Ford: Potential $32B Of Enterprise Value Recovery In H2 Aided By F-150 Lightning

Ford #Ford

Bill Pugliano/Getty Images News

Investment Thesis

Since our last analysis on Ford (NYSE:F), the stock had further retraced by -9.76% to $13.05, despite delivering a decent FQ1’22 report card on 27 April 2022. It is proof that the market remains unconvinced of its potential, despite the company delivering 3.9M vehicles in FY2021. Though the stock’s weak performance could be attributed to its 966K vehicles in FQ1’22 (thus a projected total of 3.86M for the year), we believe the market is overly pessimistic, given that Ford has reiterated its goal of 15% YoY growth in vehicle wholesale volumes in FY2022.

Its EVs segment had also reported increased sales by 139%, attributed to the robust demand for its Mustang Mach-E and E-Transit. In addition, with increasing demand for its F-150 Lightning, we expect Ford to rise as the global leader in the EV truck segment, beyond Tesla (TSLA), which will only start deliveries by FY2023. Assuming that Ford managed to ramp up its delivery by H2’22 despite the global semiconductor crunch, we expect the company to easily deliver a total of 4.48M vehicles for the year.

Ford 5Y Stock Price

Seeking Alpha

However, it is also evident that Ford only rose by 23.4% in the past five years, with a five-year price total return of 49.6%. As a result, Ford’s stock appreciation is very much tied to its future success in the EV truck and van segment. Nonetheless, given America’s 40 years of fascination with its F-Series pickup trucks and EU’s best-selling Ford Transit vans, we expect Ford to report excellent sales for its EVs moving forward, thus boosting its stock valuations. As a result, Ford could easily recover part of the $32B Enterprise Value from its January 2022 highs, once its F-150 Lightning model captures the hearts of Americans by the end of H2’22.

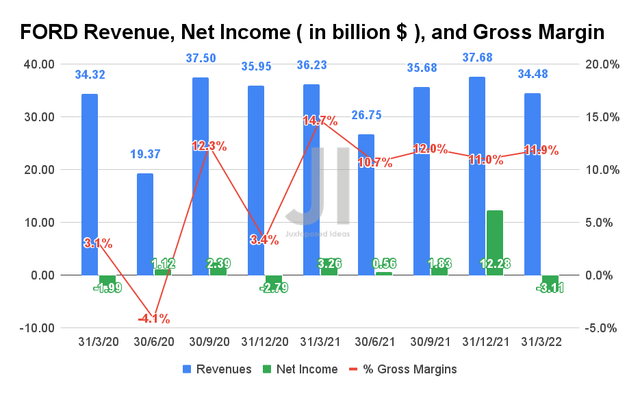

Ford Delivered A Decent FQ1’21 Despite Macro Issues Ford Revenue, Net Income, and Gross Margins

S&P Capital IQ

Ford reported revenues of $34.48B and a net income of -$3.11B in FQ1’22, representing a YoY decline of -4.8% and -200%, respectively. Even though the company delivered an impressive 966K vehicles during the quarter, global supply chain issues still gate its revenues, as the number represents a 9% decline over last year. Jim Farley, CEO of Ford, said:

The appeal of our new products is really clear and customers demand is extremely strong, beyond the supply constraint of our industry. However, we are still grappling with persistent supply chain issues that prevent us from posting even stronger quarter. We’re working to break constraints, whenever they exist to take full advantage of this incredibly hot product lineup. Both new EVs like the F-150 Lightning, but our iconic ICE vehicles as well. (Seeking Alpha)

However, we are not concerned about Ford’s growth potential, given that it reported a massive order bank of over $17B in revenues within the US alone. In fact, the company planned to boost the F-150 Lightning’s annual production capacity from 80K in FY2022 to 150K in FY2023, while also prioritizing the supply of semiconductor chips and consumer deliveries for the model. That alone is proof that consumer demand is outstripping current supply, with Reuters reporting over 200K of reservations by December 2021. By May 2022, that number could have easily doubled or tripled, given that light trucks accounted for 78% of all vehicles sold in the US in FY2021.

Furthermore, since Ford had started deliveries for its F-150 Lightning, we expect to see more positive reviews potentially creating even more demand within the US, similar to these glowing appraisals from Motor Trend and InsideEVs US:

In the meantime, we encourage you to read our previous article on Ford, which includes more details on its F-150 Lightning model.

