Zurich Insurance: Potential Growth Ahead

Zurich #Zurich

beyhanyazar/E+ via Getty Images

Investment Thesis: Zurich Insurance Group has seen strong growth across its Property & Casualty insurance segment along with continued growth in return on equity. The stock could have upside if we continue to see growth across these two metrics.

In a previous article in October 2021, I made the argument that while Zurich Insurance Group (OTCQX:ZURVY) might have further upside if premium demand continues to grow, investor appetite for the stock could decline if risk across the Property & Casualty segment is perceived to be too great.

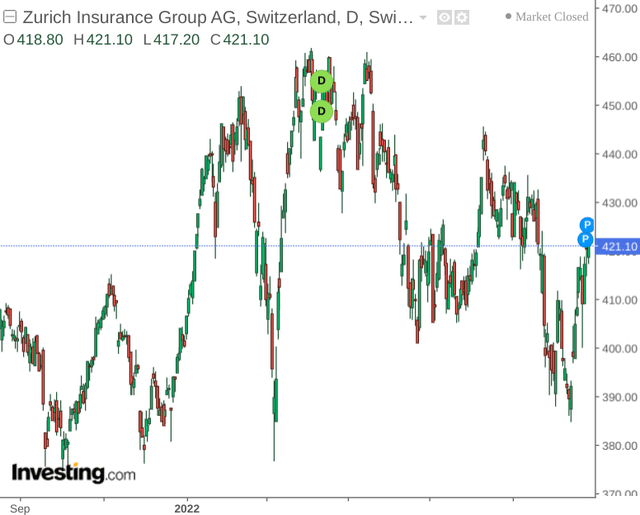

investing.com

In spite of brief bursts of upside, the stock has seen little movement overall – up slightly on price as compared to last October:

The purpose of this article is to examine how Zurich Insurance Group has been performing over the past year and assess whether the stock could be expected to have meaningful upside from here.

Performance

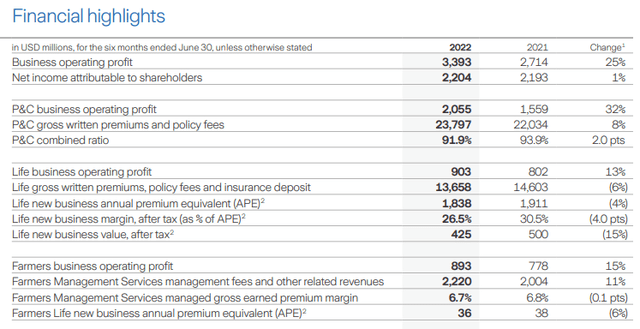

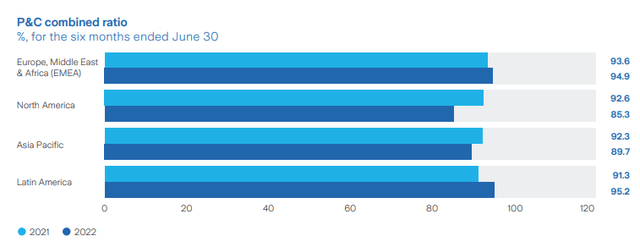

According to the company’s half-year results, Zurich Insurance Group has seen strong growth in operating profit across its business segments – particularly across Property and Casualty (P&C). In particular, it is also noteworthy that the combined ratio (which is a ratio that measures the ratio of incurred losses and operating expenses relative to the premium collected by the insurance company) fell by 2% from 93.9% in 2021 to 91.9% in 2022.

Zurich Insurance Group: Half Year Report 2022

In spite of my previous assertion that Zurich Insurance Group might see greater risk across this segment as a result of the rise of more frequent extreme weather events – a lower combined ratio indicates that this segment has seen a decrease in losses, which is encouraging.

Operating profit growth across the Life and Farmers segments was also impressive – with the business seeing double-digit growth as compared to 2021.

For the first half of 2022, Zurich Insurance Group saw growth of 25% in operating profit overall, with over 850,000 net new retail customers added during this period.

