Brent crude oil trades in a rally mode

Brent #Brent

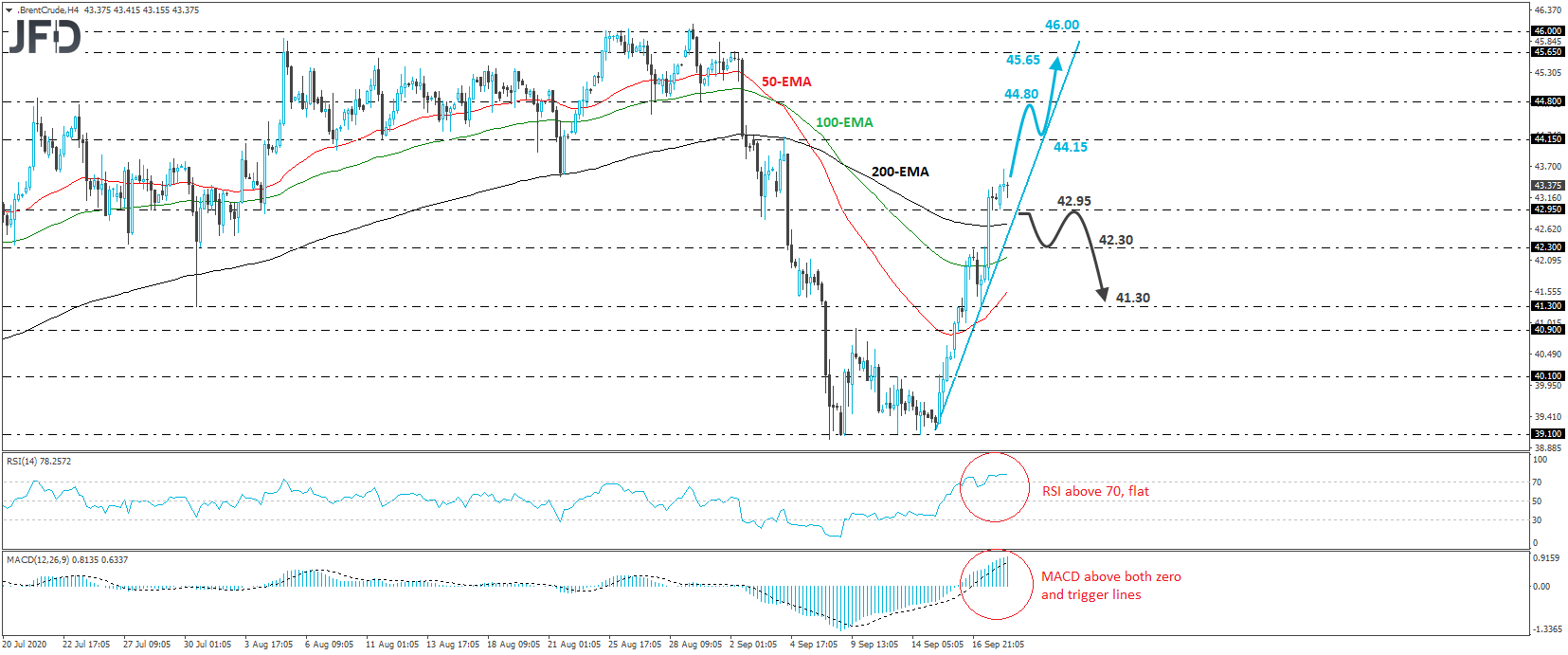

Brent oil has been in a rally mode since Tuesday, when it hit support fractionally above the key area of 39.10. Yesterday, the liquid surged above the 42.95 zone after Hurricane Sally cut US production and after the OPEC+ group agreed to take action against members not complying with their latest deal. Overall, we can mark an steep upside support line from the Tuesday’s low, above which the price continues to trade, thereby keeping the short-term outlook positive.

If the bulls are willing to stay in the driver’s seat, we may see them targeting the 44.15 resistance soon, marked by the high of September 4th. If they don’t stop there, the rally could extend towards the 44.80 area, defined as a resistance by the inside swing low of August 31st. If that zone is also violated, the next stop may be the peak of September 2nd, at 45.65.

Looking at our short-term oscillators, we see that the RSI lies above 70, but points east, while the MACD, although above both its zero and trigger lines, shows signs of slowing down as well. Both indicators detect strong upside speed, but their flattening suggests that a pullback may be on the cards soon, perhaps after the bulls challenge the 44.15 or the 44.80 zones.

In order to abandon the bullish case, we would like to see a drop back below 42.95. Such a move would also take the black liquid back below the aforementioned steep upside line and may initially trigger declines towards the 42.30 barrier, defined as a support by Wednesday’s inside swing high. Another break, below 42.30, could carry larger bearish implications, perhaps setting the stage for yesterday’s low, at around 41.30.

JFDBANK.com – One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

84.25% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure