tax breaks. And districts stand to bring in millions in extra payments from the very companies seeking the incentives.

“I’ve never seen a beast like 313. It’s essentially free money for big business,” said Nathan Jensen, a professor at the University of Texas at Austin who has long studied the program.

But in scores of cases reviewed by the Chronicle, records show some tax breaks might not even be necessary.

The shale boom

It was early 2011, and the Eagle Ford Shale boom in South Texas was helping reinvent the American energy industry.

The region’s first successful horizontal fracking well had been drilled in La Salle County more than two years earlier, unlocking enormous deposits of oil and gas trapped in rock formations deep beneath the earth.

All that oil and gas had to go somewhere.

For Texas energy companies, the shale revolution has married ingenuity with good fortune — the geological reality that the state straddles some of the richest oil and gas reserves on the continent.

Yet some of the world’s largest companies have raked in tens of millions of dollars in state subsidies for doing what simply made sense — building the pipelines, processing plants and petrochemical facilities necessary to profit from this windfall of resources.

Enterprise Products Partners, like its competitors, had begun building a network of new pipelines dedicated to transporting “natural gas liquids” in the Eagle Ford to its processing plants in South Texas.

The Houston-based energy company said enormous demand for its services soon would overwhelm its South Texas plants. But in April 2011, the company sought taxpayers’ help in building a new gas processing plant in Lavaca County by applying for a Chapter 313 incentive for the project.

To prove the project qualified for the tax break, Enterprise told the comptroller’s office that it had a large pipeline network and gas processing plants in four other states, allowing “substantial flexibility in plant location.”

But like so many of its competitors, Enterprise had told its investors a different story.

The company had discussed the plant in public statements dating back 10 months — its location, its capacity, its construction timeline, the length of pipe needed to connect it to the company’s network — and described it as part of a series of projects necessary to “meet the needs of producers” in the Eagle Ford.

If the comptroller’s office was aware of these statements, they were not mentioned in the office’s letter recommending the $41 million in tax incentives be approved.

In all, at least 35 gas plants in Texas received about $380 million in Chapter 313 incentives, almost all of them in the Eagle Ford or West Texas’ Permian Basin.

At least 10 of them were publicly announced before the companies applied for tax breaks, either by name or with the same capacity, construction timeline and region as the plants the companies described in their applications.

10

1of10

1of10

The sun sets behind a petrochemical facility in Mont Belvieu, where the local school district has approved dozens of tax breaks for companies under Texas’ Chapter 313 program.

Mark Mulligan, Houston Chronicle / Staff photographerShow MoreShow Less  2of10

2of10

An aerial view of Mont Belvieu and its petrochemical plants. Tax breaks under Texas’ Chapter 313 program have subsidized scores of facilities in the town.

Mark Mulligan, Houston Chronicle / Staff photographerShow MoreShow Less  3of10

3of10

A sign for a Lone Star NGL facility in Mont Belvieu. Lone Star is one of several companies that participates in the Chapter 313 tax incentive program.

Mark Mulligan, Houston Chronicle / Staff photographerShow MoreShow Less  4of10

4of10

A flare burns at an Enterprise Products petrochemical facility in Mont Belvieu. Enterprise is one of several companies that receive tax breaks in the Chapter 313 program.

Mark Mulligan, Houston Chronicle / Staff photographerShow MoreShow Less  5of10

5of10

This Enterprise Products facility is one of scores of sites in Mont Belvieu that split natural gas liquids into separate components such as ethane and propane.

Mark Mulligan, Houston Chronicle / Staff photographerShow MoreShow Less  6of10

6of10

An ONEOK facility in the petrochemical hub of Mont Belvieu. The company participates in the Chapter 313 tax incentive program.

Mark Mulligan, Houston Chronicle / Staff photographerShow MoreShow Less  7of10

7of10

The entrance to an Enterprise Products facility in Mont Belvieu. The company saves millions on property taxes under the Texas Chapter 313 program.

Mark Mulligan, Houston Chronicle / Staff photographerShow MoreShow Less  8of10

8of10

An Enterprise Products facility in Mont Belvieu. The company received Chapter 313 tax breaks for nine fractionators in the town — more than any other company.

Mark Mulligan, Houston Chronicle / Staff photographerShow MoreShow Less  9of10

9of10

The local school district in Mont Belvieu, Barbers Hill, has granted more Chapter 313 tax breaks than any other district in Texas. Total cost to taxpayers: Nearly $900 million.

