Coalition dilemma on backing Labor’s tax cuts

jane hume #janehume

“That’s the equivalent of 25,000 full-time jobs, which is more than double the labour supply impact of the old stage three,” he said.

The government argues increased labour supply would mitigate against any inflationary impact of giving more money to people on lower incomes, who are more inclined to spend it.

With the legislation to be introduced next week, the only certainty agreed to so far is that the Coalition will not go to the next election pledging to revoke Labor’s tax cuts, regardless of which way it votes on the package.

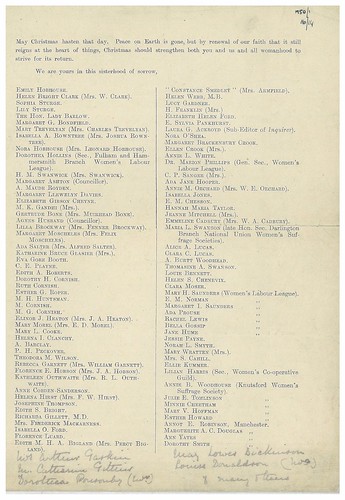

“Our starting position has always been that the Coalition will be in favour of lower and simpler taxes,” said opposition finance spokeswoman Jane Hume.

The package is almost certain to pass with the support of the Greens and Senate crossbenchers.

Nationals MP Barnaby Joyce said his personal view was that “a broken promise is a broken promise” and there should be a separate assistance package to help those on lower incomes with the cost of living.

He said power bills, groceries and rent were the scourge of low-income earners in his electorate.

‘Kill aspiration, investment’: Dutton

Opposition Leader Peter Dutton, who has been conferring with colleagues, is believed to be inclined towards trying to amend the legislation and, when unsuccessful, wave it through.

In a sign of things to come, Mr Dutton launched a blistering attack on Labor’s credibility on Thursday, after Finance Minster Katy Gallagher declined four times to categorically rule out going after negative gearing tax breaks.

Last week, Dr Chalmers also declined to give a categorical assurance on negative gearing, and late last year, Mr Albanese would not rule out changes to the tax treatment of the family home.

“All of that now, I think people can reasonably say they’re worried that changes are coming,” Mr Dutton said.

“It’s wealth redistribution; it’s an attack on aspiration; it’s pitching one Australian against the other, and I don’t think it has any place here.”

Mr Dutton said Labor MPs had little understanding of those who worked for a living and took risks.

“If you work in a union your whole life or at the Labor Party’s local senator’s office – I mean, the prime minister’s been in that Labor bludgery since he left university – I guess you don’t understand the reality of what normal people do in terms of their budgeting and the way in which they live their lives,” he said.

“At the moment, Jim Chalmers is on this crusade to be Robin Hood, and in the end, all they do is kill aspiration, investment.”

In breaking his promise not to pare back the stage three tax cuts, Mr Albanese has sought to force the Coalition to choose between the original stage three tax cuts, and Labor’s U-turn, which skews much of those tax cuts towards low- and middle-income earners.

Under the Coalition’s original stage three plan, from July 1, incomes between $45,000 and $200,000 would be taxed at 30 per cent, and incomes above $200,000 at 45 per cent.

Under Labor’s changes, incomes between $18,200 and $45,000 will be taxed at 16 per cent, down from 19 per cent. The 30 per cent tax rate will apply on incomes between $45,000 and $135,000, and then a 37 per cent rate, which was abolished by the Coalition’s stage three, would apply between $135,000 and $190,000. Above that, the 45 per cent rate would apply.

The reintroduction of the 37 per cent rate would result in an extra $28 billion in bracket creep being collected over the next decade.

No deals with the Greens: PM

Mr Albanese confirmed he would not be horsetrading with the Greens or anyone else in the Senate to secure the passage of the tax changes.

“We will put this plan forward on its merits. People in the House of Representatives and the Senate can determine their view as to whether they want to provide increased support to low- and-middle-income earners or not,” he said.

“We will always look at [additional cost-of-living] budget measures, but what we will not be doing is trading across different issues. We are focused on this – this stands on its merits.”

As the economic outlook, from a political standpoint, began to look rosier, Queensland Premier Steven Miles urged the Reserve Bank of Australia, and the retail banks, to cut rates now, rather than wait for inflation to fall further.

“The Reserve Bank needs to start cutting interest rates now to take pressure off households,” he said.

“There’s no rule the banks can’t cut their rates first. Many of them lifted their rates before the RBA.

“They’re making record profits while Queensland families are struggling. It’s about time they cut their rates to leave families with more money for food.”