Adobe: High Margins, Growth, And Fairly Valued

Adobe #Adobe

David Tran

Adobe Inc. (NASDAQ:ADBE) was founded in 1982 by John Warnock and Charles Geschke. The two founders started the company after leaving the legendary Xerox PARC, the company which pioneered the modern personal computer and many related technologies. Since then, Adobe’s pioneering spirit has continued and the company has become an industry leader across creative software (Photoshop), marketing automation (Marketo), and even documents with its PDF file format.

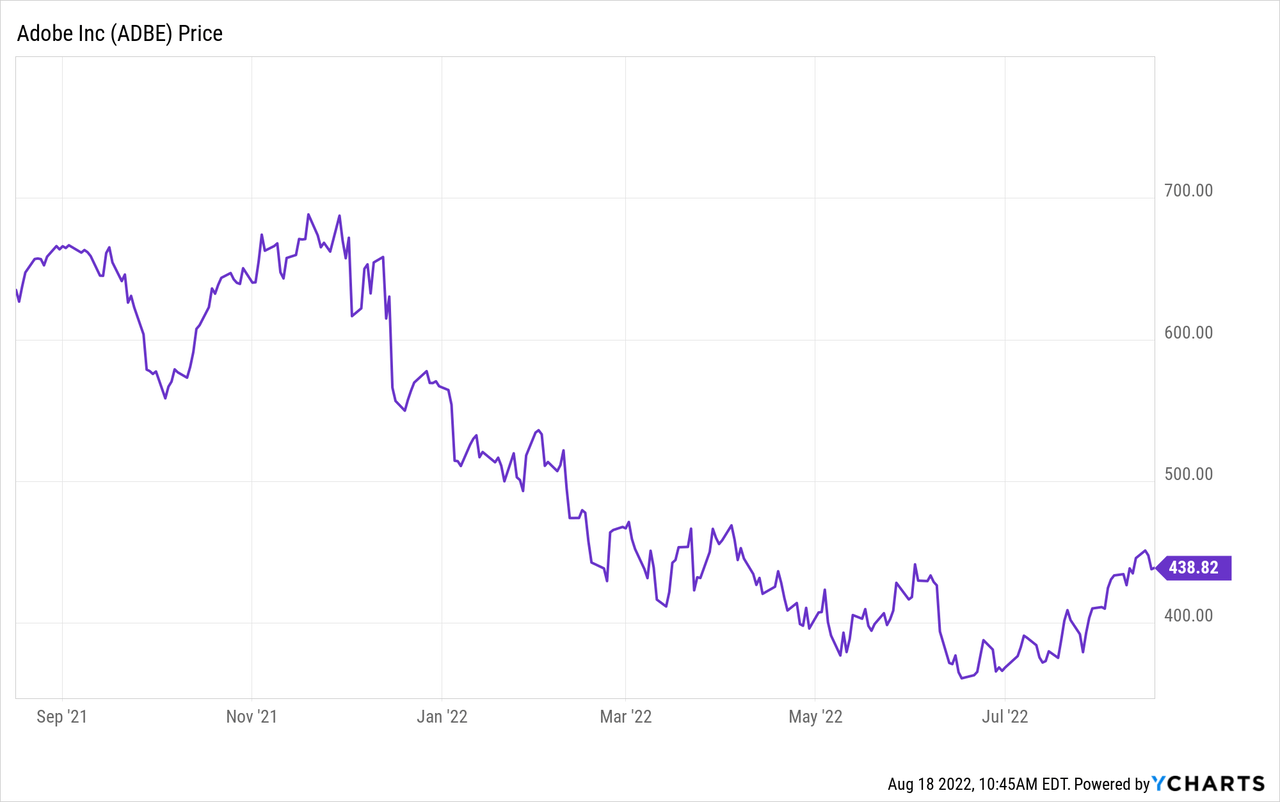

The stock price increased by over 127% in 2020 before correcting down by ~44% in the fourth quarter of 2021. This was mainly driven by the rising interest rate environment, which sent shockwaves through the entire “growth stock” market. However, the stock is now “fairly valued,” they have at least four competitive advantages and a $205 billion TAM across all segments. In this post, I’m going to dive into Adobe’s diverse business model, its financials and the valuation. Let’s do it!

Fun Fact: The name “Adobe” comes from “Adobe Creek” the river behind co-founder John Warnock’s garage, where the company was founded.

