Chesapeake Energy: Geopolitics Can Help It Thrive, But Seems Overvalued

Chesapeake #Chesapeake

Joey Ingelhart

Investment thesis: The re-emergence of Chesapeake Energy Corporation (NASDAQ:CHK) after a disastrous decade of very low natural gas prices brought it to financial ruin may not make it seem like an exciting investment opportunity. It is often assumed that the factors that brought a company, especially in the commodities sector, to insolvency might do so again. In the particular case of Chesapeake, there is an argument to be made in favor of fundamental market changes that may elevate some of the losers of the last decade to potential winners this decade. In this particular case, we are talking about a fundamental shift in America’s long-term natural gas price outlook, due to geopolitical events, mostly centered around the Ukraine war.

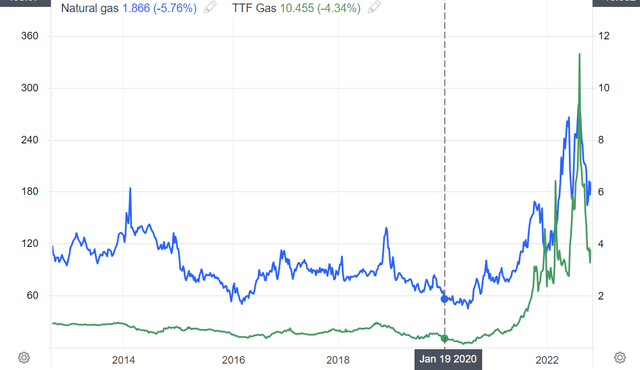

Trading Economics

Note: TTF Europe price is on the left axis and volumes are measured in MW hours, while the HH US spot price is on the right axis and the price is per million BTUs. When adjusted for the measurement of volume units, TTF currently comes out to about $35/million BTU, versus about $6/ million BTUs for HH.

It is this large price gap between the two markets as well as America’s need to support its European allies as they move away from their Russian gas dependence that makes the current U.S. natural gas price increase a long-term reality. All indications are that current natural gas price levels are more than adequate for Chesapeake to continue putting in profitable quarters for the foreseeable future, which makes it an intriguing shale investment opportunity.

Chesapeake’s Q3 results confirm its viability as a re-emerged shale company, which can thrive within the current economic & geopolitical reality

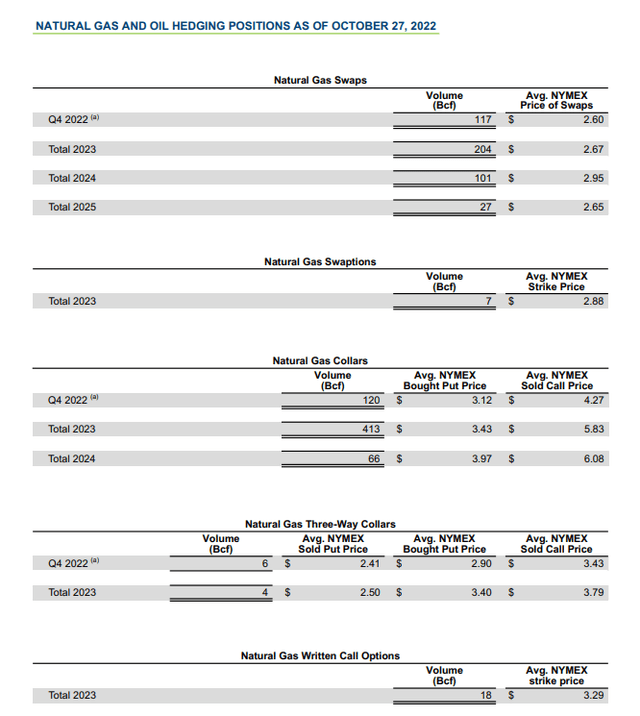

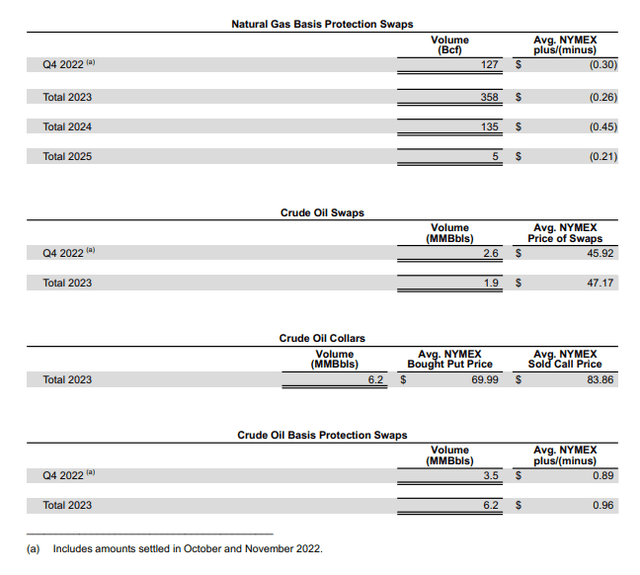

For the third quarter of this year, Chesapeake saw a net income of $883 million. Production was 4,108 MMcf, 90% of which was natural gas. Revenues came in at $3.16 billion after accounting for $1.03 billion in derivatives losses. It is normal for Chesapeake to approach its price-hedging conservatively, making sure to provide a minimum level of revenues that can help it stay afloat in some unforeseen worst-case scenario.

