GameStop, Robinhood And Reddit Are A Lethal Combination, And It’s Probably Going To Get Worse

Robinhood #Robinhood

I’m taking a break from my normal ETF coverage to bring you an important message…

This market is absolutely nuts!

If it wasn’t bad enough before when U.S. stocks were hitting new all-time highs just a few months after the worst economic crash since the Great Depression, it’s gotten even worse today. Forget for a moment that investors have pushed the P/E ratio on the S&P 500 up to 30. Forget that the federal debt is about to hit $30 trillion. Forget that the Fed has rates at 0% and we’ve got the loosest policy conditions in recent memory fueling this bubble. Forget that market euphoria and asset allocations are at their most aggressive levels in decades.

Now we’re reaching the point of outright market manipulation and conspiracy theory peddling being fueled by small yet highly aggressive traders hanging out on Reddit and Robinhood.

The GameStop Mania

Of course, GameStop (GME) has been the poster child of this mania, but it’s been carrying over into other stocks, such as AMC (AMC), BlackBerry (BB) and Etsy (ETSY).

Who do we have to thank for starting this frenzy? This guy.

Elon Musk pumps the WallStreetBets Reddit forum

That’s Elon Musk pumping a Reddit board where millions of speculative investors hang out. This is the group that not only likes to focus on stocks with low share prices and questionable financial health, but those with heavy short positions. They pile in, pump them up, hope for a short squeeze and make their money. And they don’t even buy the stock. They buy options on the stock using a small initial investment to get a lot of exposure.

“Like 4chan found a Bloomberg Terminal” Yeesh.

But these folks followed Musk’s lead and this happened.

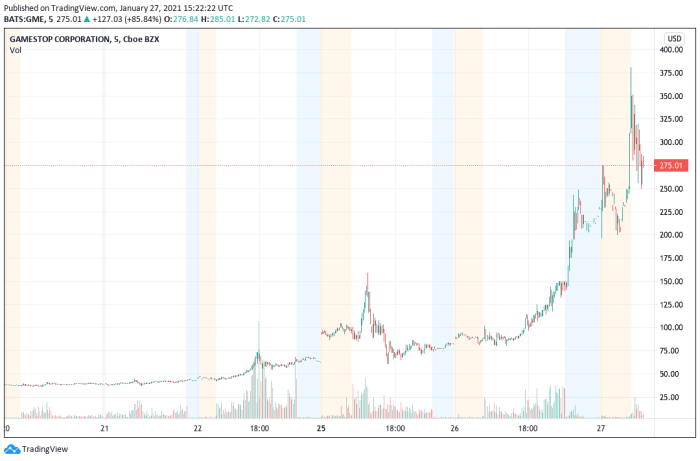

GameStop

Their plan worked and they drove up the stock price, but it’s turned incredibly volatile in the process. The main target here seems to be short sellers. Redditers are grouping up, deciding to pile into a heavily shorted stock and driving the price up.

Is there any fundamental reason for GameStop’s stock to go up? Nope. Any news? Nope. Nothing but Elon Musk’s tweet. It’s purely a coordinated effort to manipulate the stock price and drive it higher so a relatively small group of ultra-risk takers can try to profit.

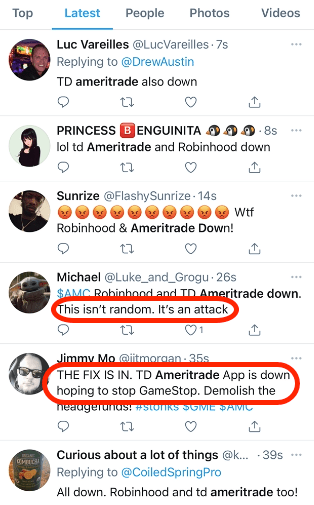

The label “Like 4chan found a Bloomberg Terminal” turns out to be pretty accurate, because it’s fueled a lot of conspiracy theories when things don’t exactly go these traders’ way.

GameStop conspiracy theories

The world of politics meets the world of investing!

But the shenanigans with GameStop is hardly the only wonky thing going on in the market today. In fact, another Elon Musk tweet just recently fueled another inexplicable spike.

Elon Musk tweets about Etsy

Four simple words. A seemingly innocuous thought. But Elon Musk’s thoughts carry a lot of weight in the financial markets, so this happened. Take a guess as to when his tweet was posted.

Etsy

Etsy’s stock rose 10% on Musk’s tweet alone. Peak stupidity? It sure seems so. Is Etsy suddenly 10% more valuable because Elon Musk simply likes the website? Apparently, investors think so.

