6 Tips to Spend Smarter and Avoid Debt This Black Friday and Cyber Monday

Black Friday #BlackFriday

This story is part of So Money, an online community dedicated to financial empowerment and advice, led by CNET Editor at Large and So Money podcast host Farnoosh Torabi.

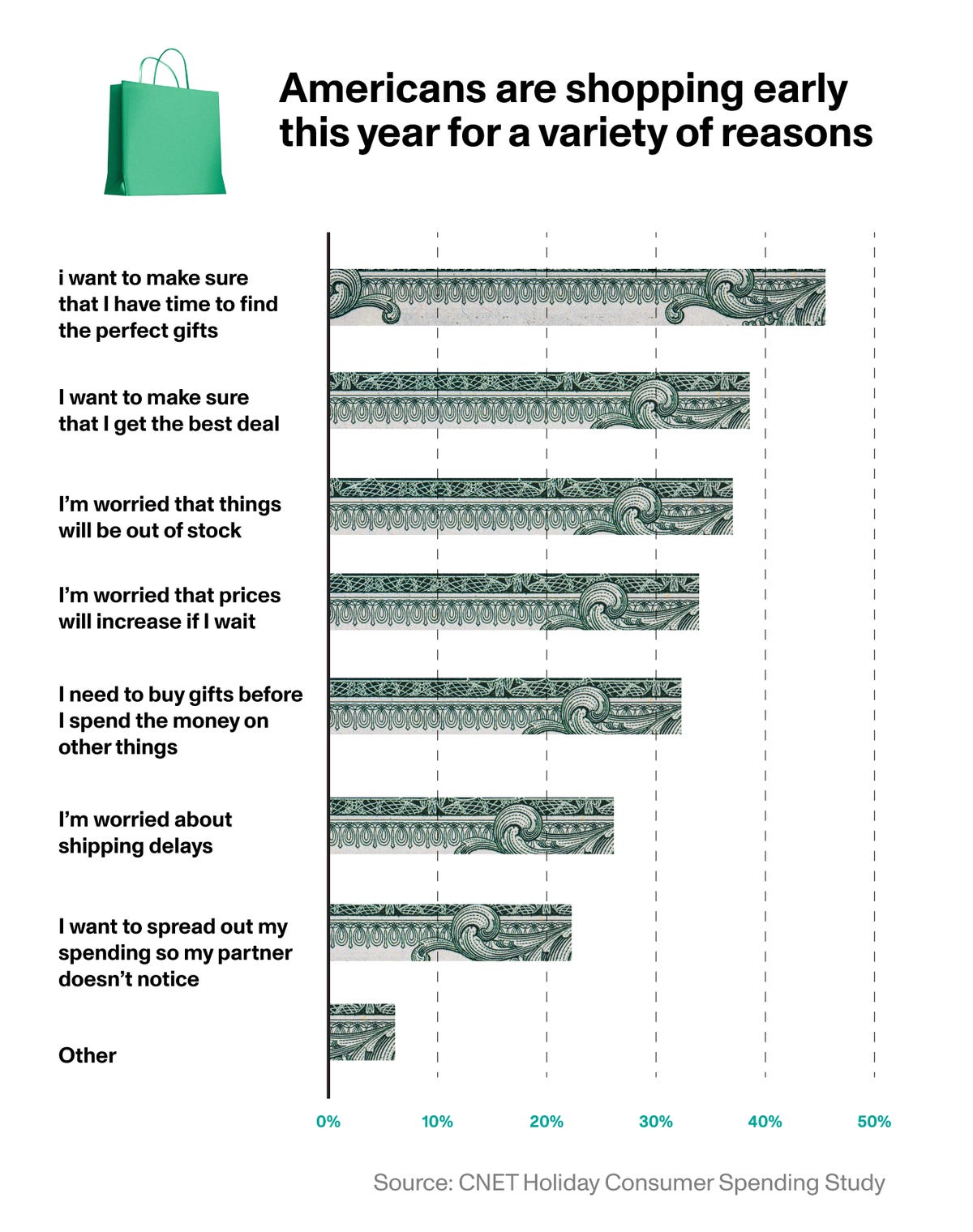

Since the pandemic hit in 2020, the holidays haven’t felt the same. Though Black Friday is considered the official kickoff to the holiday shopping season, many of us are getting a headstart, due to jitters over shipping delays, out-of-stock items and rising prices. More than 30% of people started checking items off their lists in September and early October, according to a CNET Holiday Survey.

