Cosmetics Newspaper: Japanese Beauty Brands See Popularity Skyrocket Online in China during Double 11 Shopping Festival 2020

China Lily #ChinaLily

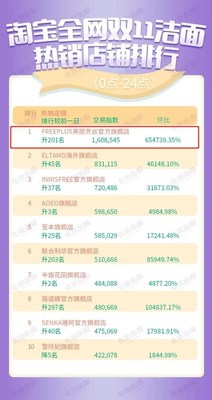

SHANGHAI, Dec. 14, 2020 /PRNewswire/ — Lily & Beauty (605136.SH), the leading provider of online cosmetics marketing and retailing services in China, has revealed that the Japanese beauty brands it operates on Tmall skyrocketed in popularity during the Double 11 Shopping Festival, with Freeplus and KISSME topping the sales charts across many sub-categories. During the annual shopping extravaganza, Lily & Beauty helped Japanese cosmetics brands such as Kanebo and Isehan unleash their potential and achieve continued success on Chinese e-commerce platforms with its comprehensive marketing solutions.

Cosmetics Newspaper, a publication focused on the cosmetic industry in China, reported on the phenomenal growth of Japanese cosmetics brands during the Double 11 Shopping Festival in 2020, and said that with their strong brand awareness built in earlier years through shopping agents and travel retail, Japanese beauty brands have managed to break into the mainstream and continue to rise in the Chinese market.

Tmall’s data show that Freeplus continued to rank number one in the facial cleansing category, and the second-tier skincare kit aqua-milky lotion also sold more than 120,000 sets, a 550 percent increase in growth compared year-on-year. The unprecedented sales record pushed Freeplus to the top spot among Japanese and Korean cosmetics. It is the same story for KISSME, which had already become the top-selling product in the mascara category since November 1 while the newly launched eyeliner in 2020 also secured its top two position in the eyeliner category on November 11.

With its incredible moisturizing, anti-aging, and repairing effects, Japanese beauty and cosmetic brands have met the skincare needs of the Chinese consumers across different demographics. Their continued popularity is backed by a strong user base and favorable policies in China. What have Japanese beauty and cosmetic brands done to consolidate their position as the industry’s new market darlings in China?

Rising Popularity of Japanese Beauty Brands in China

For a long time, in the eyes of Chinese consumers, Japanese beauty brands can be described as a “Three Goods” brand: “good brand image, good product quality and good user reputation.” The reason why Japanese beauty brands can successfully break through the multiple attacks of Korean cosmetic brands, European and American and domestic brands is also inseparable from the user base accumulated due to product reputation.

In fact, Japan has already become one of the major players in China’s imported beauty market. In the first quarter of 2019, Japan’s total export of cosmetics to China reached CNY5.48 billion, surpassing France and South Korea for the first time, ranking first. According to data from the Japan Cosmetic Industry Association, Japan’s exports to China have hit a record high for six consecutive years, with sales accounting for more than 70 percent.

Among the medium and long-term strategic plans of many Japanese companies, the Chinese market has always occupied an important place. Moreover, with the formal signing of the Regional Comprehensive Economic Partnership (RCEP), China and Japan have reached bilateral tariff reduction arrangements for the first time. Therefore, Japanese beauty brands will embrace unprecedented huge growth opportunities in the Chinese market.

Catching up: Localized operation leads to breakthrough of Japanese beauty brands

The performance of Japanese beauty brands in the Chinese market is the result of a cross-influence of multiple factors such as economic and cultural exchanges, and the operation strategy of brands in the Chinese market also has a profound impact on the global and even local market share of the brand. However, for a long period of time, Japanese beauty brands have not exerted their inherent advantages in user cognition. Chinese consumers have been guided by the fast-paced launch of new products from European and American brands with high positioning and development, and endless new brands and new technologies have greatly satisfied a consumer psychology of being keen to have new things. However, the operation of Japanese brands in the Chinese market still follows the logic in Japan. For example, slow product development speed, long brand decision-making cycle, and moderate brand marketing and promotion strategy, Japanese brands have little advantage over European and American brands in head-on competition.

Yet the challenges of such differences in business habits and culture are increasingly being eliminated by the localized operation ability of Japanese brands. Long-term cooperation with Chinese partners has significantly improved the market response speed of Japanese beauty brands. Since Japanese brands follow new operations in the Chinese market, a number of super single items with excellent word-of-mouth promotion and sales are quickly springing up. Freeplus Mild Soap ranked number one in the cleansing category on Tmall during Double 11 festival for five consecutive years; KISSME mascara has ranked number one in the mascara category on multiple occasions; ALLIE sunscreen ranked number one in the sunscreen category this June. Such super single items with high cost performance have brought good word-of-mouth promotion and continuous re-purchase for these Japanese brands.

This shows that, in addition to the hot super single items, the long-established brand power described above is increasingly strengthened under the acceleration of the localized operation of Lily & Beauty, a retail service provider, where more new categories and products under are emerging. Additionally, retail service providers are adopting more flexible marketing strategies for Japanese brands, allowing different channel scenarios to reach consumers.

Take livestreaming as an example. During the Double 11 event, unlike the dependence of well-known brands in Europe and America on livestreaming sales and super anchors, livestreaming sales of Freeplus accounted for a very low proportion of the total sales, and the self-broadcasting room made a very high contribution to livestreaming sales. This is ascribed to Freeplus’ introduction of external traffic to the self-broadcasting room through tactics such as digital red envelopes, seconds kill and lucky draw, so that the transaction permeability of the self-broadcasting room exceeded ten percent, and second-tier potential goods have achieved an average growth of more than 200 percent.

The super anchors levered the volume through the super items and cooperated with the store self-broadcasting for full acquisition of new customers. The full-band livestreaming has brought more than 500,000 new customers to the Freeplus stores, and livestreaming contributed to 25 percent of total new customers.

It has become clear, with the support of retail service providers, Japanese brands are actively merging into the Chinese market, tapping user potential, catering to the preferences of Chinese consumers, and adapting to the rapid changes of e-commerce channels, thus gaining a larger market share. However, it is still clear that Japanese brands are still very restrained in their actions in the Chinese market, especially cautious in new product launches and marketing investments. If they can strengthen their cooperation with retail service providers to improve decision-making efficiency, there is still more room for the development potential of brands to be explored.

Market focus from a global perspective: a new e-commerce pattern of Japanese cosmetics post-COVID-19

Sweeping the world in early 2020, the COVID-19 pandemic has had a severe impact on the global economy, and the Japanese cosmetics industry has also been hit hard. Due to the pandemic, the number of visitors to Japan fell 93 percent in March and even 99 percent in April, according to the Japan National Tourism Organization (JNTO). Meanwhile, Japan’s domestic consumer market has also been affected. After the Japanese Government announced the Emergency Declaration in April, a large number of department stores and cosmetics shops were forced to temporarily suspend their business. Moreover, with the popularization of working from home and the habit of wearing masks, consumer demand for beauty and cosmetics continued to shrink.

In addition to the travel retail and domestic market, Japanese beauty makeup also found it difficult to resist the downward trend in the global market. Japanese cosmetics exports in May were JPY98.46 billion, down 39.1 billion from a year earlier, according to the Ministry of Economy, Trade and Industry. A number of Japanese cosmetics companies reported declines of more than 20 percent in global sales in the first three quarters, and some were unusually in the red.

Global sales of beauty makeup products fell about 50 percent between April and June from a year earlier and are expected to fall 20 to 30 percent for the full year, according to McKinsey. Against the backdrop of the general downturn in the global beauty market, China has, as the world’s second largest cosmetics consumer market, been the first to recover from the pandemic, and become a safe haven for global cosmetics companies. For Japanese beauty brands, strong growth in the Chinese market, especially in the e-commerce channel, has made the greatest contribution to the corporate recovery.

In the tough post-epidemic retail environment, it is not easy for Japanese beauty cosmetics to achieve growth in the e-commerce channel of the Chinese market, which is largely attributed to retail service providers with a combination of refined operations, marketing, and consumer operations. Depending on their accurate analysis and judgment on the changes of e-commerce channels and continuous output of brand values, they have continuously expanded the user base for Japanese beauty cosmetics in the Chinese market, thereby accelerating the rapid development of brands.

Rapid adaptation to the pace of development, operation mode and marketing strategy of e-commerce channels is the core factor for Japanese beauty brands to achieve brilliant performance in the Chinese market. Especially in the current post-epidemic period, Japanese brands generally facing the pressure of growth, need to and should join hands with partners proficient in the logic of e-commerce operations more than ever before, so as to sound the horn of recovery in the Chinese market.

SOURCE Lily & Beauty