Mark Mulligan, Houston Chronicle / Staff photographerShow MoreShow Less  10of10

10of10

Facilities run by companies including Enterprise, Lone Star NGL and ONEOK in Mont Belvieu. All three companies have received tax breaks under Texas’ Chapter 313 program.

Mark Mulligan, Houston Chronicle / Staff photographerShow MoreShow Less

Twice, another company, Energy Transfer, not only announced a gas plant before applying but even acknowledged starting construction and site work months before — with $16 million invested at one site and $20 million at the other — yet still got the subsidies.

Energy Transfer spokeswoman Alexis Daniel did not address the timing of the tax incentives but said the company is “proud to be a Texas-based, Fortune 100 company” with many employees in the Houston region.

“In 2020 alone, we paid approximately $218 million in property taxes on our pipelines and facilities in Texas,” she said. “These taxes support schools, hospitals, community centers, roads and various other projects and services that are important to our state.”

Enterprise Products spokesman Rick Rainey, meanwhile, said a Chapter 313 incentive is one of many factors the company considers in evaluating investments.

“The economic viability of a project is analyzed, including the impact of 313,” he said, “and helps determine where a project will be built, or whether it will be built at all.”

Energy analysts, however, said the state’s dozens of gas plants were certain to be built here.

“The processing plants would have had to come up no matter what,” said Ajay Bakshani, an oil and gas analyst with East Daley Capital Advisors. “You need these plants in order to extract value out of the gas that’s coming out of the ground.”

And these plants, said Rusty Braziel, president of the Houston energy analytics firm RBN Energy, are typically no more than 25 miles from the cluster of wells producing the gas in need of processing. Just nine of the 35 gas plants that got Chapter 313 deals are that close to neighboring states.

The subsidies have become so ubiquitous that companies routinely remind the comptroller’s office in their applications that their competitors often have received tax breaks to build comparable projects.

While Craymer, the program supporter, said the review process usually works, he acknowledged some projects destined to build in Texas likely slip through.

“I do think this is an area of discomfort with many, and, quite honestly, we’re willing to work with folks on a better approach,” Craymer said.

Hector Rivero, president of the Texas Chemical Council, agreed.

“Someone that has got a project that’s coming here regardless, that’s an abuse,” he said. “We want the comptroller to be able to ferret those out.”

Bryan, of the comptroller’s office, said his colleagues weigh public statements as part of their review process, adding, “Our determinations don’t typically rely on a single document or issue.” He gave the same answer when asked about projects that had started construction and still received tax breaks.

A similar pattern can be found in the renewable energy industry. Wind farms are projected to receive $2.1 billion in Chapter 313 tax breaks. Yet West Texas’ bountiful supply of wind and transmission lines already makes it the perfect location for such investments, according to a 2016 state Senate committee report.

In their Chapter 313 applications, both wind and solar farms often acknowledge selecting their sites based on their proximity to state-financed transmission lines but say the incentives are still needed.

Wind farms frequently start construction to secure federal tax credits but then seek Chapter 313 subsidies as well. They tell the comptroller’s office that their investments do not commit them to the sites, and they routinely say they cannot compete on price with their competitors who already have received the state subsidies.

In sheer numbers, most Chapter 313 applications are filed by renewable energy companies. But most of the tax breaks — more than $7.6 billion — are going to more expensive projects in the manufacturing industry that include huge petrochemical firms.

The subsidies can be traced through the entire production process of the Texas shale boom.

When natural gas liquids leave processing plants, they flow mostly through pipelines to facilities called “fractionators” that split them into their separate components — chiefly ethane and propane — which are then sold, exported or refined into fuels and plastics.

In North America, the chief hub for this activity has long been Mont Belvieu, a town 25 miles east of Houston in Chambers County, which sits atop scores of salt caverns — some larger than the Empire State Building — that let companies store massive amounts of oil and gas products.

As these liquids flowed to Mont Belvieu, the tax breaks followed.

Mont Belvieu is a petrochemical hub where dozens of projects receive Chapter 313 tax incentives.

Mark Mulligan, Houston Chronicle / Staff photographer Unavoidable projects

Chapter 313 has subsidized at least 36 fractionators in Texas at a combined cost of $770 million, a figure that includes a few other projects that were submitted on the same applications as the fractionators. All of them are near the Gulf Coast; 26 of them are in Mont Belvieu.

