Happy Thanksgiving- Three Reasons For Meats To Move Higher In 2021

Happy Thanksgiving #HappyThanksgiving

Happy Thanksgiving to all! Today is traditionally a day when family and friends gather to share a meal of turkey and all the trimmings. Thanksgiving is the start of the holiday season and the beginning of the winter each year. It celebrates the end of the harvest.

The holiday in 2020 is a lot different than in the past years. Rising coronavirus cases and hospitalizations have caused new social distancing rules that prevent the same celebration as in past years. We had hoped that the virus would be a memory by the holiday season, but it returned over the past weeks with a vengeance. The second wave seems worse than the first. While the mortality rate has declined, more people are coming down with the virus. The announcements of highly effective vaccines over the past three weeks are little solace to those suffering from COVID-19 this Thanksgiving or those left alone as fear of the virus are making for a lonely holiday. There is light at the end of the tunnel, but the coming weeks and months will be challenging until we achieve herd immunity through mass vaccinations.

Turkey is a Thanksgiving staple. The demand for smaller birds this year has created a glut of the 20-plus pounders. Meanwhile, there is a shortage of turkeys under ten pounds. The global pandemic created price distortions in many markets across all asset classes. In the animal proteins, prices dropped for producers and ranchers as processing plants closed or limited activities. Meanwhile, consumers have been paying much higher prices and confronting shortages of beef and pork.

We could see the impact of the virus in the futures market in 2021 as the cure for the low prices of 2020 for producers is likely to lead to much higher prices in 2021. The iPath Series B Bloomberg Livestock Subindex Total Return ETN product (COW) moves higher and lower with cattle and hog prices.

2020 was a rough year for beef, and pork producers and consumers

The global pandemic took a massive bite out of beef and pork prices for producers in 2020. In April, live cattle future fells to their lowest price since 2009.

Source: CQG

As the quarterly chart highlights, the price of the beef futures declined to a low of 81.45 cents per pound.

Source: CQG

The quarterly chart of feeder cattle futures shows that the decline to a low of $1.0395 in April 2020 was the lowest level since 2010.

Source: CQG

At 37 cents per pound, lean hog futures dropped to its lowest price since 2020, in almost two decades.

Producers suffered from the global pandemic’s impact, but the lower prices did nothing for carnivorous consumers. Shutdowns at packing plants caused shortages. Prices at butcher counters across the US rose while availabilities fell. Many stores limited beef and pork purchases.

Low prices tend to favor consumers. When they rise, producers benefit. However, COVID-19 created dislocations in the animal protein markets for producers and consumers as everyone was a loser.

Coronavirus is likely to continue to cause price dislocations

The second wave of the coronavirus is now sweeping across the US and Europe. The holiday season and winter months are the offseason for animal protein consumption, which tends to peak during the summer months. The grilling season begins on the Memorial Day weekend in late May and runs through Labor Day at the start of September.

However, packaging plants operate all year. The rising number of cases and hospitalizations because of the virus spreading like wildfire threatens more shortages. Processing plants and food manufacturers face new shutdowns or regulations that limit the number of employees because of social distancing. The bottom line is that this wave of the virus is likely to prompt more price dislocations for producers and consumers.

The first bullish factor is feed prices

As cattle and hog producers are coming off the worst year in over a decade, they face increasing costs. The primary input in raising animals for meat is feed. Soybean meal, a soybean product, and corn are feed staples. When the prices rise, the cost of production moves higher. At a time when ranchers and producers are suffering from the lowest prices in years, rising feed prices add insult to injury. In the past, higher feed prices caused producers to deliver animals to processing plants at lower weights. In 2021, producers are likely to reduce the number of animals in herds, leading to higher prices and insufficient supplies.

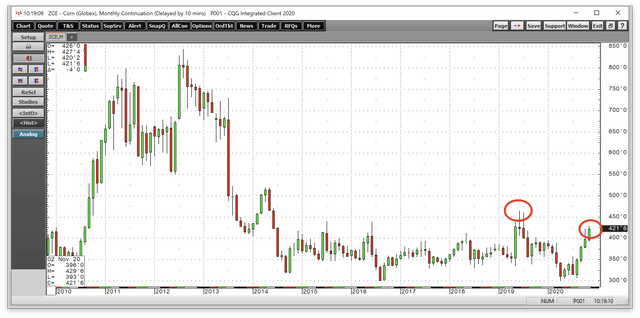

Source: CQG

Soybean prices have risen to the highest level since June 2016. This week, the price hit the $12 level and was threatening to challenge the next level of technical resistance at the June 2016 high of $12.0850 per bushel.

Source: CQG

Corn prices are rising and were trading at above $4.20 per bushel this week. The next upside target is at the June 2019 high of $4.6425. Above there, corn traded to a high of $5.19 per bushel in 2014. Wheat has already hit a six-year high, with the price of the grain above the $6 per bushel level. Rising grain and oilseed prices will put upward pressure on meat prices.

