An Economy That Is Quickly Slowing

Hyman #Hyman

Darren415

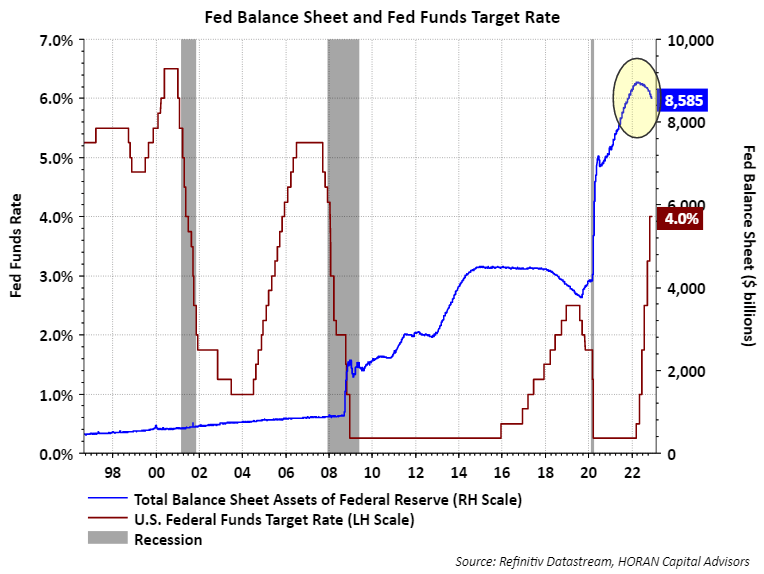

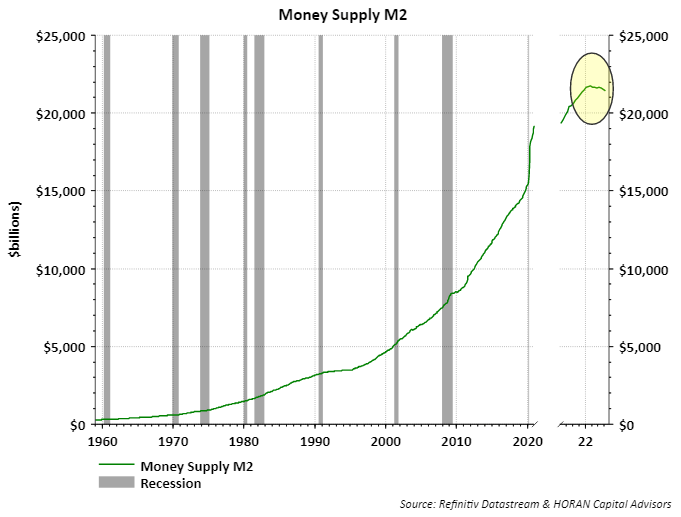

Eyes are on the Fed again this week as the FOMC will announce their interest rate decision on Wednesday. Last month the Fed gave indications the magnitude of future rate increases would be lessened in order to evaluate the economic impact of earlier rate hikes. In an earlier post I touched on the fact the current tightening pace has been the steepest on record with the most recent hikes consisting of four consecutive 75-basis point increases in the Fed Funds target interest rate, or 0.75%. The market is anticipating a 50-basis point hike Wednesday. Below is a video of a recent interview with Ed Hyman conducted by Cosuelo Mack on WealthTrack and Ed believes the Fed should increase rates by just 25 basis points.

Ed Hyman has been voted the top economist on Wall Street by Institutional Investor for an unprecedented 42 years. Ed discusses his reasoning behind why he believes inflation has peaked, which would be welcome news to the Fed. In the video link near the end of this post, Ed Hyman notes:

