Atlanta Braves: Sensible Play For Exposure To U.S. Sporting Franchise

Braves #Braves

Pgiam/iStock via Getty Images

Investment summary

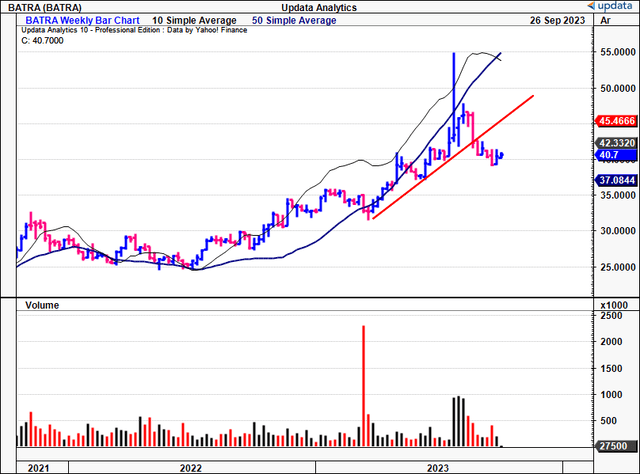

Atlanta Braves Holdings (NASDAQ:BATRA) has emerged as a standalone entity after completing its split-off from the former Liberty Media in July. As a bit of recent history, back in 2016, Liberty created a class of tracking shares, to track the performance of three of its core assets, BATRA included (as the name implies, tracking shares are a form of equity that simply tracks the performance of an underlying asset, but don’t actually represent an ownership stake in these assets. This is a key distinction to make). You can see the performance of BATRA’s total return in Figure 1(a).

Prior to the split-off, Liberty had a rather complex capital structure. The aim of reorganizing in this fashion was to give greater recognition to its core assets, particularly BATRA. This in effect has unlocked a new potential source of value for investors that represents an actual ownership stake in The Atlanta Braves sporting franchise, alongside its adjacent assets.

This report will work through the pertinent details of the split-off, with additional details on the company’s operational structure and latest numbers. Net-net, I rate BATRA a buy, eyeing potential value to an objective of $49, a c.20% value gap as I write.

Figure 1.

Data: Updata

Figure 1(a).

Data: Updata

Breakdown of company structure + split-off 1. Split-off from Liberty SiriusXM

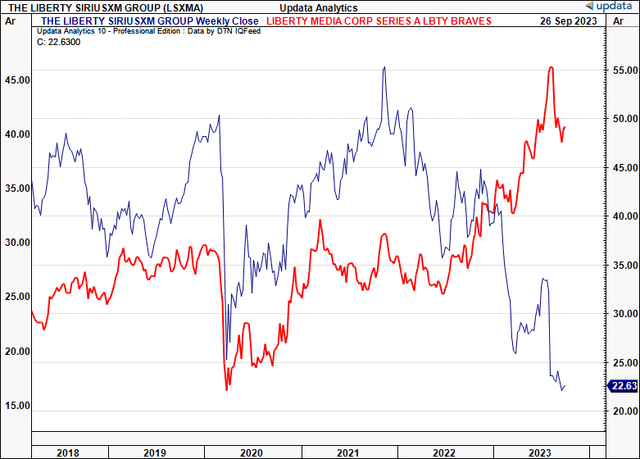

Before becoming an independent publicly traded entity, BATRA previously existed as a subsidiary of Liberty SiriusXM (LSXMA) [formerly known as Liberty Media]. Separating the company from LSXMA was done via a split-off-not to be confused with a spin-off. The key difference between a split-off and a spin-off is in the mechanism of how the separation occurs:

So basically, in a spin-off, shares of the new company are distributed to shareholders, while in a split-off, shareholders can exchange their shares in the parent company for shares in the new company. In that vein, split-offs are often used when the parent company wants to divest a portion of the whole business, but still allow its existing shareholders to maintain an interest in the new entity. There are also tax benefits, given there is no exchange of income. As a result of the split-off, LSXMA reclassified itself as Liberty SiriusXM, Formula One Group (FWONA) and Liberty Live Group.

As per the S-1 prospectus filed in September, BATRA had the following capitalization (all common stock) to which investors could own:

Critically, only BATRA owners are entitled to voting rights, whereas BATRA and BATRK offer the most liquidity for trading purposes. All classes of common stock represent ownership in the company’s net assets.

2. Operational structure

BATRA itself is structured as a holding company. Its main responsibility is to manage and oversee the operations of The Atlanta Braves Major League Baseball Club. It also manages The Braves’ stadium, and its mixed-use development, The Battery Atlanta, located right near the stadium.

The Braves have a long and rich history that dates back to their founding in Boston in 1871 when they were known as the Boston Red Stockings. They relocated to Atlanta in 1966. The Braves were one of the original members of the National Association of Professional Baseball Players-the first professional baseball league in the US. What’s remarkable about the Braves in my opinion is that they’ve fielded a team in every season of professional league play since 1871, making them the only Major League (“MLB”) franchise to do so.

The company reports in 2 segments, baseball and mixed-use development:

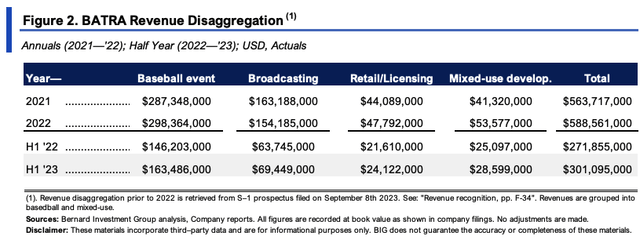

A more granular breakdown of the company’s top-line sales across all categories is seen in Figure 2. Critically, we have data going back to 2021, as provided in the S-1 prospectus from September. In 2021, it booked $563 mm in revenue, the bulk of which ($287.3mm) stemmed from baseball games. This lifted to $588.6mm and $298.3mm in 2022, respectively.

By H1 FY’23, it had clipped $301mm in top-line sales, with baseball revenues at $163.5mm, growing 11.8% from H1 last year. Operating costs for its baseball division amounted to $195.5mm in Q2 and $232mm for the YTD. If it continues at this pace, it could do ~$325mm in baseball sales, and clip >$600mm in top-line sales for the FY’23 year in my view.

BigInsights

3. Profitability and valuation

Seasonality is one major risk factor to consider in the profitability debate, as it is with all major sporting franchises. The MLB season runs from March to October and involves 162 games in a season. Naturally, there are no ticket sales in the off-season, but The Battery is open year-round.

The Braves are nevertheless a profitable franchise, clipping $42mm in adj. OIBDA for Q2 FY’23, down from $48.2mm last year. It booked a total of $58.77mm adj. OIBDA in FY’22. As to the profit breakdown by segment (in terms of adj. OIBDA):

Given the seasonality factor, most of the company’s sales and operating income are recognized in Q2 and Q3, aligning with the baseball regular season. After depreciation, finance costs and taxes, the company posted a first-half loss of $28.9mm, lifting to a net profit of $20.5mm when excluding all losses on intergroup interests as ‘pro forma earnings’. Per BATRA’s S-1, pro forma earnings per share “is computed by dividing net earnings, excluding any unrealized gains (losses) on intergroup interests, by 61.7 million common shares, which is the aggregate number of shares of Series A, Series B and Series C common stock that were issued on July 18, 2023 in connection with the split-off.”

The newly formed entity currently trades at 4.6x forward sales, and consensus has forecast $626.5mm at the top for BATRA in FY’23, stretching up to $660mm in FY’24. Assigning the 4.6x forward to consensus FY’24 estimates derives a target of $3.04Bn in market value or $49.20/share, including all shares outstanding across all 3 classes of common stock. This represents a c.20% value gap, and is an attractive proposition in my view.

Risks to consider that may impact the investment thesis:

There are a few risks to consider here in the BATRA investment debate:

Discussion

BATRA gives investors the opportunity to own a profitable sporting franchise with a deep network entrenched in U.S. baseball history. Now trading as a standalone entity, BATRA represents a sensible investment for those seeking exposure to professional sports labels in my view. Seasonality is one immediate factor to consider, but BATRA has accommodated this factor via its ownership of adjacent assets that provide reasonable income year-round. Intra-season, the company’s baseball franchise is profitable and made a strong rebound from the pandemic. Valuations are well supported when factoring consensus estimates, and I am eyeing a $49/share target as the next objective. In short, rate buy.