Ethereum whales turn bullish with Shanghai upgrade less than a month away

Ethereum #Ethereum

Share:

Ethereum (ETH) Shanghai upgrade is drawing close, while market participants remain indecisive. It is key for ETH holders and bulls to defend critical support at $1,680 to fight further decline in the altcoin’s price. Ethereum whales holding between 1,000 and 10,000 ETH have been scooping up the altcoin consistently for a week. With the countdown to the Shanghai upgrade and the Ethereum token unlock event, there is a spike in Ethereum demand among retail investors.

Also read: Ethereum Layer 2 rat race intensifies, here’s how to benefit

Ethereum bulls need to defend against a drop below $1,680, here’s why

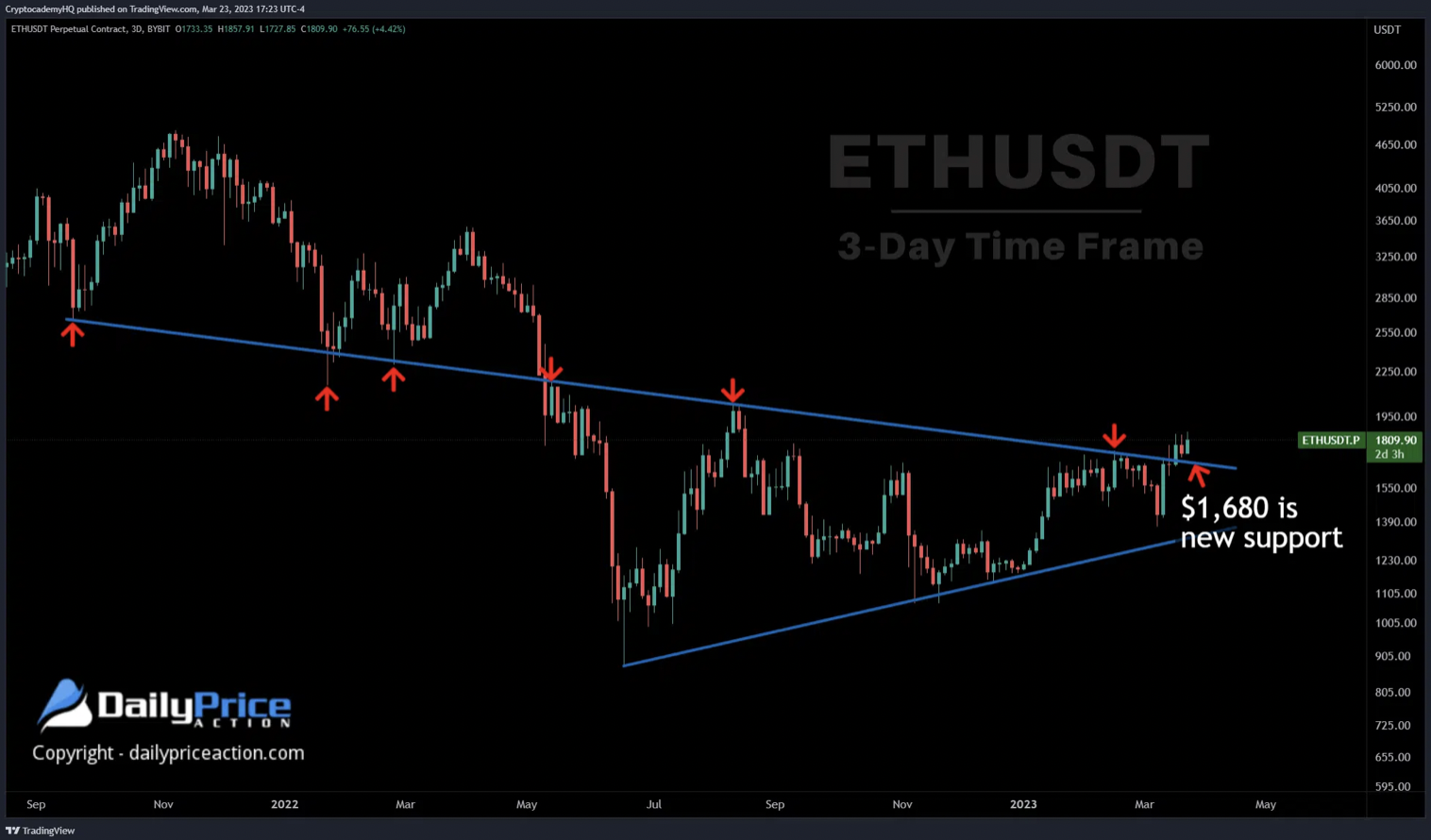

On the Ethereum price chart, the $1,680 level represents the top of a symmetrical triangle that dates back to September 2021.

ETHUSDT Perpetual Contract

$1,680 is therefore key support for the altcoin and bulls need to defend against a drop below this level. While crypto market participants remain indecisive it is key for Ethereum to sustain above its critical support level to defend against further decline in the days leading up to the ETH token unlock event.

Ethereum whales accumulate ETH ahead of Shanghai upgrade

Ethereum network’s large wallet investors have continued accumulation of the altcoin as the Shanghai upgrade draws close. The upgrade aims at making Ethereum accessible and scalable. Importantly, ETH token unlock will occur post the Shanghai upgrade; this is an event that the Ethereum holder community has anticipated since the launch of the ETH2 deposit contract.