Additionally, the effects of COVID-19 on the company’s business has continued to decline, with related losses across the Life business having fallen to USD 26 million from USD 137 million.

In this regard, the company’s business has seen significant growth. However, the stock does not appear to have been following suit. It is possible that broader macroeconomic concerns with respect to inflation and a potential recession have deterred potential investors.

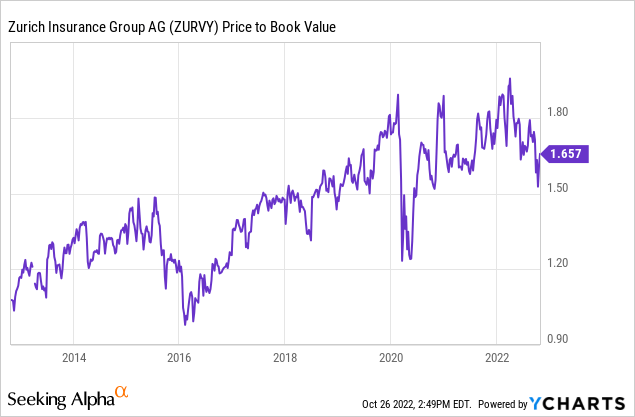

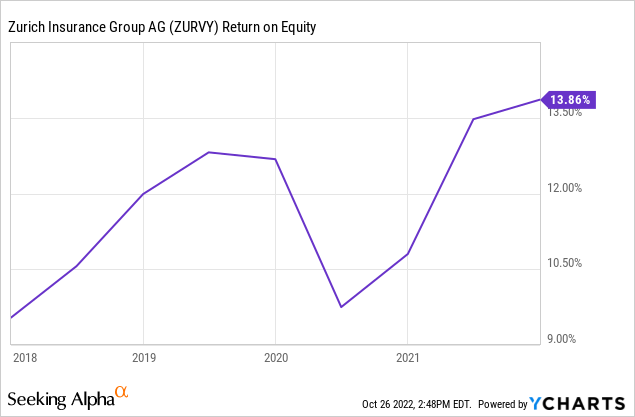

From a longer-term standpoint, we see that while the company’s price to book ratio is near a 10-year high (indicating that the stock is more expensive on this basis), the company’s return on equity is above 10% and at its highest level since 2018.

Price to Book

ycharts.com

Return on Equity

ycharts.com

From this standpoint, while the stock may be more expensive than in previous years – there is a significant possibility that growth still lies ahead based on the current trajectory.

Looking Forward

While we have seen a reduction in the P&C combined ratio over the past year – it is unclear whether this could rise significantly once again as a result of losses incurred due to Hurricane Ian in the United States.

According to Insurance Insider, Zurich Insurance Group, along with Chubb Limited (CB) and USAA have some of the highest retentions among insurers with exposure to property catastrophe risk across the Florida market.

Additionally, competitor Swiss Re (OTCPK:SSREF) also reports that losses from Hurricane Ian are expected to see losses of USD 1.3 billion as a result of the event.

With that being said, we can see that for the six months ended June – Zurich Insurance Group’s P&C combined ratio for the six months ended June of this year came in at 85.3%, which was substantially lower than the figure of 92.6% seen for 2021, and also the lowest among the company’s geographies.

Zurich Insurance Group: Half Year Report 2022

In this regard, if Zurich Insurance Group still manages to see a respectable combined ratio across North America, even taking account of Hurricane Ian – then this could serve as a catalyst for upside. Particularly, if we see that the P&C combined ratio for North America does not exceed the 2021 level of just over 92% – then this could demonstrate significant evidence that Zurich Insurance Group is still in a good position to maintain profitability across this segment despite higher catastrophic losses.

Conclusion

To conclude, Zurich Insurance Group has seen impressive growth over the past year. However, broader macroeconomic concerns seem to have kept price near that of last year’s levels.

That said, I take the view that the company is potentially being under-appreciated in the current risk averse environment and has potential to grow from here. I take a bullish view on Zurich Insurance Group.