At least 15 times, companies announced the fractionators publicly before filing their tax break applications. Ten other times, the companies did not prematurely announce the projects in detail but did indicate they soon would need to add capacity.

Enterprise Products received tax breaks for nine such units in Mont Belvieu, the most of any company. Enterprise announced two of its fractionators were “under construction” weeks before seeking tax breaks to build them — and still got approved.

The projects were inevitable, energy analysts said. Once the newly abundant gas liquids were gathered and processed, they would need to flow through a fractionator in order to be usable.

In theory, more gas liquids could flow to Louisiana, New Mexico or Kansas, Braziel said. But, though Mont Belvieu’s salt caverns put it on the map, the town is the world’s gas liquids hub for another reason: 70 percent of these compounds are exported or sold to petrochemical plants, and both industries are clustered along the Gulf Coast.

There are docks, refineries and petrochemical plants in Louisiana, too, Braziel said — but not enough. The notion that three dozen Texas fractionators would have gone to Louisiana in the absence of tax breaks, he said, is folly.

“Could some? Yes. Could all of them? No,” he said. “The majority are going to land in Texas.”

What’s more, Bakshani said, by the time a fractionator is announced, most or all of the material the unit will produce is typically already under contract with customers — often petrochemical plants planning to use it in specific units nearby.

“A lot of the companies now have such a presence at Mont Belvieu that if they suddenly come out and say they’re building a fractionator in Louisiana, it would be a head-scratcher,” Bakshani said. “Why not take it to all the fractionators you already have that are next to all the facilities you already own?”

The flurry of Chapter 313 activity didn’t go unnoticed by competitors.

In early August 2017, Permico announced its Texas NGL project, an effort to pipe gas liquids from the Permian to a new fractionator in Corpus Christi.

When the company applied for a Chapter 313 subsidy, Permico CEO Jeffrey Beicker learned the comptroller’s office had questions. He was furious. Why didn’t his competitors face the same scrutiny?

“All these other companies have multiple news releases, quarterly reports and annual reports that state their intentions,” Beicker wrote in an email to his consultant. “We refuse to lie to receive the tax abatement. Apparently our competitors do not share this moral dilemma.”

Beicker’s company got the tax break. A Permico executive referred questions to Beicker, who did not respond to requests for comment.

‘Building and building’

‘Building and building’

More than a third of gas liquids go to petrochemical plants, which pounced on the cheap fuels the shale boom produced by launching a staggering array of projects.

As the compounds flowed from Mont Belvieu and elsewhere to chemical plants along the coast, in dozens of cases the subsidies followed them.

Some of the biggest Chapter 313 subsidies have been for petrochemical units called “crackers.” These turn ethane — the main material flowing from all the new fractionators — into ethylene, a key building block of plastics.

Chevron Phillips Chemical announced it would build one such unit in Baytown in late 2011 — months before it applied for incentives to do so — then sought tax breaks for another as part of a larger project in Orange in 2019. Combined subsidies: $491 million over 10 years.

LyondellBasell secured three Chapter 313 incentives in 2013 to increase ethylene production at its Channelview, La Porte and Corpus Christi plants despite announcing all three publicly before applying.

And ExxonMobil was already building an ethylene cracker in Baytown that had gotten Chapter 313 subsidies when it filed more tax break paperwork in 2016 as part of a joint venture with the Saudi firm SABIC.

The companies’ new chemical plant near Corpus Christi includes an ethylene cracker and accompanying units and will get a projected $457 million in subsidies over a decade.

Exxon spokesman Todd Spitler said the company supports “a business environment that encourages capital investment and job-creating activities,“ but he did not comment on its Chapter 313 deals.

Chevron Phillips spokesman Bryce Hallowell said the company’s announcement of its Baytown project was followed by “significant” analysis. Chapter 313 tax breaks were “a key component” of that review before the company made a final decision to build the project, he said.

Lyondell spokesman Chevalier Gray said public policy is among the factors the company considers when considering a new project, adding, “Our projects provide increased tax revenues, among other economic benefits, across the region for many years after economic incentives expire.”

The windfall of natural gas not only made it a cheap raw material for petrochemical giants. The materials soon were so abundant that companies sought buyers overseas.

In a five-year span beginning in the summer of 2010, federal regulators approved more than 20 requests from companies to build facilities to load gas liquids onto ships for export.

Among them were seven sites along the Texas coast — four of which were approved for Chapter 313 tax breaks. Some touted their proximity to the Eagle Ford and the Permian as competitive advantages; all four announced their plans months before seeking subsidies.

“The shale story just kept building and building over the past few years until, finally, we did the engineering and it just made sense,” Freeport LNG CEO Michael Smith said in November 2010, months before his company applied for a tax break to turn its recently opened facility to import gas into a hub for exports.

The projected tax breaks for these export projects are among the program’s largest: $456 million to Freeport LNG; $354 million to Sempra Energy’s docks near Port Arthur; $857 million to Cheniere’s site near Corpus Christi; $388 million to Exxon and Qatar Petroleum’s joint venture near Port Arthur.

Freeport LNG spokeswoman Heather Browne stressed that the company provides hundreds of jobs — and thousands more when the facility was under construction — and will pay a projected $2 billion in state and local taxes during the project’s first two decades of operations.

“The Chapter 313 value limitation tax subsidies, approved and entered into prior to Freeport LNG making its final investment decision to construct our facility in 2014, helped our project compete in the global marketplace for customers, and thereby assisted the company in moving forward with the project in Texas,” Browne said.

The three other Texas projects were in Brownsville. One never sought a Chapter 313 deal, and two — opposed by a coalition of shrimpers, fishermen, environmentalists, Native Americans and others — had their tax-subsidy applications rejected by the Port Isabel school board.

Yet, neither spurned company stopped work when their subsidies were denied. Only last month, six years later, did Annova LNG announce it was abandoning the project, blaming market shifts. The other two companies still plan to build.

At least eight times, in fact, the Chronicle found companies said they needed the subsidies to build, had their applications rejected by a school district or the comptroller’s office or withdrew them under questioning — then proceeded anyway.

Nor do all companies say they need the subsidies. The owners of dozens of gas processing plants, including some just south of the New Mexico border, built without ever filing requests for a tax break.

Mark Varnado grew up in Chambers County and has owned his current home in Mont Belvieu since the 1990s. Varnado fell behind on his property taxes while dozens of companies near him receive tax breaks.

Mark Mulligan, Houston Chronicle / Staff photographer Nothing for homeowners

There’s simply nothing like Chapter 313 for everyday Texans and small-business owners.

“We don’t think this program should exist,” said Carine Martinez, director of research and publications at the Texas Public Policy Foundation, a conservative research group that has been calling for the repeal of Chapter 313 for years. “We favor a broad-based tax system so we can lower it for everyone instead of favoring some.”

Homeowners are eligible for some protections such as the homestead exemption, which cuts appraised values by $25,000 for taxes owed to school districts. But with the median home value in Texas at $170,000, many owners are still responsible for paying taxes on a large share of their property appraisals.

“I’m one of those people who believe that you should do everything on your own as much as you can, but we keep handing money to these corporations and nothing to the citizens,” said Mark Varnado, a Mont Belvieu homeowner who owes more than $3,200 in overdue taxes and penalties. “That doesn’t quite make sense to me.”

Varnado acknowledges falling behind on his taxes in 2019 and says he meant to catch up last year. But business from his side gig as a disc jockey dried up during the pandemic, and he had to support a son who lost his job. Now Varnado is falling even deeper in the hole as late fees add up.

The Texas Comptroller’s Office almost never penalizes Chapter 313 companies that fail to meet their job-creation targets. And unlike the homestead exemption, Chapter 313 lets many businesses pretend a large portion of their investments are invisible on tax rolls.

Why are Texas officials approving so many deals, even for projects that might have been built anyway?

The answer is simple: That’s how Chapter 313 was designed.

Coming next: The Gatekeepers

More from our ‘Unfair Burden’ series

Support our journalism

Help our journalists uncover the big stories. Subscribe today.

Credits

Reporters: Mike Morris, John Tedesco and Stephanie Lamm

Photography and video: Mark Mulligan, Marie D. De Jesús, Jon Shapley and Laura Duclos

Page design: Jordan Ray-Hart

Photo editing: Jasmine Goldband

Audience: Mark Lorando and Jennifer Chang

Newsletters: Tommy Hamzik

Social: Dana Burke