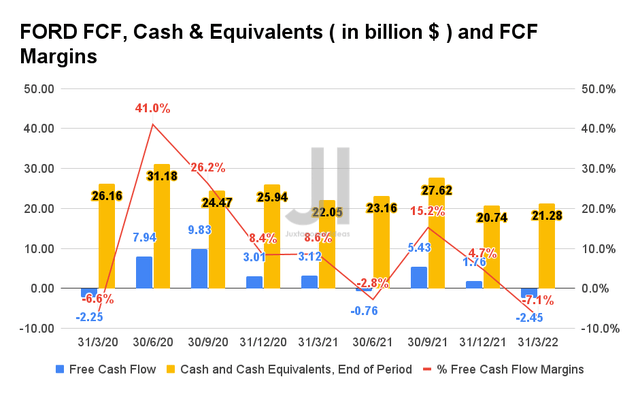

FORD FCF, FCF Margins, and Cash & Equivalents

S&P Capital IQ

For FQ1’21, Ford reported Free Cash Flow (FCF) of -$2.45B and FCF margins of -7.1%, partly attributed to the 53K completed vehicles pending component installations affected by the global semiconductor shortage. Furthermore, the company is aggressively investing in its Level 2, 3, and 4 autonomy EVs software while transitioning its production capacity from ICE to EVs. As a result, we do not expect to see massive FCFs moving forward, with Ford guiding an adjusted FCF in the range of $5.5B to $6.5B.

Nonetheless, given that Ford still has a massive war chest of $21.28 in cash and equivalents for the quarter, we are not concerned about its liquidity at all. In addition, we expect the 53K vehicles to be bottom-line accretive by H2’22 once supply eases given the increased production capacities from its wafer and chip suppliers then. In addition, Ford had stayed on top of its game by designing its way out of the global supply chain issues. As a result, we expect the company to continue its strong execution moving forward, despite the ongoing macro issues.

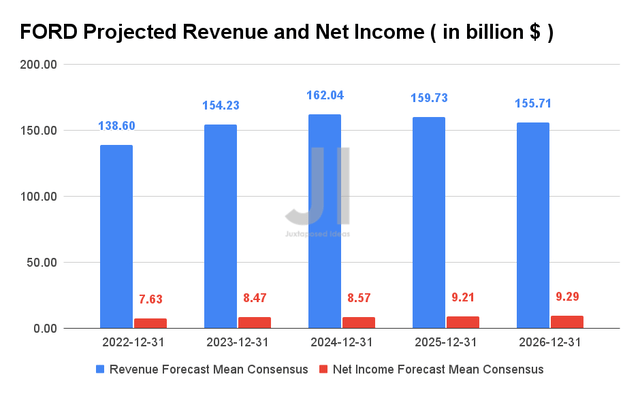

Ford Projected Revenue and Net Income

S&P Capital IQ

Ford is expected to report revenue growth at a CAGR of 2.36% over the next five years. For FY2022, consensus estimates that the company will report revenues of $138.6B and a net income of $7.63B, representing YoY growth of 9.7% and a decline of -57.4%, respectively. The temporary headwinds to Ford’s net income can be partly attributed to the inflation in raw material prices, labor, and shipping, though we expect the reduction in its operational costs to offset these pricing pressures. As Ford is also passing on the incremental cost to its consumers, we expect the company to maintain strong gross margins despite macro issues.

Nonetheless, given its ambitious EV goals of over 2M EVs production by 2026 and potentially over 3.3M EVs deliveries by 2030 ( based on its peak deliveries of 6.65M in FY2016 ), we expect Ford to continue reinvesting its gross profits into its auto business. We are encouraged to see the company taking great steps to maintain its long-term competitiveness in the rapidly changing auto industry. Thus, Ford should see the benefits of its efforts by the next decade as it transitions into a successful dual-mode ICE and EV auto company. As a result, investors looking for quick gains through Ford should look elsewhere.

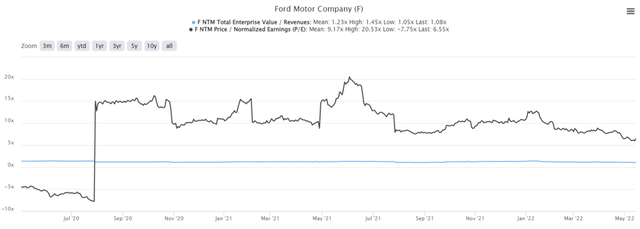

So, Is Ford Stock A Buy, Sell, or Hold? Ford 2Y EV/Revenue and P/E Valuations

S&P Capital IQ

Ford is currently trading at an EV/NTM Revenue of 1.08x and NTM P/E of 6.55x, lower than its 2Y mean of 1.23x and 9.3x, respectively. The stock is also trading at $13.50, down 47.8% from its 52 weeks high of $25.87 and only 16.1% higher from its 52 weeks low of $11.62. Consensus estimates also rate Ford stock as fair value now, given its reasonable valuation and promising integrated EV pipeline. As a result, interested investors may use this opportunity to add more exposure.

Therefore, we rate Ford stock as a Buy for long-term investors.