It is worth noting that Etsy stock gave back those gains within mere hours of Musk’s endorsement and that’s where the biggest risk lies for speculative traders who don’t care about fundamentals and are simply trying to ride the latest hot name. How many investors jumped in near the top only to ride the $30 per share loss all the way down?

Moving On From GameStop

While GameStop is still seeing a lot of trading activity, the Robinhood/Reddit group seems to have found its new target – AMC.

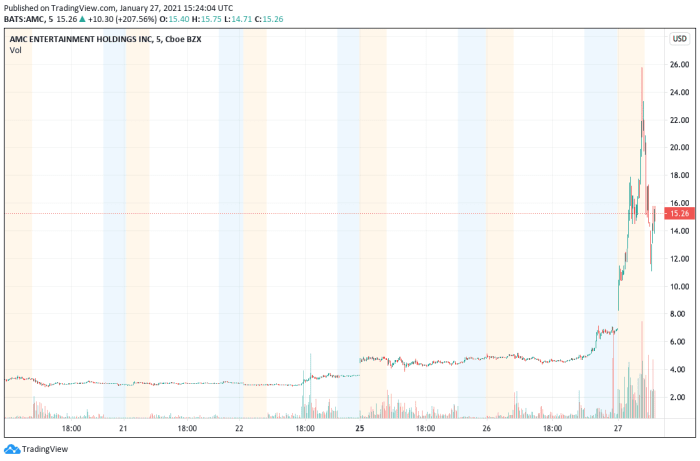

AMC Entertainment

That’s the beleaguered theater chain, which has suffered mightily during the COVID-19 pandemic, suddenly rising from $6 a share to $26 in just a couple of hours. It’s no surprise either. AMC has a single digit share price and is one of the market’s most heavily shorted stocks (as are many of the hospitality and airline names). BlackBerry, Nokia, Express, Kodak. They’re all doing the same thing.

AMC has already plummeted back to $15, which brings up another good point. These manias are unsustainable. A lot of small investors truly believe that stock prices only go up. Of course, that’s not the case, but many of these folks are going to have to learn the hard way that what they’re doing is merely gambling, not investing, and that the house always wins.

It’s Probably Going To Get Worse

Not only has this behavior resulted in wildly speculative trading activity and complete fundamental disconnects, it’s created people like these two.

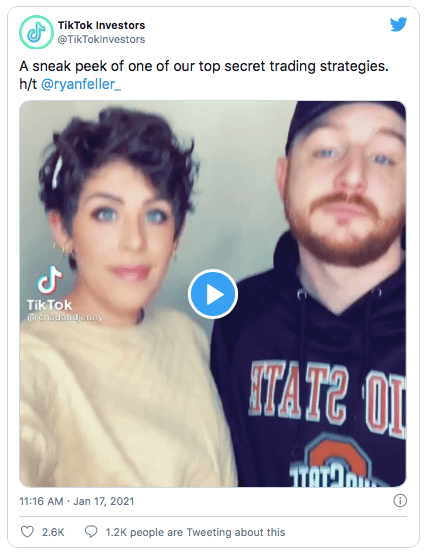

The TikTok Traders

This is the pair that claim they live entirely off of their day trading. They created a TikTok video that has garnered about 2 million views in which they succinctly describe their trading strategy…

“I see a stock going up and I buy it — and I just watch it until it stops going up and I sell it. I do it over and over.”

Keep in mind that as he was saying this he was finger pointing in the air to mimic a rising stock price chart. And keep in mind that after he got rightfully dragged for this video, he posted a follow up telling people he was going to keep on giving people advice and that people who don’t like it should “suck a butt”. Just the kind of people you want to be taking investment advice from.

Be Very Cautious

The bottom line is that this market has gotten incredibly dangerous. There’s already over-enthusiasm about risk assets and the expectations that asset prices are going to keep rising are tilting towards the extreme end of the spectrum.

Add in the fact that inexperienced retail traders are engaging in incredibly speculative and dangerous trading behavior (and manipulating stock prices in the process) just increases the risk that all of this ends very badly. An army of inexperienced traders are believing themselves to be experts when all they’re doing is gambling based on what they’re hearing on message boards.

I really don’t like what I see here.

Also read:

What Might The New ARK Space Exploration ETF Look Like?

MJ vs. YOLO: Which Cannabis ETF Should You Choose?

6 Vanguard ETFs That Fit In Any Retirement Portfolio

4 ETFs For Adding A 9% Yield To Your Portfolio

This Fund Could Be ARK ETF’s Next Big Winner

7 Top Dividend Growth ETFs For 2021

15 Low Cost iShares ETFs You Can Buy And Hold Forever

An 8% Monthly Pay Yield Tied To The Nasdaq 100