The second bullish force is a change in US trade policy

The incoming Biden administration is likely to take a different route towards trade with the Chinese. The Trump administration’s tariffs and tensions could disappear early in 2021, creating more trade between the US and China. China is the world’s most populous nation. China has been purchasing soybeans hand over fist over the past months, contributing to the oilseed futures’ bullish price action.

Meanwhile, China had suffered from a massive pork shortage in 2019 as the African Swine Fever killed off many of its hogs. As the Chinese rebuild their pig population, the demand for soybean meal is rising. A calming trade environment between the US and China in 2021 will increase the demand for US agricultural products, and the costs of raising animals for meat will rise.

The third is that the cure for low prices is low prices

Low prices in 2020 are likely to cause higher ones in 2021. In commodity markets, the cure for low prices is low prices. Pricing cycles in commodities markets often move from periods where prices drop to unsustainable levels as producers lose money and curtail output. Inventories decline, and prices rise. When the price of any raw material of agricultural commodity increases to levels where producers earn more, they increase output. As consumers find substitutes and cut back on purchases because of high prices, inventories begin to rise, and prices decline.

As we move into 2021, producers are likely to cut back on output. Not only are they licking their financing wounds from low prices in 2020, but feed prices are increasing, raising the cost of production. We should expect higher animal protein prices in 2021 and beyond as the markets continue to feel the impact of the global pandemic’s dislocations. I am a scale-down buyer of cattle and hog futures on any price weakness over the coming weeks and months.

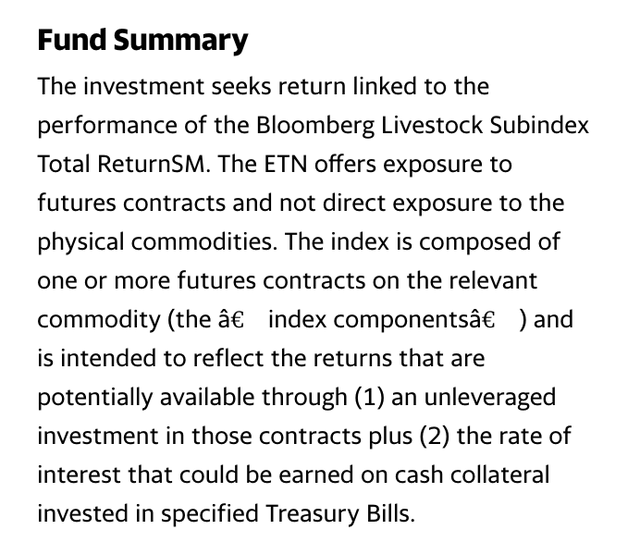

The most direct route for a risk position in the beef and pork markets is via the cattle and hog futures and futures options. The iPath Series B Bloomberg Livestock Subindex provides an alternative for those looking to participate in the future price appreciation in the meat markets. Total Return ETN (COW) provides an alternative. The fund summary for COW states:

Source: Yahoo Finance

COW has net assets of $23.79 million, trades an average of 68,289 shares each day, and charges a 0.45% expense ratio.

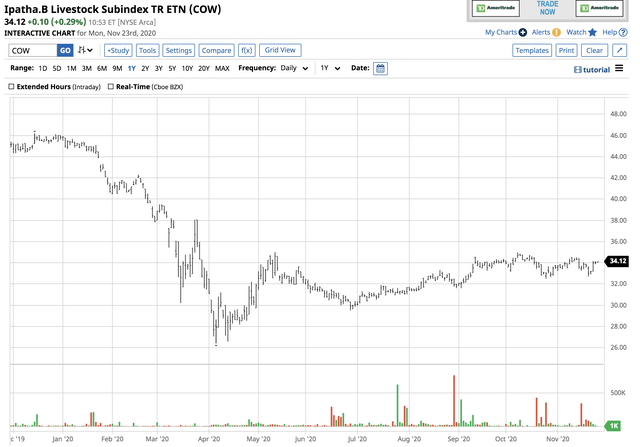

Source: Barchart

The chart shows that the COW ETN product rose from a low of $26.40 in April when cattle and hog futures reached lows to the $34.12 per share level on November 25 or 29.2%. If cattle and hog prices are going much higher in 2021, the COW ETN will appreciate.

Happy Thanksgiving to all! Unfortunately, there is no ETF or ETN product for turkey or poultry. However, those markets are also likely to suffer from the increase in feed prices. Social distancing this Thanksgiving could also create a glut of larger turkeys as families limit the number of people they feed. We will be making a traditional dinner and delivering it to the doorsteps of those who would ordinarily come to our home. Thanksgiving in 2020 will be different than in past years and lonely for many. Let’s hope and pray that the pandemic is close to an end.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in both commodities, forex, and precious metals. My weekly report covers the market movements of over 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.