At the same time, it limits revenues & profits even as natural gas prices are more likely to stay high than they are to crater for a sustained period, given the global supply/demand situation. The profit margin is around 28%, which is quite comfortable, meaning that Chesapeake can withstand a sizable decline in natural gas prices before it starts losing money. Net earnings came in at $883 million for the quarter.

While the derivatives issue will continue to severely limit Chesapeake’s profitability moving forward, it could also help to provide some financial stability.

Chesapeake

Chesapeake

Chesapeake can still benefit from higher prices in the future, selling volumes that are not already covered by hedging contracts at a market price, while at the same time if or when we will have periods of severe economic downturn, these hedging positions can provide enough of a buffer for Chesapeake to make it past any such periods of potential financial distress for U.S. shale producers.

Europe continues to deepen its reliance on U.S. natural gas in order to cope with its divorce from Russian energy, and an overall tight global energy supply situation

While the U.S. natural gas market is currently providing U.S. shale producers with a favorable environment in terms of their current profitability, it is often rightly assumed that such good times are never long-lasting in the commodities extraction business. The bullish case for U.S. natural gas producers may not last indefinitely either, but in this case, it may last just long enough to make this a good decade for shale gas producers like Chesapeake.

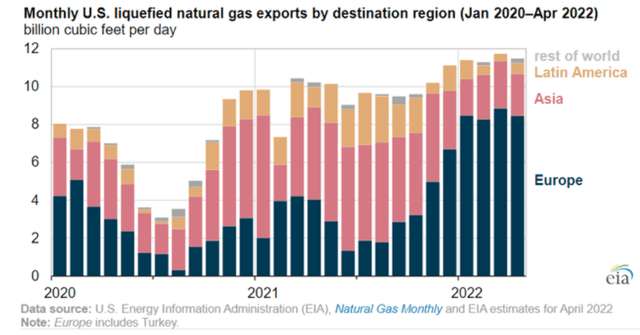

EIA

As the chart shows, with its divorce from Russian energy supplies, Europe is increasingly becoming dependent on U.S. LNG exports. The situation calls for higher U.S. LNG exports, as well as the redirection of flows to Europe, from other markets. The situation at hand amounts to the U.S. being politically bound to a policy of high LNG exports, because it cannot let its European allies down, after pushing them towards a policy of divorce from Russian pipeline gas.

The inevitable outcome is an open-ended U.S. commitment to supplying Europe with large volumes of natural gas, that cannot easily be walked away from. This commitment should provide for a high-price environment for much of the rest of the decade for U.S. natural gas producers. It would take some rather unlikely events to derail this assumed outcome for high natural gas prices going forward.

A severe global economic downturn, an unlikely sudden surge in global LNG supplies, or a massive surge in US shale gas production, a warm winter for both North America as well as Europe and China hitting the markets simultaneously. Any of these unforeseen events could still surprise the markets, but none of them are very likely to occur, therefore odds are that U.S. natural gas prices will remain high on average this decade.

Investment implications:

The bull thesis on Chesapeake’s financial outlook seems solid, with the strong global market and geopolitical fundamentals in place, being a basis for that thesis. Its latest quarterly results are encouraging. The one thing that is not entirely enticing at the moment is its valuation.

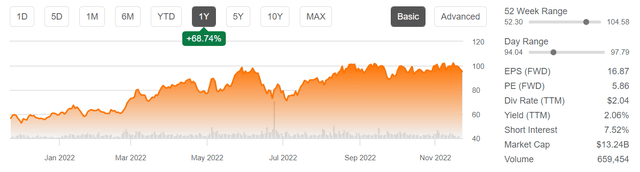

Seeking Alpha

A P/E of around 6 would ordinarily not seem like such a high valuation, but for instance, when measured up against an oil & gas producing company with a solid history and decent future prospects like Suncor (SU) for instance, which currently trades at a forward P/E of 5, it is comparatively unattractive. The entire shale industry seems to be trading at higher comparative valuation levels when measured up against other peers. For instance, EOG Resources (EOG) trades at a forward P/E of almost 10 currently, justified comparatively speaking by its solid historical financial track record, as opposed to Chesapeake’s own troubled past.

It should be noted that there is a massive question mark that hangs over the entire shale industry in regard to how much prime acreage may be left to drill. The Bakken & Eagle Ford fields seem to be suffering from severe prime-acreage depletion already, so it may not take long for the rest of the industry to suffer the same fate. Individual companies, including Chesapeake, may hit a wall in this regard at any point, and it may be sudden rather than gradual. In other words, it may be drilling down its prime acreage at a relatively even pace along all of its projects. This is a major risk factor for any shale industry-related investments, which we should be mindful of when assessing the risk/reward situation of any particular shale company.

The long-term market fundamentals that match Chesapeake’s own business profile make for a solid bullish argument. However, at the moment, Chesapeake is seeing its valuation bolstered by a market that seems content with the entire industry trading at higher valuation levels than can arguably be justified, when compared with other oil & gas producers outside of the shale patch, as well as compared with the overall valuation trends for commodities producers. As a result, there seems to be significant downside risk, even as the upside potential thesis makes Chesapeake Energy Corporation a tempting investment opportunity.