Early data shows that this year’s gift-buying tendencies are driven by the hope of finding a good deal. And no wonder. Inflation, increased interest rates, a volatile stock market and concerns over layoffs are pushing us to try to cut back where we can. One-third of shoppers are worried that if they wait too long to buy presents, prices will go up.

Whether you’re buying a new gaming console for your kid, clothes for your partner or goodies for your colleagues, here are some tips to help you spend within your means and decrease the chance of entering the new year with a financial hangover.

Plan in advance

Supply-chain clogs aren’t over, and 38% of survey respondents are worried that their gift items will be out of stock this year, while 26% are concerned about shipping delays. That’s why, even if they hadn’t started actually buying yet, the majority of holiday shoppers were actively researching gifts. Planning in advance and comparison shopping are the best ways to avoid stress and be kinder to your wallet.

Robert Rodriguez/CNET

If you’re planning to wait until the last minute to buy gifts, know that it’s a test on both your time and budget. When we put off gift-buying until the final hour, we often have less patience for bargain-hunting, items get costlier and we tend to overspend. If you find yourself in a rush to get a gift, don’t go overboard. Just opt for a simple gift card — a practical gift preferred by many.

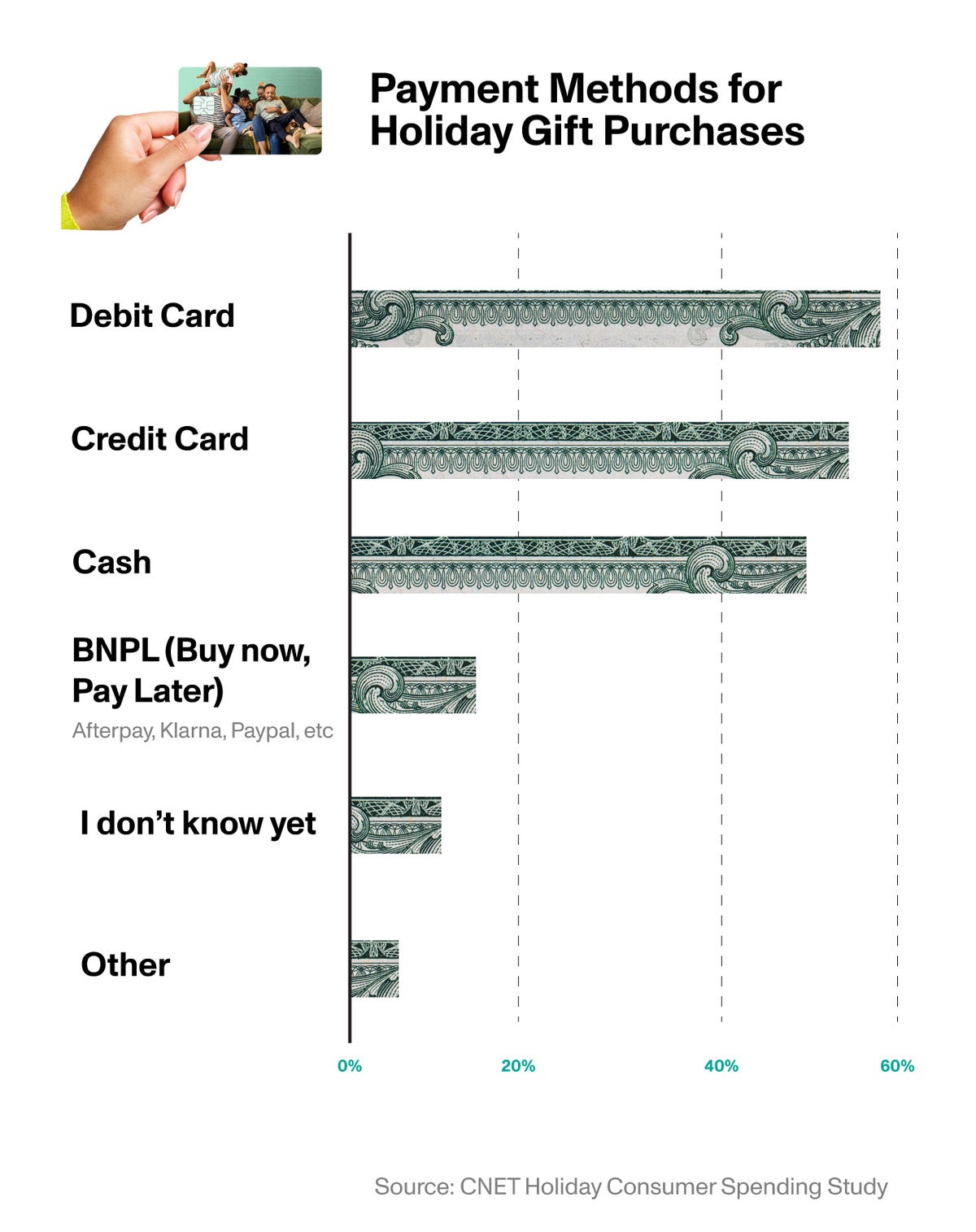

Use credit wisely

Over half of the shoppers surveyed plan to pay with a credit card this holiday season. With the Federal Reserve hiking interest rates, credit card APRs are also getting higher. If you’re paying with plastic, use the card with the lowest interest rate, just in case you need to carry a balance into the new year. And always create a repayment plan to stick to after the holidays, so you can stay on track financially without accumulating debt.

Robert Rodriguez/CNET

If you’re applying for a new credit card, a 0% introductory APR card might be a good pick if you need more time to cover your balance. Or try a rewards card, which can help you earn cash back or points for each dollar you spend. If you’re already an avid credit card user, check to see if you’ve accumulated points or cash rewards you can redeem toward holiday shopping.

If you plan to use Buy Now, Pay Later to buy your gifts this year, tread carefully. Plans such as Affirm, Afterpay and Klarna have become increasingly popular because they offer an interest-free way to pay in multiple installments (typically four). But there are pitfalls, especially if you pay late. If you suspect you won’t be able to cover the cost of your gift on schedule, think twice about using a BNPL plan. If you do, make sure you review the terms and conditions.