Based on data from Santiment, ETH wallet addresses holding between 1,000 and more than 10,000 ETH, and 1 million to 10 million ETH tokens have added the altcoin to their balance consistently in the last seven days. Large wallet addresses are accumulating the largest altcoin by market capitalization.

%20[11.14.57,%2027%20Mar,%202023]-638154937098960677.png)

ETH accumulation by large wallet investors

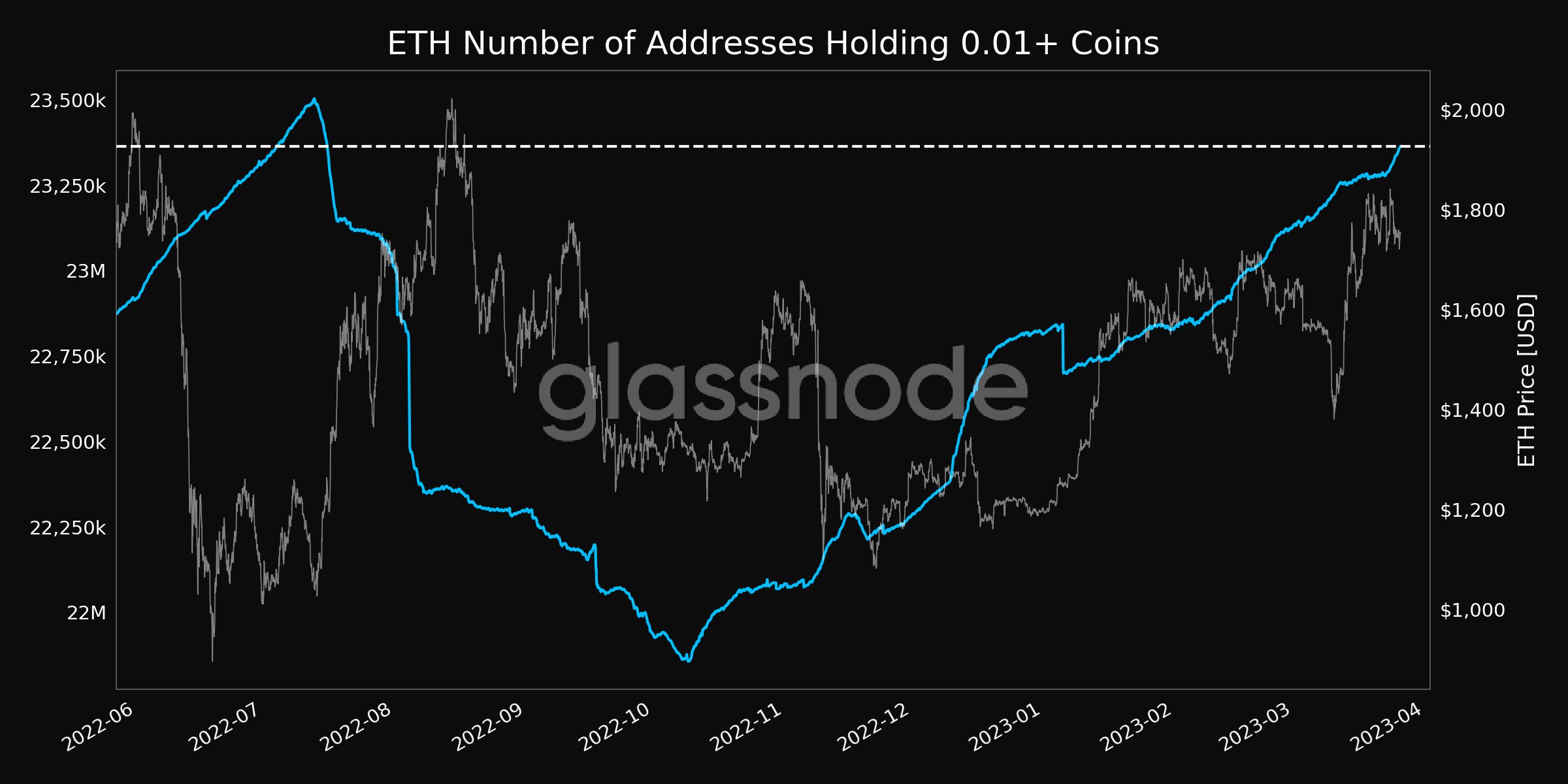

Retail investors match whale’s enthusiasm. There are currently over 23.3 million addresses that have at least 0.01 ETH and the address count has hit an eight month high according to Glassnode.

ETH number of addresses holding 0.01+ Ethereum tokens

Interestingly, Total Value Locked (TVL) in the ETH2 deposit contract hit an all-time high above 17 million ETH. These metrics fuel a bullish thesis for the second-largest cryptocurrency by market capitalization.

With the rising uncertainty in the crypto ecosystem, despite the bullish thesis, influencers and crypto analysts question why the narrative has turned bearish. David Gokhstein, American entrepreneur and crypto influencer recently questioned why $10,000 ETH forecasts have disappeared from social media platforms.

David Gokhstein asks if $10,000 Ethereum forecasts have gone extinct

David Gokhstein, founder of Gokhstein Media often tweets about cryptocurrencies and price targets. Gokhstein commented on the 2022 narrative of Ethereum price rally to $10,000 and how this forecast has disappeared despite the upcoming major upgrade in the ETH ecosystem.

The influencer wonders whether the ETH community believes that the altcoin has the bullish potential to hit the $10,000 level. Ethereum is currently exchanging hands at $1,754, and bulls need to defend critical support to fight a price decline in the altcoin ahead of token unlock.