ADBE data by YCharts Diverse Business Model

ADBE data by YCharts Diverse Business Model

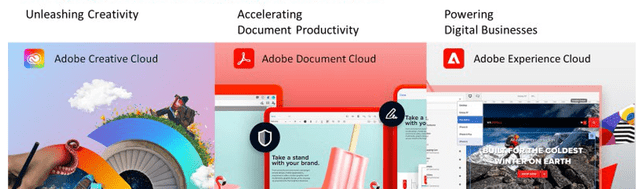

Adobe is a diversified software company which derives ~92% of its revenue from subscription products. The company reports across two main operating segments; Digital Media and Digital Experience. This can then be further subdivided into its three business/product units; Adobe Creative Cloud, Document Cloud and Experience Cloud. The Creative Cloud and Document Cloud combined make up the Digital Media segment and approximately 73% of Revenue. Adobe’s mission is to “Change the world through digital experiences,” and these growth engines are the driving force behind that.

Adobe Clouds (Investor presentation)

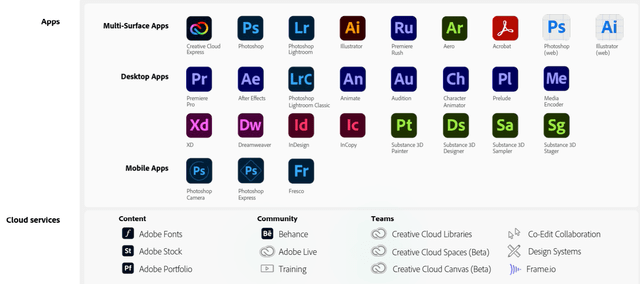

Adobe has 8204 patents globally, with 6703 patents active. This is a testament to the company’s gold standard technology which can be a competitive advantage. 1. Creative Cloud

Adobe is arguably most famous for its Creative Cloud. Users pay a subscription fee to get access to iconic applications such as Photoshop, Illustrator, Premiere Pro, After Effects, and more. A key sign a company has “share of mind” of the consumer is when the name of an action becomes synonymous with the brand name. For example, people have a tendency to say, “Is that image Photoshopped?” when really people should say is that image edited (as other editing software is available). We see a similar psychological tendency with Uber, “call an Uber” as opposed to a cab. This psychological tendency can be backed up with facts from Adobe, such as “90% of the worlds creative professionals use Adobe Photoshop.” Its Video editing software such as “Premiere Pro” also consistently ranks number one as the best video editing software for professionals and is the market leader in the industry.

Creative Cloud (Analyst Presentation)

Adobe also completed its acquisition of Frame.io in October 2021, which finally solves the problem of collaborating on video edit projects with teams and clients. As someone with industry knowledge of Video editing (I run a large investing YouTube Channel, Motivation 2 Invest), I know that this platform solves a real pain point for video editors globally.

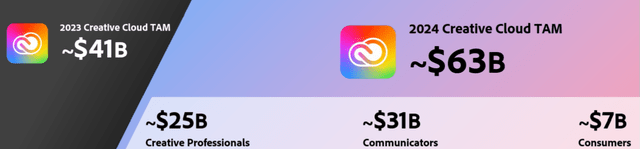

Adobes target audience for its creative cloud include; Creative Professionals, Communicators and Consumers. Its total addressable market (“TAM”) across the three groups is estimated to be $63 billion by 2024, up from $41 billion forecasted in 2023. This growth is expected to be driven by the explosion in the “creator economy” which has been enhanced by the proliferation of video-based social media apps and a content-first marketing strategy.

TAM Creative Cloud (Financial Analyst Meeting)

Network Effects – Competitive Advantage

Adobe’s Creative Cloud benefits from network effects due to the vast number of professionals using the software products internationally. When young creative students do a course, they need to learn Adobe software products just to be able to get a job in the industry, even if the products are more expense than other tools (which they tend to be).

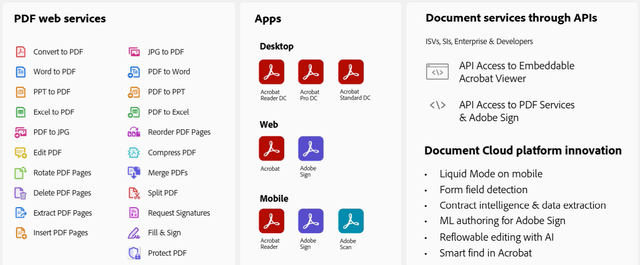

2. Document Cloud

Adobe believes digital documents are core to the future of work. Its Document Cloud consists of its famous PDF file type (which the company invented), E signatures, and even AI-powered document intelligence. Its business strategy is a low-friction, free-to-paid version, which is powered by a user downloading Adobe Reader to open a document, then deciding to pay for the Word to PDF converter or E-signature functionality.