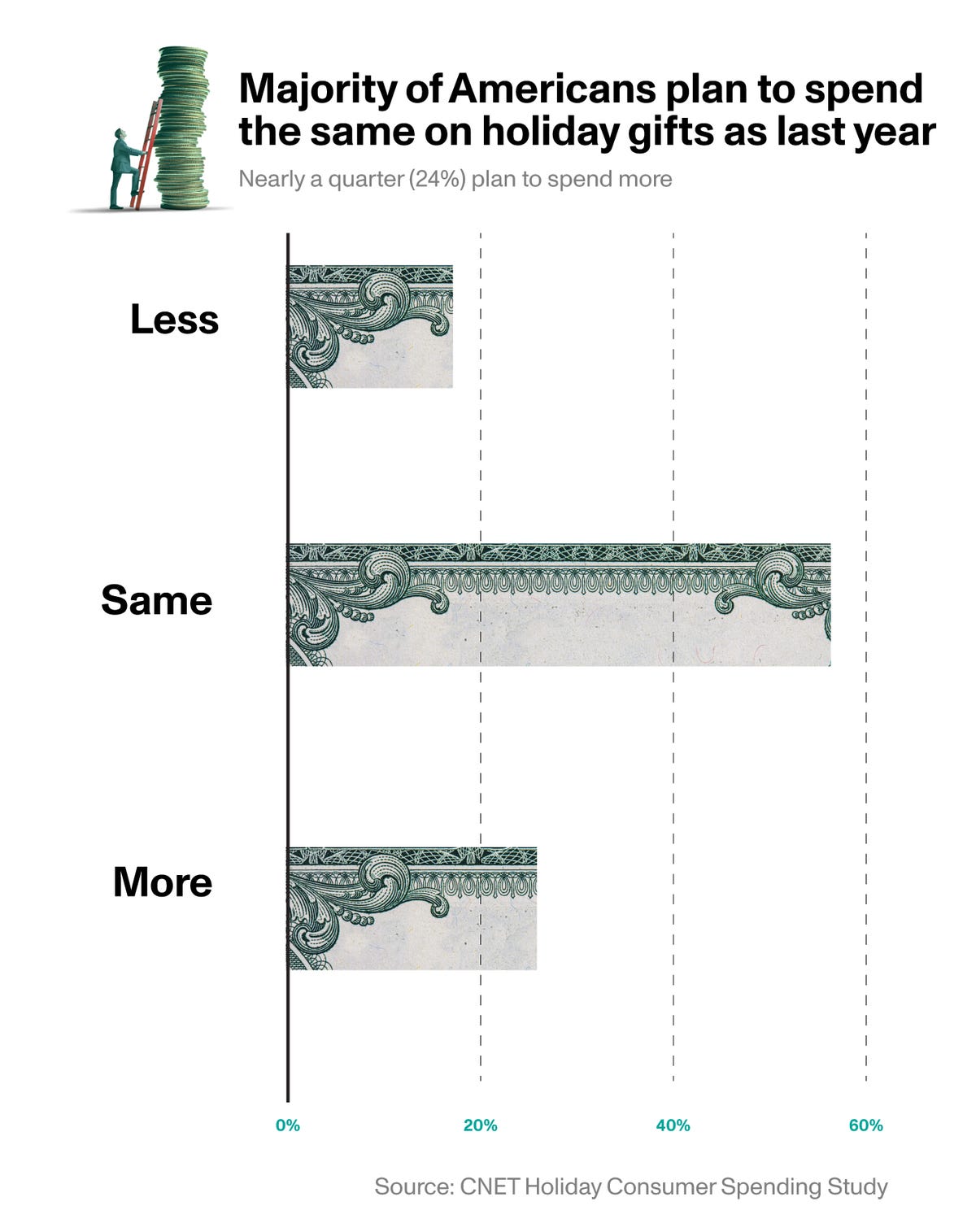

Make a budget and pay with cash or debit card

The majority of shoppers surveyed (74%) say they expect to spend the same or less than last year. If you’re worried about overspending, establish a strict spending plan with a list of gifts you plan to buy, especially if you’re trying to snag certain Black Friday and other holiday deals. You can create a budget using Excel or Google Sheets, or use a budgeting app to figure out how much you can afford this holiday season.

Robert Rodriguez/CNET

And if you’re still worried about busting your budget, do what about half of the survey respondents are doing — shop with cash. A 2021 MIT study found that parting with physical dollars at the register versus tapping your credit card elicits a higher degree of pain. That’s a good thing. Credit cards have an intangible, “deal with it later” quality to them, but when we use cash, we only pay for what we have in our wallet, and that can improve our chances of sticking to a budget.

While debit cards are also technically similar to cash and can improve your chances of spending less, remember that they lack the purchase and theft protections that credit cards typically offer.

Establish guidelines with friends and family

If you can’t afford to spend this holiday season, talk to your friends and family about it. There’s often pressure to get the best gifts for your loved ones, and we sometimes feel like we need to match what others spend. But others on your list are probably also facing financial pressure. We recommend reviewing your budget and deciding what level of gift-giving fits into your financial plan.

If you don’t want to skip gifts entirely, one way to relieve the burden is to discuss setting a price limit or spending cap for gifts. Another option is to exchange homemade gifts or offer services, such as babysitting or cleaning.

You could also propose a white elephant or Secret Santa gift exchange. This type of exchange randomly assigns you to buy a gift for just one person in your group, and only one person will be assigned to buy something for you. Combine that with a price limit, and you’ll end up spending a lot less this holiday season.

