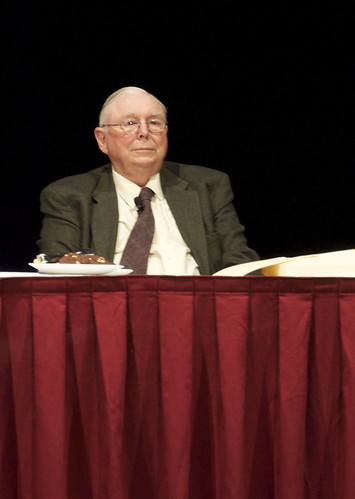

Charlie Munger was still a master of the one-liner in his 90s, calling crypto ‘venereal disease’ and AI overhyped

Charlie Munger #CharlieMunger

Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go. download the app

The late Charlie Munger, who died Tuesday aged 99, was known for his signature sense of humor as well as for his meteoric success during a five-decade tenure at Berkshire Hathaway.

Warren Buffett’s right-hand man leaves behind decades’ worth of life lessons – as well as his fair share of zingers, including savage takedowns of bitcoin and other cryptocurrencies.

Here are 11 of the Oracle of Pasadena’s best quotes on investing and markets.

The stock market

1. On the 2008 financial crisis: “The bubble in America was caused by some combination of megalomania, insanity and evil in, I would say, investment banking, mortgage banking” – Munger at a 2011 conference in Pasadena, CA

2. On former Lehman Brothers CEO Dick Fuld: “I bet Richard Fuld doesn’t have an ounce of contrition. It’s just megalomania. When it’s like that, you need rules to prevent catastrophe. When banks are borrowing the government’s credit rating, you need rules to prevent stupid things” – Munger in a 2010 interview with CNBC

3. On derivatives: “What do you think a derivatives trading desk is? It’s a casino in drag. They make the witch doctors look good” – Munger at the 2015 Daily Journal annual meeting

4. On what value investing has in common with fishing: “I have a friend who’s a fisherman. He says, ‘I have a simple rule for success in fishing. Fish where the fish are.’ You want to fish where the bargains are. [It’s] that simple” – Munger at the 2020 Daily Journal annual meeting

5. On meme stocks: “What we’re getting is wretched excess and danger for the country. A lot of people like a drunken brawl, and so far those are the people that are winning, and a lot of people are making money out of our brawl” – Munger at the 2021 Daily Journal annual meeting

The Federal Reserve

6. On Alan Greenspan, Fed chair in the run-up to the financial crisis: “Alan Greenspan is a smart man. He just totally overdosed on Ayn Rand at a young age” – Munger at a 2011 conference in Pasadena, CA

Artificial intelligence

7. On the ChatGPT-fueled AI investing craze: “I am personally skeptical of some of the hype that has gone into artificial intelligence. I think old-fashioned intelligence works pretty well” – Munger at the 2023 Berkshire Hathaway annual meeting

Bitcoin and crypto

8. On bitcoin when it was trading at $150: “I think it’s rat poison” – Munger in a 2013 interview with Fox Business

9. Five years later, when the token was valued at $9,000: “So it’s more expensive rat poison” – Munger in a 2018 follow-up interview with Fox Business

10. On dodging the crypto craze and subsequent crash: “I’m proud of the fact that I avoided it. It’s like some venereal disease. I just regard it as beneath contempt” – Munger at the 2022 Daily Journal annual meeting

11. On the US not banning crypto transactions: “I am not proud of my country for allowing this crap – well, I call it crypto shit. It’s worthless, it’s crazy, it’s not good, it’ll do nothing but harm, it’s antisocial to allow it… I think the people that oppose my position are idiots” – Munger at the 2023 Daily Journal annual meeting