Adobe Document Cloud (Analyst Presentation)

The company believes the Document Cloud industry will be worth ~$21 billion in 2023 and that this will grow to $32 billion by 2024. Adobe believes this growth will be driven by the surge in knowledge/hybrid workers and business data standardization.

Document Cloud (Investor Presentation)

3. Experience Cloud – 25% of Revenue

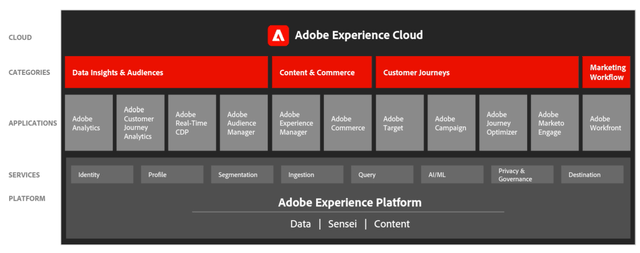

Adobe Experience Cloud (formerly known as the Marketing Cloud) is less well known to the everyday consumer, but to enterprises this includes the gold standard in marketing software.

Effective marketing in today’s world is not about mass “carpet bomb”-style advertising campaigns where everyone is given the same message. Today’s marketing requires “Hyper-personalization” of messaging so each person or customer segment receives the right message at the right time.

Adobe Experience Cloud (Analyst Presentation)

Adobes Experience platform uses a combination of data, software and advanced analytics to enable an end-to-end tracking of the buyer journey. Its products can be segmented into the following categories;

Data Insights & Audiences: Adobe Experience Platform, Adobe Analytics, Customer Journey Analytics, Real-time Customer Data Platform (CDP) and Adobe Audience Manager.

Content & Commerce: Adobe Experience Manager

Marketing Workflow: Adobe Workfront.

Customer Journeys: Marketo Engage (Email automation), Adobe Campaign, Adobe Target, and Journey Optimizer.

Adobe Marketo is the gold standard in Enterprise level email automation. This enables the segmentation and automation of email drip campaigns to specific audience segments. The software was also a pioneer in advanced features such as “Dynamic Content” which allows a customer to see personalized email content based upon their industry. This was a gamechanger when released and is widely used by those using an Account Based Marketing or B2B strategy.

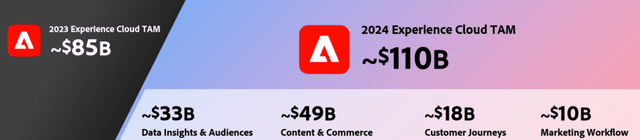

Adobe experience cloud is second largest part of Adobe’s business and makes up ~25% of revenue. The company estimates the total addressable market for the segment will be $85 billion in 2023 and this will grow to $110 billion by 2024.

Experience Cloud (Adobe)

High Switching Costs – Competitive Advantage

Adobes Enterprise level software has high “stickiness” and switching costs. For example, once an Enterprise customer has multiple Email automation campaigns running and Adobes Data platform analyzing its big data, switching becomes unlikely. This is for a few reasons from the tendency of large organizations to not want to “break” working systems, to the complex migration process and even the thought of losing an edge against competitors. This can give the company pricing power with enterprise level customers, as they care less about the cheapest software and more about the best.

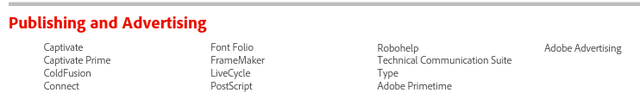

Publishing and Advertising – 2% of Revenue

Adobe Advertising Cloud makes up 2% of its revenue and is a platform which is used to manage ads across digital channels. This segment also includes legacy software such as Adobe Captivate, which is used for creating eLearning content such as software demonstrations and simulations.

Publishing (Investor Data Sheet)

Management’s overall strategy has been to continually innovate and expand its customer base across categories, while also executing pricing power in certain product areas. Although, personally, I think price raises should be executed with caution given the increasing competition that I will discuss in the “Risks” section.

Growing Financials

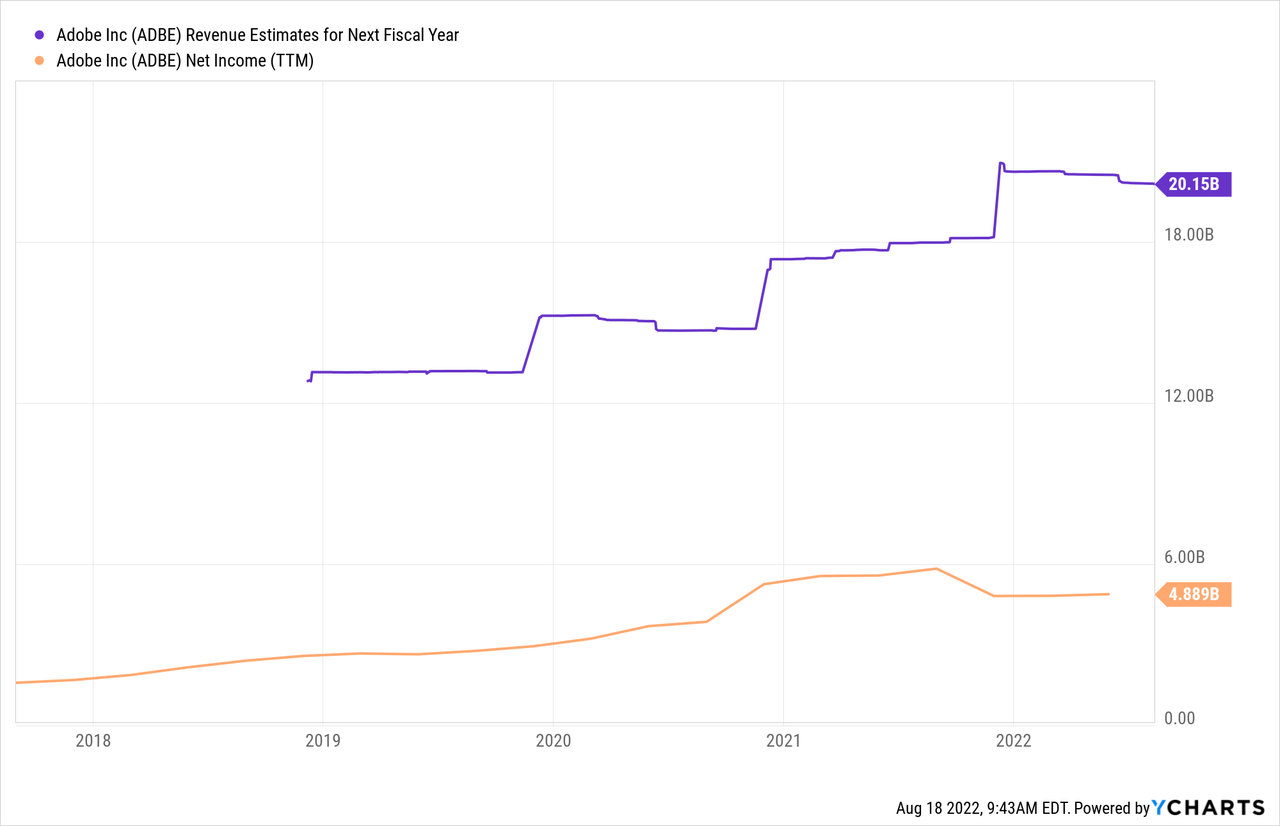

Adobe generated solid financials in the second quarter of 2022. Revenue reached a record $4.39 billion, which beat analyst expectations by $39.15 million, up by 15% year-over-year. This was driven by strong growth in the Digital Media Segment (Creative and Document Cloud), which increased to $3.2 billion, up 15% year over year. Document Cloud Revenue popped by 27% to $595 million. Net New Digital Media Annualized Recurring Revenue (“ARR”) was $464 million, with total Digital media ARR $12.95 billion.

ADBE Revenue Estimates for Next Fiscal Year data by YCharts

ADBE Revenue Estimates for Next Fiscal Year data by YCharts

The Digital Experience segment generated $1.10 billion in revenue, up a solid 17% year-over-year. The majority of this segment’s revenue ($961 million) is from subscription services, and this was up 18% year over year.

Adobe generated solid operating income of $1.53 billion and net income of $1.18 billion. Levered Free Cash Flow was $1.73 billion, up 4% year over year and a rapid 36% quarter over quarter.

GAAP earnings per share was $2.49 for Q2, which was inline with analyst consensus estimates.

Adobe has a strong balance sheet with $5.3 billion in cash and short term investments and just $500 million in current debt (due within the next two years). Management also bought back 1.9 million shares in the quarter, a positive sign.

Reduced Guidance

Despite the strong quarter, Management reduced its guidance for the second quarter of 2022. The company is forecasting Revenue of $17.65 billion, which is less than analyst consensus estimates of $17.85 billion. It also is expecting $13.50 for Adjusted EPS, which is less than analyst consensus estimates of $13.66. This lower guidance is driven by higher tax rates for stock-based compensation. This is in addition to the company’s exit from Russia (war related) and an $175 million in FX headwinds across Q3 and Q4.

Advanced Valuation

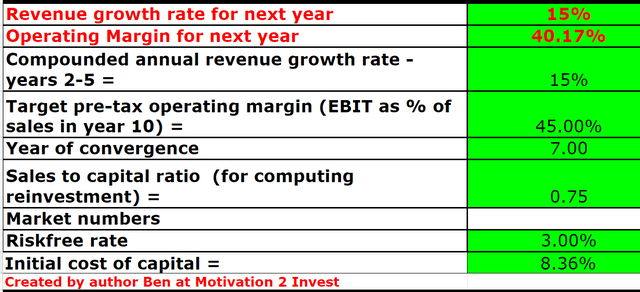

In order to value Adobe, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of analysis. I have optimistically forecasted 15% Revenue growth per year for next 5 years. This is based on prior growth rates, such as the recent 15% in 2021/2022. I have stated this is “optimistic,” as the management is forecasting headwinds in the next couple of quarters at least.

Adobe Stock Valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted Adobe’s super SaaS margins to increase to 45% over the next 7 years, as its rapidly growing Document Cloud and other Cloud products increase in popularity. Keep in mind this operating margin is adjusted for R&D expenses, which I have capitalized.

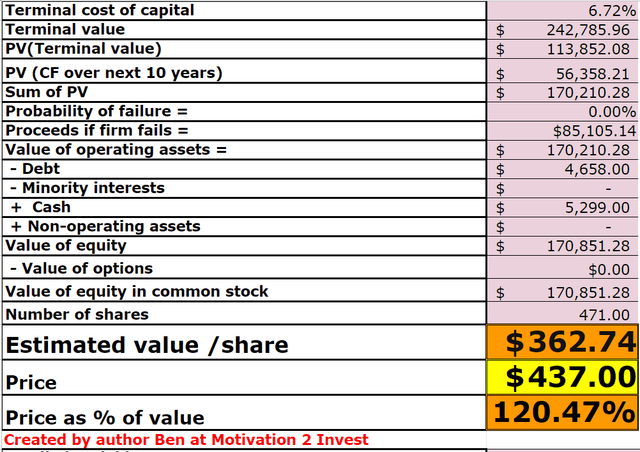

Adobe Stock valuation 1 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $363/share. The stock is trading at ~$437/share at the time of writing and therefore is ~20% overvalued intrinsically.

As an extra data point, it is also interesting to that the stock price found support at a ~$365 share price in mid June, which is close to my valuation model prediction, before popping by ~20%. Therefore, this gives me increasing faith in my method of valuation.

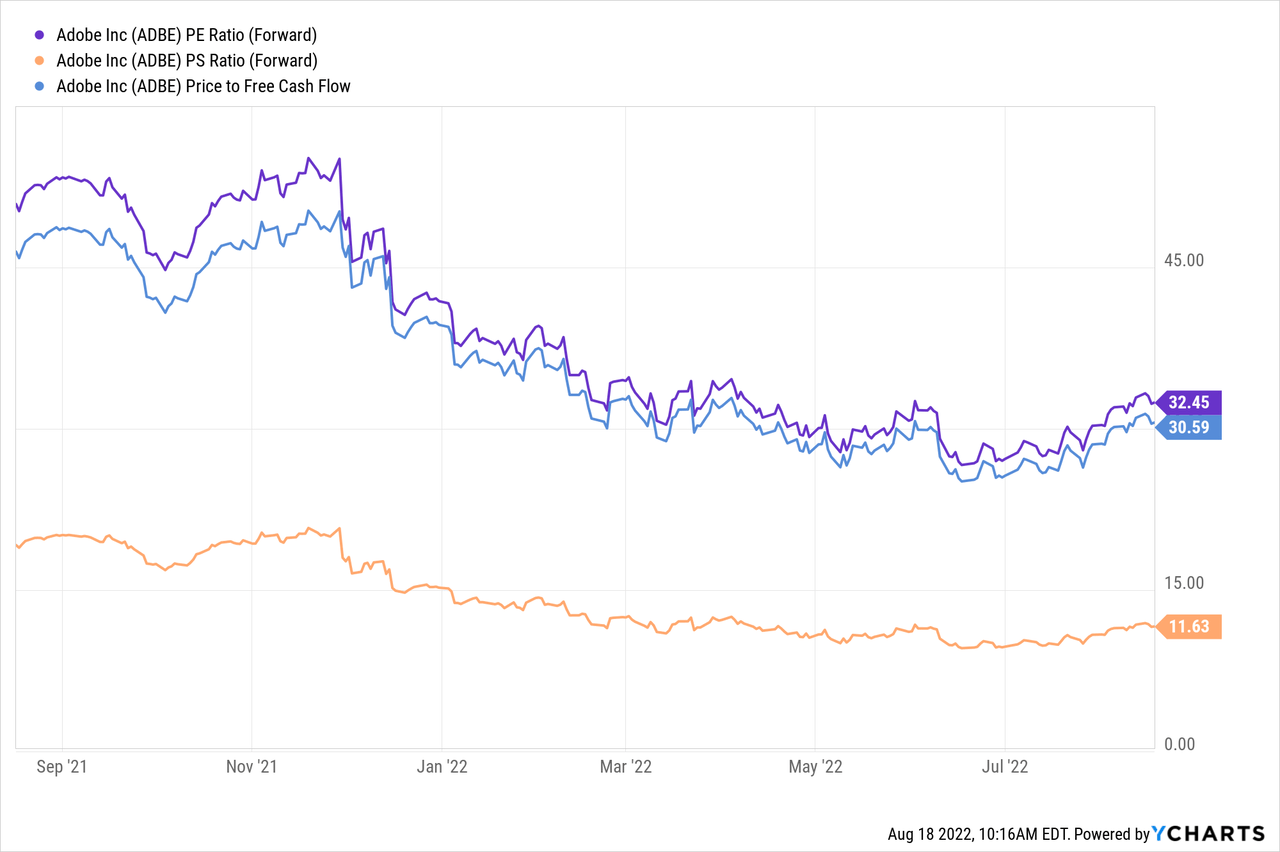

For a relative valuation metric, the stock trade at a Price to Earnings (forward) ratio = 32.33 which is ~16% cheaper than its 5 year average. Adobe’s Price to Sales Ratio (forward) = 11.49 is also ~15% cheaper than its 5 year average. Finally, the Price to Cash Flow (forward) is 26.57, which is 20% cheaper than its 5-year average. Given all the datapoints, from both my intrinsic and relative valuations, I would deem Adobe to be “Fairly Valued” at the current level.

ADBE PE Ratio (Forward) data by YCharts Risks Competition/Disruption

ADBE PE Ratio (Forward) data by YCharts Risks Competition/Disruption

Adobe offers best-in-class software, which is industry leading across many areas from creative work to marketing. However, the software doesn’t come cheap, and many competitors have noticed this.

I believe Adobe is being disrupted and could lose market share among the Creator and SMB customer types. This is because those customers tend to value cost and features more than just branding. Adobe’s software for these customers does tend to be “better,” but not usually by enough more to justify higher prices.

The disruptive competitors have a much lower friction and flexible freemium model. Examples include:

As a small business owner, I personally use Da Vinci Resolve for video editing, Canva for graphic design and HubSpot for my marketing. I find these platforms to be very valuable and also have a much more enticing freemium business model. However, I don’t believe the lower cost/free alternatives will effect Adobes Enterprise customer base. It is interesting to know that Adobe is no longer the only game in town.

Final Thoughts

Adobe is a pioneer in digital technology and gold standard software. The company’s brand is strong and its products are immensely “sticky” amongst industry professionals and enterprise customers. The TAM across the creative, digital and data industries is growing, and this is expected to benefit Adobe long term.

The stock is overvalued intrinsically but undervalued relative to historic multiples. Thus, I deem the stock to be “fair value” for the long-term investor.