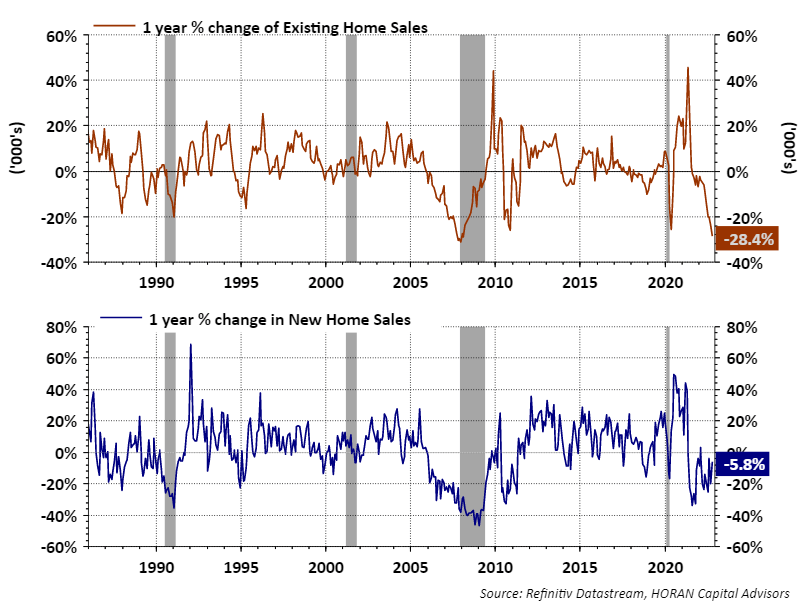

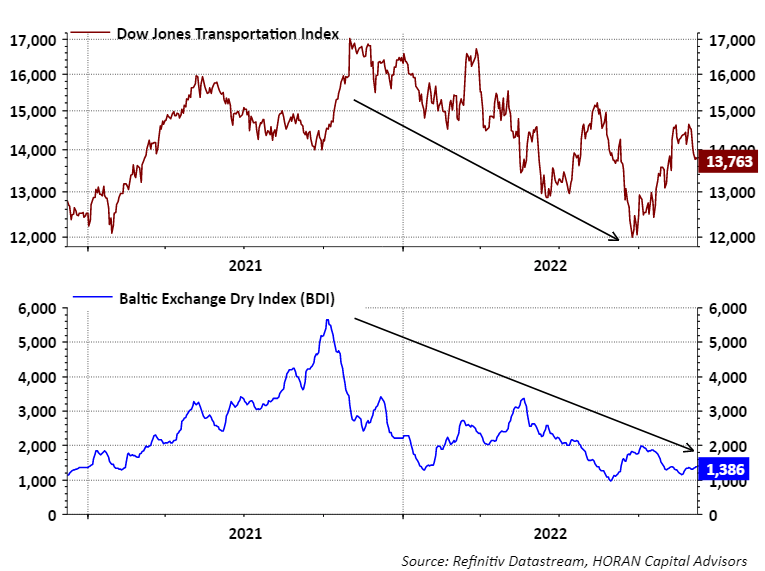

Ed Hyman’s firm conducts a number of industry surveys, one being a trucking industry survey, and it is providing near recessionary level results. His reliance on trucking is due to the fact the industry has one of the highest correlations to GDP. Also showing weakness is shipping data as measured by the Baltic Dry Index (BDI) which measures global freight rates for dry bulk shippers. When global demand for shipping rises, the BDI rises as well. The BDI peaked in October of last year and has mostly been trending lower since, an indication of less demand for shipping as seen in the bottom half of the below chart.

Other factors cited in the interview as an indication the economy is slowing,

Image

Image

Finally, Ed Hyman’s interview here provides one’s insight into 2023. It goes without saying though, the crystal ball is not always perfectly clear.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. Click to enlarge

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

HORAN Capital Advisors is an SEC registered investment advisor that manages investment portfolios for individuals and institutions. Our firm utilizes a disciplined investing approach that should create wealth for our clients over time. Our investment bias is to invest in companies that generate a steady return over time, i.e., singles and doubles. This singles and doubles approach tends to lead to investments in higher quality dividend growth/cash flow growth companies. On the other hand, there are times when a company’s stock price seems to be trading below its fair valuation. Short term gains are possible in these situations. I have been managing investment portfolios for individuals and institutions for over fifteen years and believe investing is like running a marathon and not a sprint. Taking the road less traveled, more often than not, leads to higher returns. Visit: The Blog of HORAN Capital Advisors at (https://horanassoc.com/insights/market-commentary-blog)

Additional disclosure: Copyright © 2022 HORAN. All rights reserved.