Sign up for coupons and deals

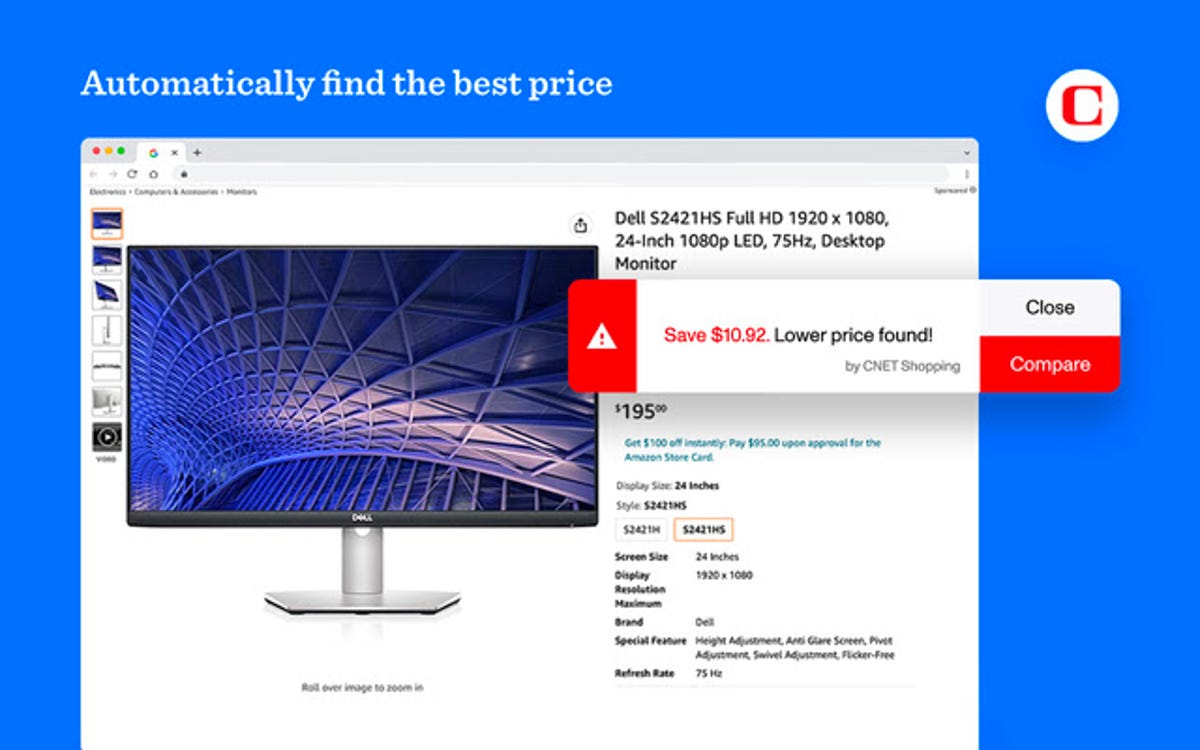

An easy way to find deals this holiday season is through internet browser extensions that scour the web for coupons and online rewards and then apply discounts at checkout.

To save money and compare prices on gifts, check out CNET Shopping, a free browser extension that uniquely offers two features: price comparison and coupons. CNET Shopping automatically scours thousands of retailers for the lowest price on a specific item and applies coupons to your online cart before purchase. That means you won’t have to search the web for coupon codes that often don’t work, and you’ll see right away if there’s a lower price for the item you’re looking for.

Use savings apps to put away some money

While savings and investing apps won’t help you avoid debt this holiday shopping season, they can give you a head start on next year by stashing away small amounts of money with every purchase you make.

For example, Acorns is a micro-investment platform that invests your leftover change in an Acorns account for just $1 a month. Digit is another savings app that tracks your spending patterns and automatically saves tiny amounts of your money (from $5 to $20) into an FDIC-insured savings account. Since launching in 2015, the app says it’s saved users a total of over $7 billion. You can try it for free for 6 months and then it’s $5 a month.